Automated Invoice Processing: AI-Powered Efficiency for AP Teams

Every finance team knows the pain of manual invoice processing. It’s a slow, tedious process riddled with inefficiencies—lost invoices, endless approvals, and data entry errors. These bottlenecks don’t just frustrate employees; they impact cash flow, strain vendor relationships, and make audits a nightmare.

But what if invoices could process themselves? What if errors, delays, and compliance headaches became a thing of the past?

Enter automated invoice processing. By leveraging AI, machine learning, and OCR technology, businesses can eliminate these pain points, transforming how accounts payable (AP) functions. With automation, invoices are scanned, categorized, approved, and paid with minimal human intervention.

The result? Faster workflows, cost savings, and improved financial control.

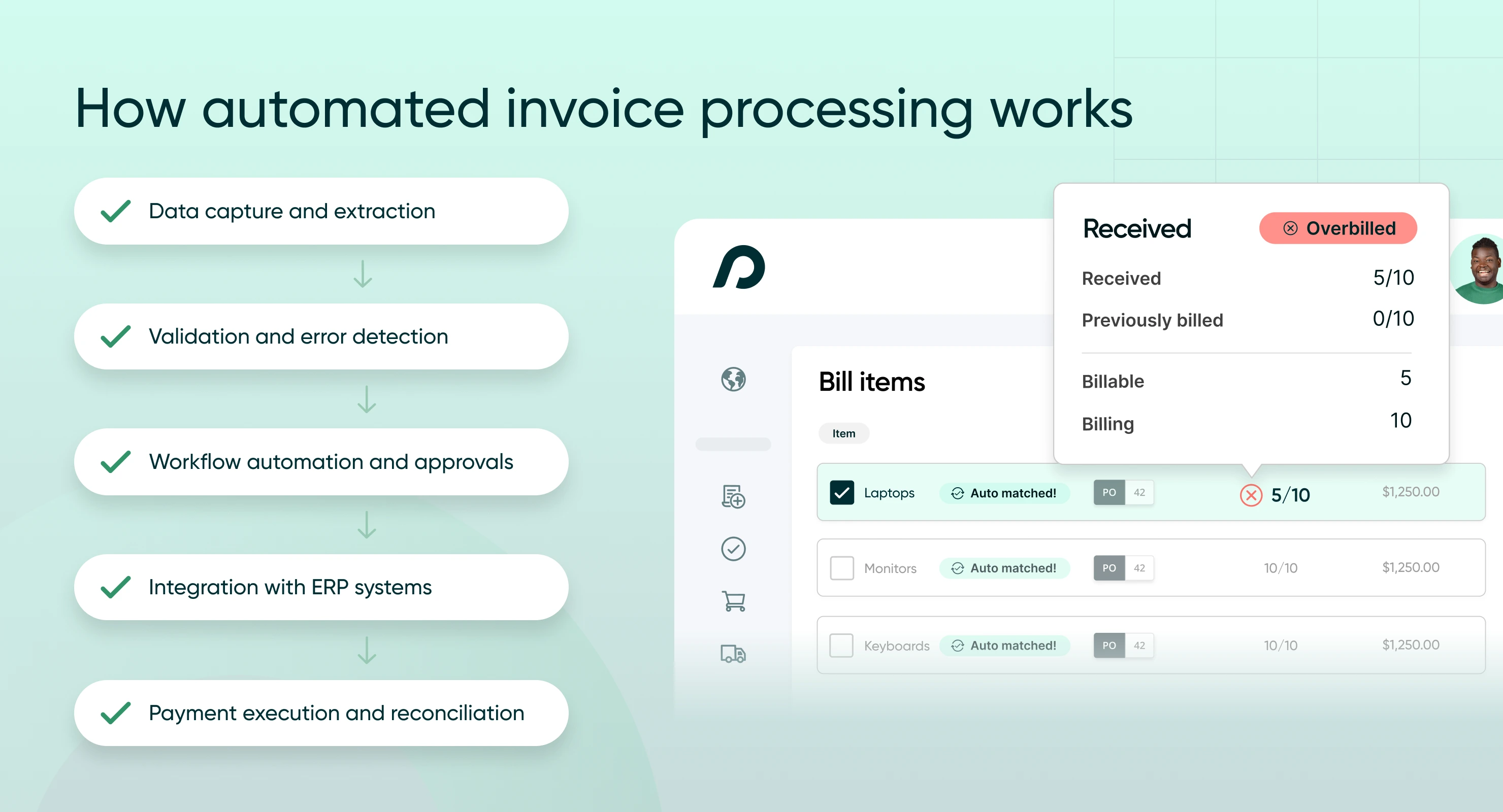

How automated invoice processing works

Automated invoice processing transforms a traditionally manual workflow into an interconnected digital process that significantly enhances speed and accuracy.

Here’s a detailed look at how it works:

-

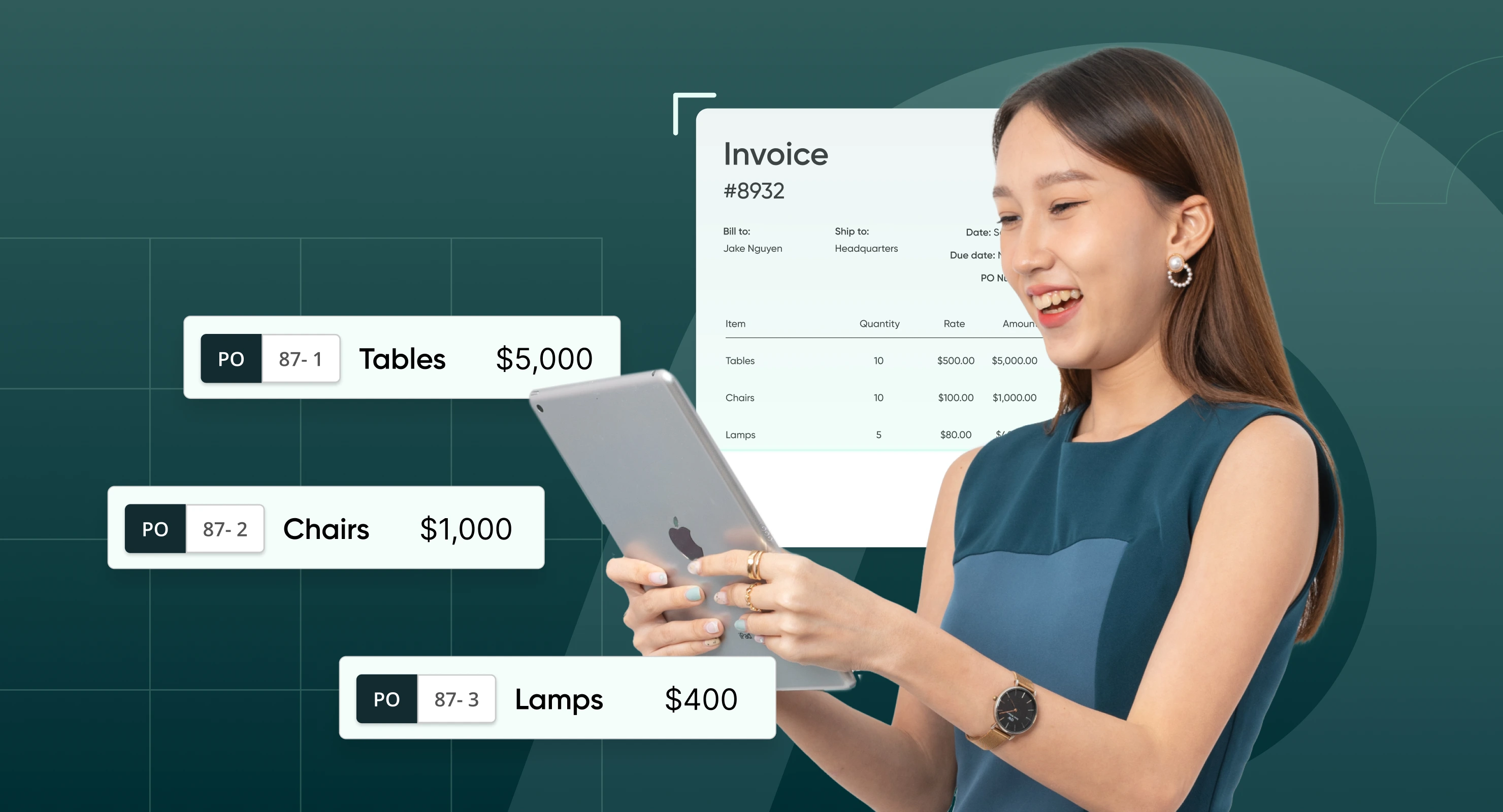

Data capture and extraction: Invoices received via email, uploads, or scans are processed using OCR and AI tools to extract vendor details, invoice amounts, and line-item data. This eliminates manual data entry, accelerating processing time and reducing human error.

-

Validation and error detection: Extracted data is cross-checked against vendor details and purchase orders. Any discrepancies, such as mismatched totals or missing information, are flagged for review, ensuring only accurate, compliant data moves forward.

-

Workflow automation and approvals: Validated invoices are automatically routed to relevant approvers based on predefined workflows. Approvers receive notifications and can approve invoices digitally, streamlining approval cycles and eliminating manual follow-ups.

-

Integration with ERP systems: Approved invoices are uploaded to the organization’s ERP or accounting system, where they are matched with purchase orders and receipts. Real-time synchronization ensures consistency across platforms and prevents duplicate efforts.

-

Payment execution and reconciliation: Once invoices are approved and recorded, payments are scheduled according to due dates and terms. Automated three-way matching matches payments with invoices and bank statements, identifying discrepancies for review and ensuring financial records are up to date.

The challenge with manual invoice processing

Picture this: A growing company receives hundreds of invoices each month. Some arrive by email, others as PDFs, and a few still come in as paper copies. The finance team manually enters data into spreadsheets, chasing down approvals and double-checking numbers to prevent costly errors. A missed invoice leads to a late payment, souring a key supplier relationship. A duplicate entry results in an overpayment, tying up company funds unnecessarily. These inefficiencies add up quickly.

Without automation, businesses face:

-

High processing costs – AP teams spend significantly more per invoice due to inefficient, labor-intensive workflows.

-

Increased errors – Manual input leads to duplicate payments, incorrect entries, and compliance risks.

-

Approval bottlenecks – Lengthy approval chains delay payments, causing missed discounts and strained vendor relationships.

-

Limited visibility – Lack of centralized tracking makes reporting, audits, and cash flow forecasting more difficult.

How automation is transforming invoice processing

Technology has reshaped invoice processing, making it faster, more accurate, and cost-effective. Automated systems handle invoice intake, data extraction, validation, approvals, and payment reconciliation—minimizing human intervention and maximizing efficiency.

From paper-heavy processes to intelligent automation

Historically, finance departments were buried under stacks of paper invoices, manually tracking each step from approval to payment. Errors were inevitable, and processing time could stretch into weeks. Today, AI-driven automation eliminates these inefficiencies. OCR technology extracts key details, AI validates data against existing records, and machine learning adapts to different invoice formats over time. The result is a seamless, intelligent workflow.

Seamless integration with finance systems

Automated invoice solutions don’t just streamline AP—they integrate directly with ERP and accounting software, ensuring:

-

Real-time data consistency across platforms

-

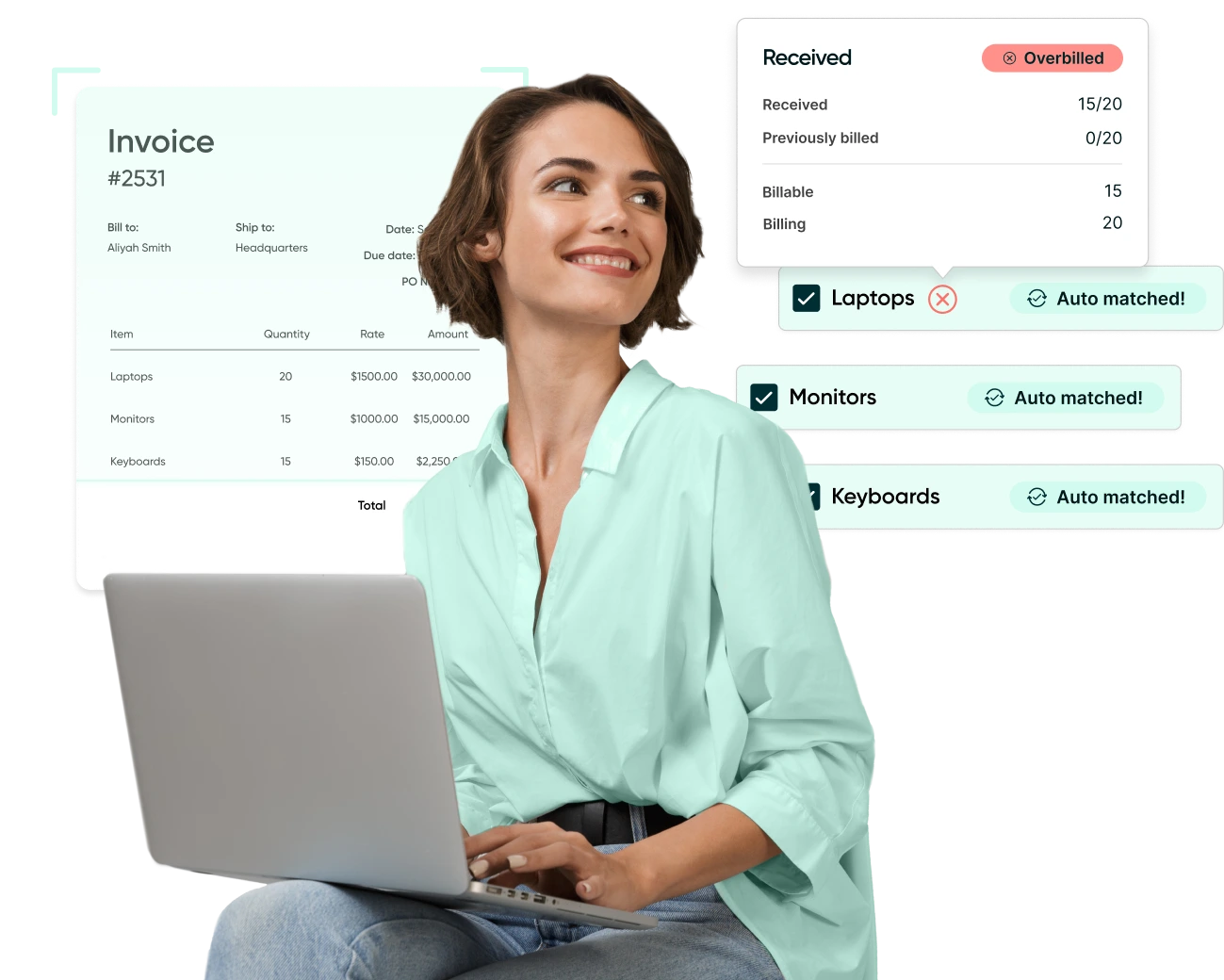

Instant reconciliation with purchase orders and receipts via automated three-way matching

-

Automated flagging of discrepancies, preventing financial errors before they occur

A proactive approach to compliance and security

With increased scrutiny on financial accuracy, compliance is critical. Automated audit trails provide transparency, ensuring adherence to internal policies and external regulations. Encrypted data storage and role-based access controls protect sensitive financial information from fraud and unauthorized access.

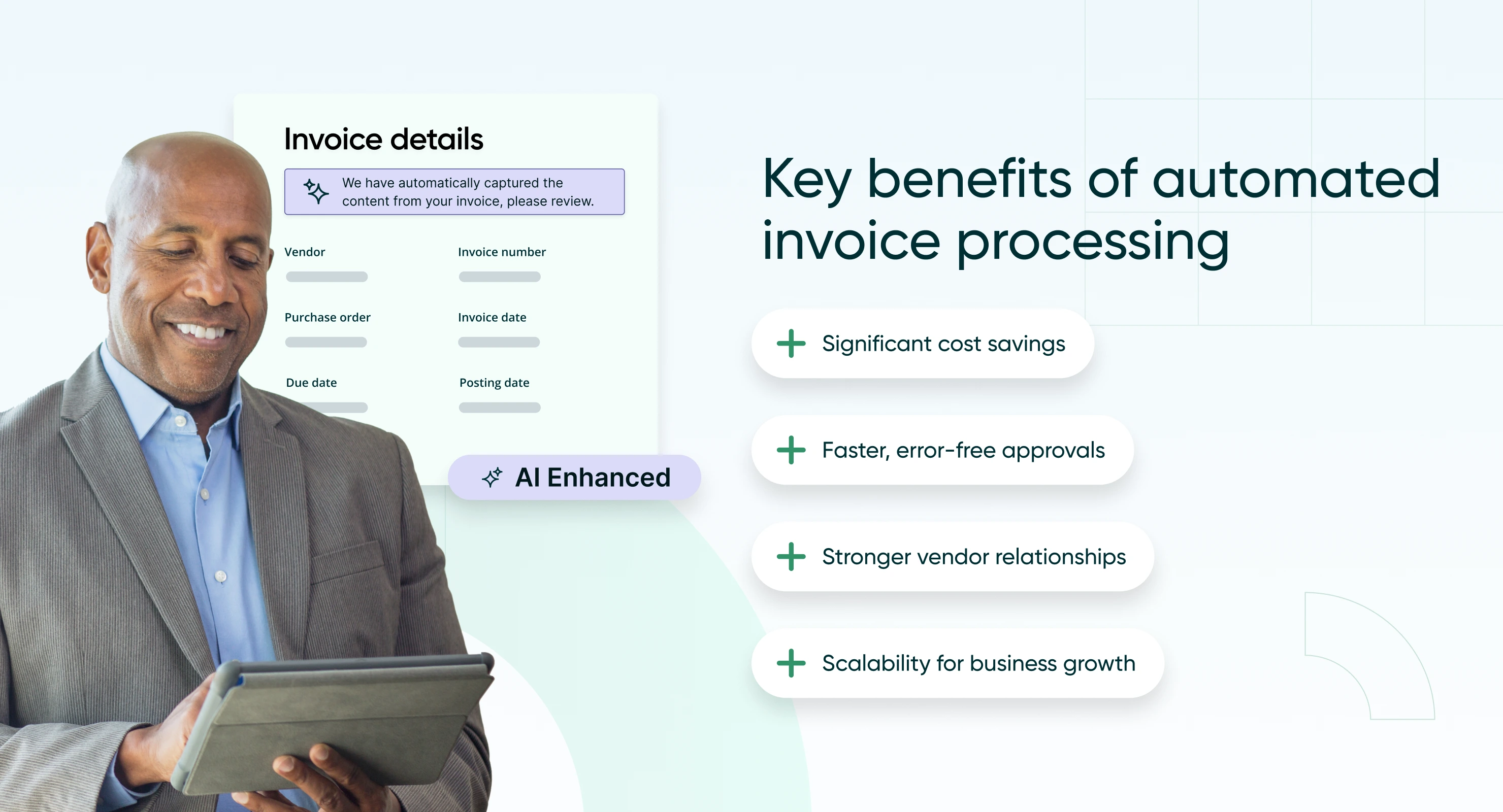

Key benefits of automated invoice processing

Significant cost savings

Automation reduces invoice processing costs by up to 80%.

Imagine a company handling 1,000 invoices per month. By eliminating manual labor and reducing errors, automation could save thousands annually—funds that can be redirected toward strategic growth initiatives.

Faster, error-free approvals

In a manual system, an invoice can sit on a manager’s desk for days before being approved.

Automated workflows instantly route invoices to the right approvers, eliminating bottlenecks. AI-driven validation ensures accuracy, preventing duplicate payments and mismatched data before they become costly problems.

Stronger vendor relationships

Suppliers thrive on timely payments.

Delays can strain relationships, while prompt payments open doors to better contract terms and early payment discounts. Take this hypothetical scenario for example: paying a $50,000 invoice early at a 2% discount could yield $1,000 in savings—as you can imagine, multiplied across hundreds of transactions, this adds up quickly.

Scalability for business growth

A growing business means more invoices, but that doesn’t have to mean more overhead. Automated solutions scale effortlessly, ensuring efficiency as invoice volume increases without requiring additional AP staff.

Automated invoice processing in action: Customer success story

Pindari, an Indigenous-owned contracting company in Australia’s mining and resources sector, faced significant challenges managing accounts payable (AP) across its 15 locations. With rapid growth and a decentralized workforce, manual invoice processing led to inefficiencies, data silos, and the risk of duplicate payments. Seeking a scalable solution, Pindari implemented Procurify to digitize its AP and procurement workflows, ensuring real-time visibility, streamlined approvals, and improved financial control.

Since adopting Procurify, Pindari has processed over AU $4 million in POs, leveraging automated three-way matching to eliminate duplicate invoices and reduce errors. Procurify’s OCR technology has enabled quick and accurate data extraction, while its intuitive interface simplified adoption across teams. By centralizing procurement and AP functions, Pindari has significantly improved internal communication and efficiency, allowing its finance team to focus on strategic growth rather than manual data entry.

“The last three or four years have been a period of sustained company growth. If we didn’t have a building block such as Procurify at that earlier stage, it probably would have significantly impacted our ability to grow,” said Holly Hammond, Financial Controller at Pindari.

With Procurify’s automation, Pindari has achieved greater control over spending, minimized financial risks, and positioned itself for continued expansion in the mining and commercial sectors.

The future of invoice automation

Automation isn’t just an efficiency tool—it’s a strategic asset.

As AI and machine learning continue to advance, invoice processing will become even more intuitive, further reducing AP workload and enhancing financial strategy. Companies that adopt automation today position themselves for long-term success, ensuring agility, accuracy, and control over their financial processes.

Webinar: Automate Your AP Processes with Procurify

Learn how AP automation enhances the efficiency, accuracy, and financial visibility of your accounts payable workflows.