All-New AP Module: AI-Powered Automation for Control and Efficiency

AP workflows aren’t exactly glamorous.

Manual invoice entry, endless calls and emails for verification, and vendor miscommunications can make processing a single invoice take anywhere from five minutes to over an hour.

That’s why Procurify’s new AP module, powered by AI and automation technology, is designed to reclaim time and resources for finance teams while ensuring accuracy and visibility.

“It’s really about creating efficiency,” said Yishi Pan-Artani, Senior Director of Product Management at Procurify. “When AI helps take care of mundane tasks, AP and finance leaders can allocate energy to solve other problems within the organization.”

Procurify’s reimagined AP module allows finance and accounts payable teams to:

-

Leverage AI to speed up invoice processing

-

Automate three-way matching to improve accuracy

-

Unlock deposit payments to increase the flexibility of their financial management processes

Right from the point of the initial purchase requisition, Procurify’s end-to-end procure-to-pay software acts as a single system to unify a company’s purchasing and accounts payable workflows.

This visibility and cohesion between AP and procurement will strengthen an organization’s financial control, according to Pan-Artani.

Requisitions, purchase orders, invoices, and item receipts are connected in Procurify and tracked throughout the purchasing process, presenting finance teams with a single digital paper trail to easily match and reconcile bills and get payment approvals.

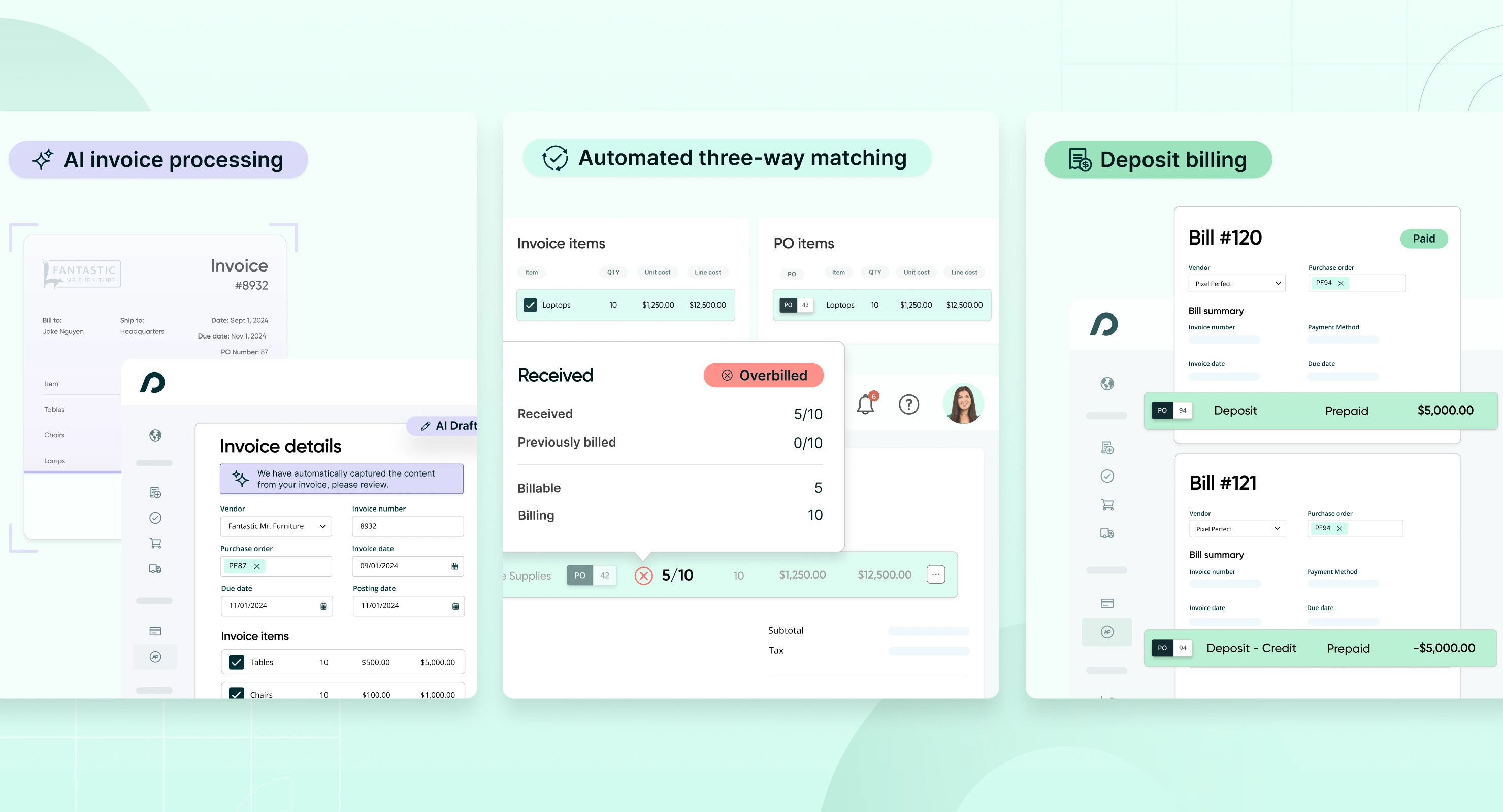

AI-enhanced invoice processing

It’s as simple as forwarding an email.

With the new AP module, invoices can be forwarded from any user’s email inbox to a secured Procurify email inbox where AI-enhanced optical character recognition (OCR) technology will instantly scan the invoice, automatically extract invoice data at the header and line level to pre-populate draft bills for review and revision.

“Invoice processing is historically one of the most frustrating aspects of the AP workflow because it is often done manually and with mistakes,” said Nam Lai, Senior Product Manager at Procurify. “Our team aimed to shorten the processing time so that users can focus on more strategic tasks.”

This new AI-driven solution exponentially improves efficiency by automating traditionally time-consuming and error-prone tasks. All invoice data is automatically extracted, leaving AP professionals to simply verify the outcome.

Pan-Artani estimates that the AI in the feature will cut the processing time for each invoice by at least half after users no longer have to manually type in each line item and visually cross-reference data.

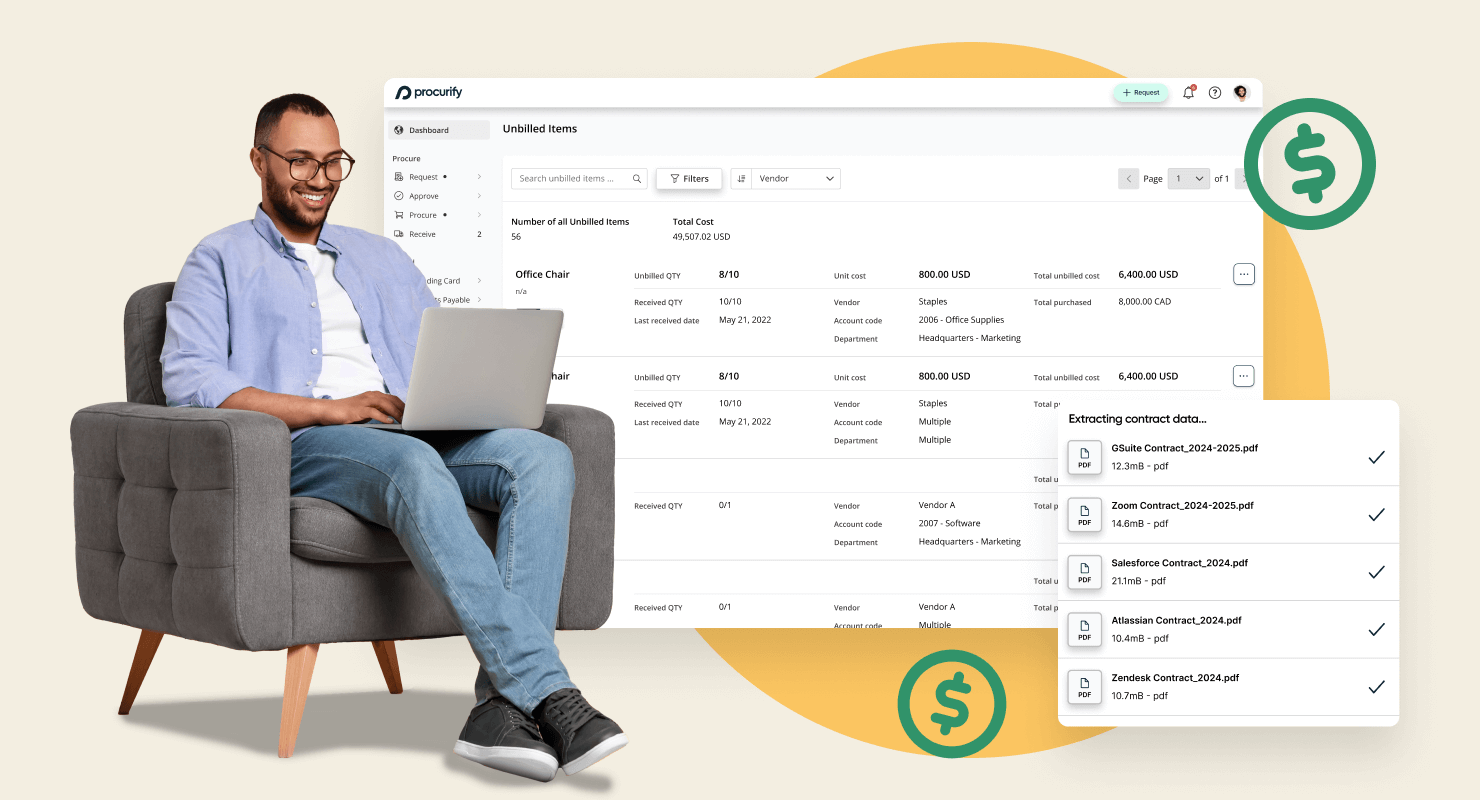

With the built-in AI technology in the AP module and the Smart Upload feature for contracts, Procurify empowers users to streamline their workflows and maximize the benefits of artificial intelligence.

“AI is no longer some far-fetched futuristic research,” Pan-Artani said. “It is very much a mainstream tool today designed to enhance our daily efficiency. Why can’t finance professionals benefit from this technology as well?”

Automated three-way matching

Before implementing Procurify’s AP module, it was difficult for Curtin Maritime, a California-based marine transportation and construction company, to quantify money lost to AP errors.

“We didn’t have a robust enough system to really validate how much processing time was wasted or duplicate bills that we were paying,” said Nick Sullivan, Director of Process Improvement at Curtin Maritime.

Curtin Maritime’s AP challenges are not unique.

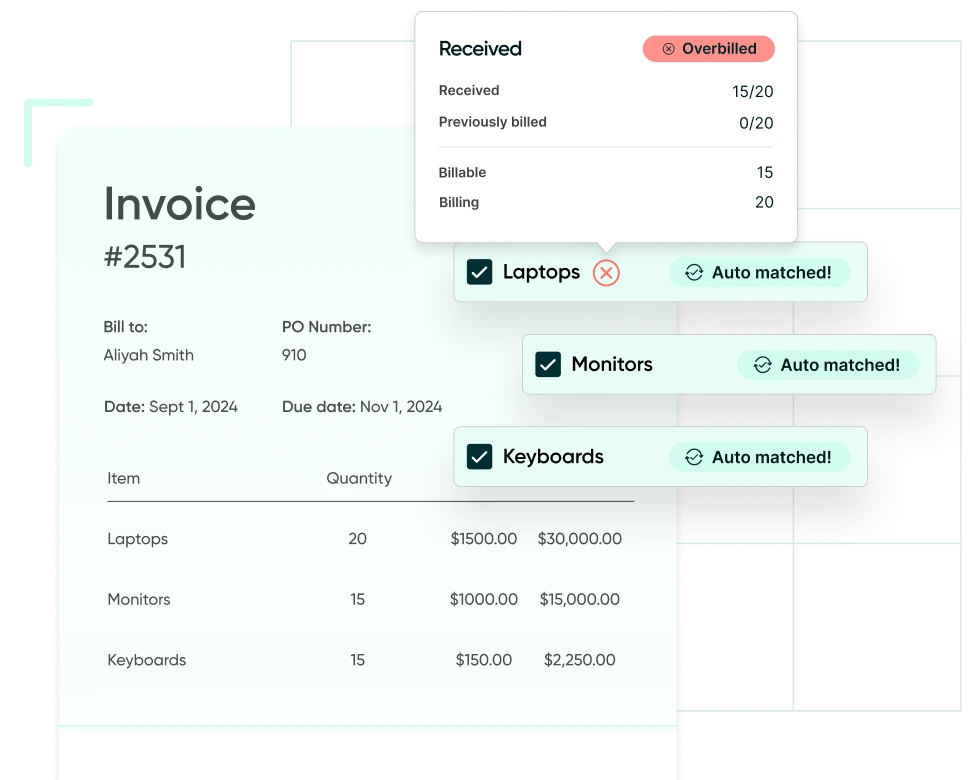

“AP specialists have to meticulously compare the bill purchase order with the receipt,” said Lai. “Without automation capabilities, users have to do it manually. Now, imagine they have to deal with 100 to 1000 invoices every month.”

The automated three-way matching feature in Procurify’s AP module seamlessly validates purchases by matching line items across purchase orders, invoices, and item receipts. Exception flagging automatically alerts you of any variances in unit cost or received quantity so you can review and resolve them before payment.

For organizations, this:

-

Eliminates errors and overspending,

-

Protects against fraudulent or duplicate invoices.

For Curtin Maritime, automated three-way matching — and the accuracy it provides — is expected to be a game changer.

“The AP module is critical for us because it ensures that we’re processing bills properly,” said Sullivan. “Before, we did not have the practical approach to tracking our procure-to-pay – now, it’s an area where we have much greater confidence.”

Unlock the power of Procurify’s AI-enhanced AP automation

Discover how AI can expedite and automate your invoice process while saving time and reducing errors.

Deposit billing

Procurify’s AP automation enables a proactive approach to account payable workflows.

The deposits feature lets you create bills for deposit payments by allocating them to a prepaid expense account code when the deposit is paid. Once items are received and paid in full, the amount is moved into the applicable account code and a negative deposit credit is automatically applied to the prepaid account code.

This proactive and flexible approach to billing strengthens the financial control of an organization by:

-

Following accounting best practices for tracking cash flow in your general ledger

-

Improving vendor relationships with accurate and on-time deposit payments

Additional features

Rounding up a comprehensive, end-to-end AP solution are two key feature enhancements:

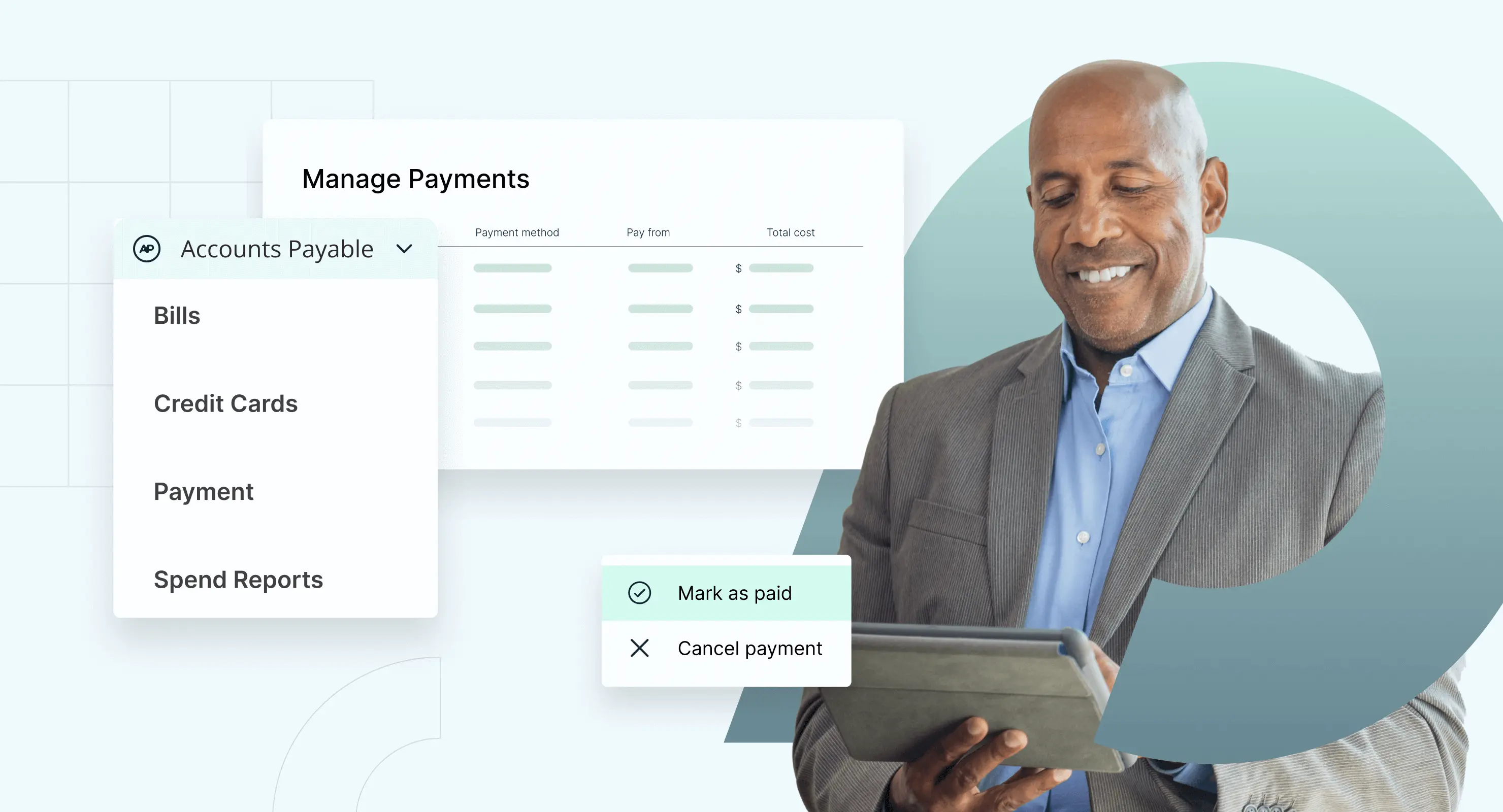

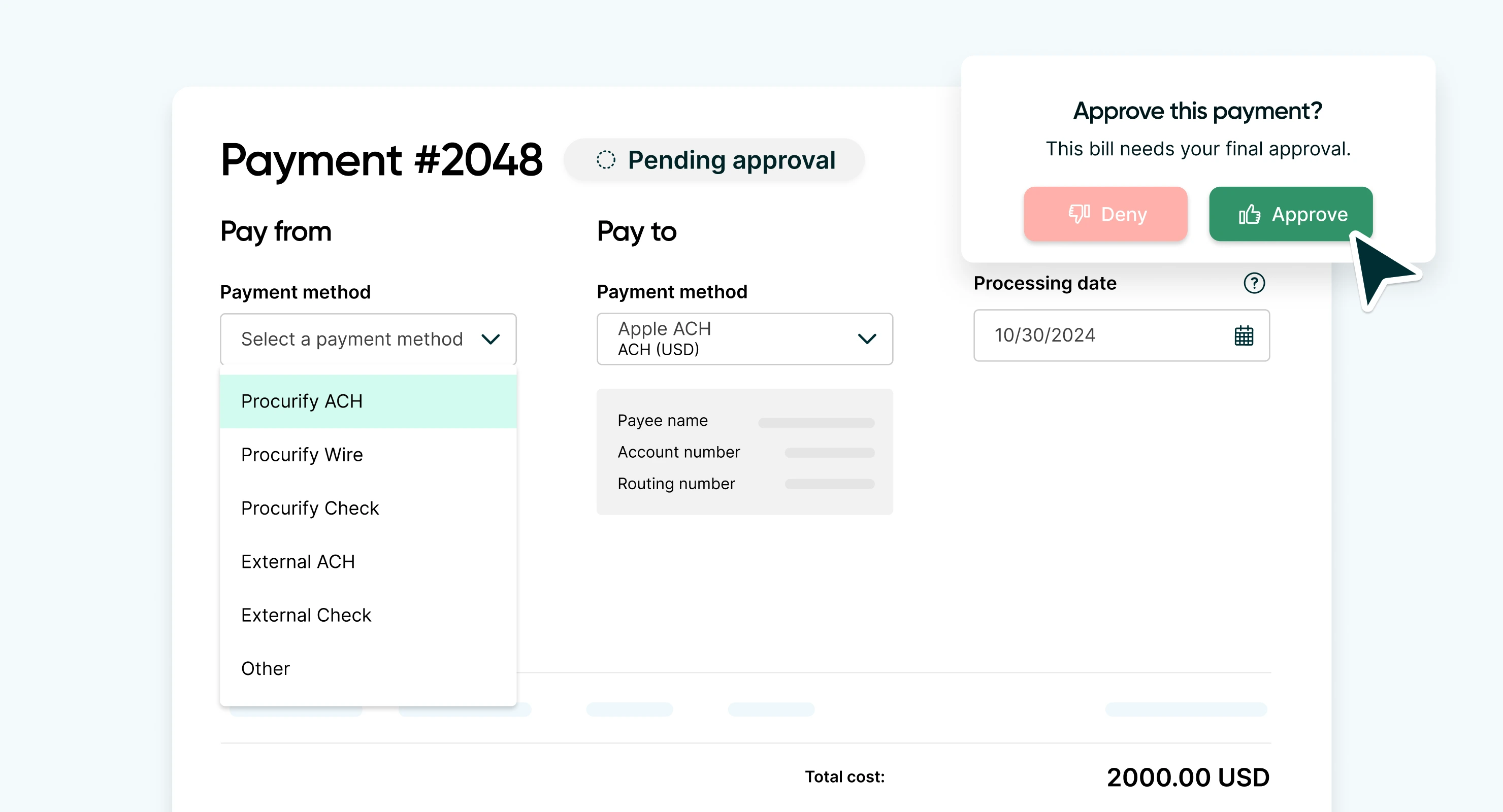

Bill payments

Bill payments enable a proactive approach to paying your vendors. There is increased flexibility in payment and scheduling. The expanded bill payments capabilities include ACH, wire, and check payments in the U.S. and EFT in Canada.

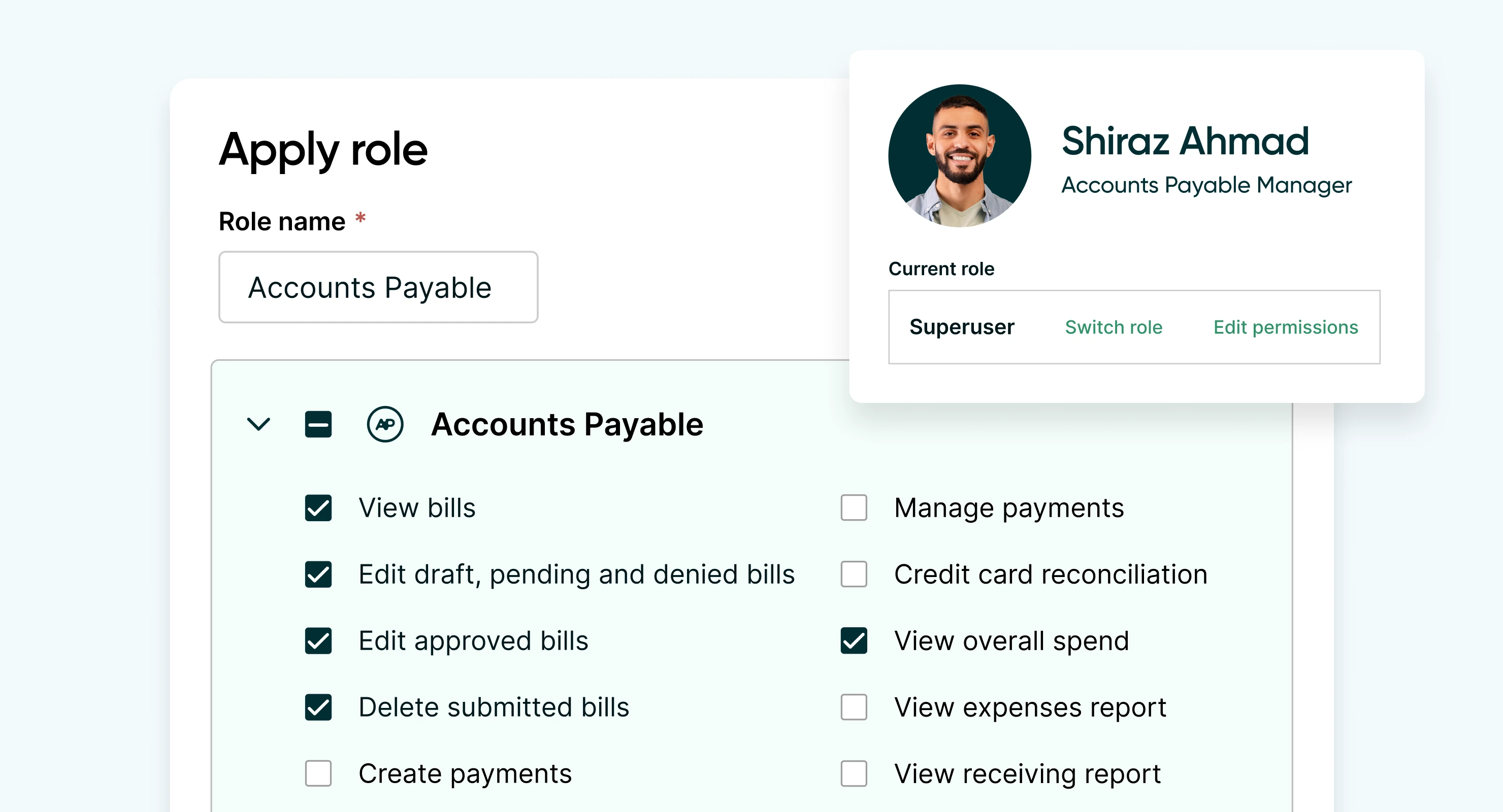

AP permissions

AP permissions provide a more granular approach to managing users on the AP module and controlling their access and actions. Customers now can assign certain roles from view-access permissions to bills.

The overall control and visibility provided by Procurify’s new AP solution can be truly transformative for organizations. As Pan-Artani put it:

“What really matters is having context for your spending data, and the AP module provides that clarity to customers — from the point of requisition all the way to payment.”