The End of Expense Reports? How Virtual Debit Cards Simplify Spend Management

Managing corporate spending is a challenge for mid-market companies. Traditional corporate cards come with fraud risks, limited visibility, and a reliance on manual reconciliation that drains time and resources. Expense reports pile up, unauthorized spending slips through the cracks, and finance teams are left reacting rather than staying ahead.

These inefficiencies don’t just create headaches—they cost companies real money. Unapproved purchases, delayed approvals, and unclear financial reporting can lead to budget overruns and financial blind spots.

Virtual debit cards provide a better way. Unlike traditional cards, these digital payment tools give businesses complete control over spending. Finance teams can assign cards with custom limits, track every transaction in real time, and prevent fraud before it happens.

This blog post explores how virtual debit cards work, their key benefits, and how mid-market companies are using them to streamline procurement, improve financial oversight, and eliminate unnecessary administrative work.

What are virtual debit cards?

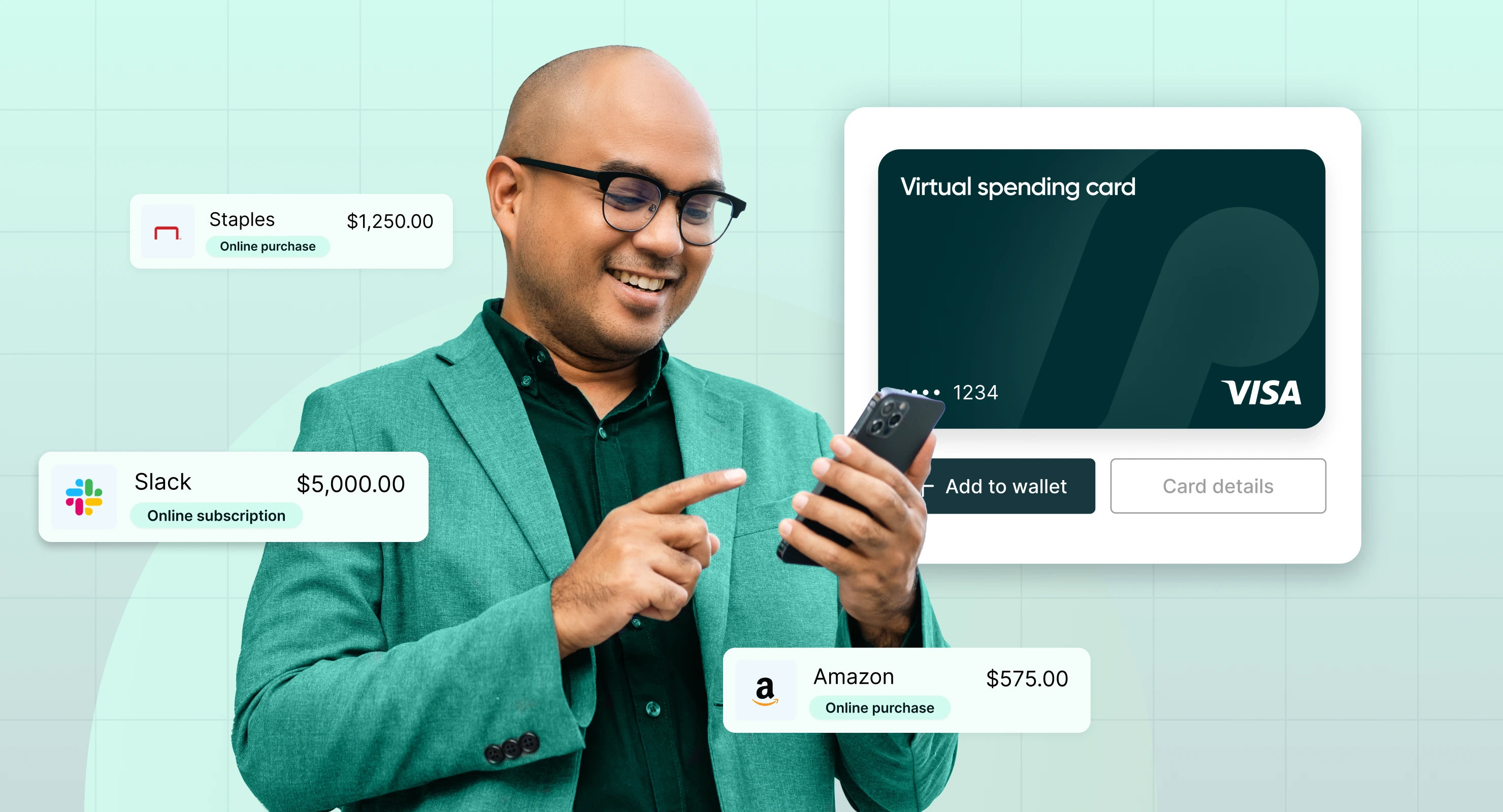

Virtual debit cards are digital payment methods that function like traditional debit cards but exist only in electronic form. Each virtual card is linked to a company’s primary bank account or funding source and is assigned a unique 16-digit number, expiration date, and security code.

These cards can be issued instantly and used for a variety of business transactions, including supplier payments, employee purchases, and recurring subscriptions. Because they are digital, businesses can generate them on demand, set strict usage parameters, and deactivate them immediately if needed.

For mid-market companies struggling with spend control, virtual debit cards offer a flexible and secure way to manage transactions while integrating seamlessly with existing financial systems.

How virtual debit cards work

The process of using virtual debit cards is simple and highly controlled:

-

Issuance: Finance teams generate virtual debit cards through a secure platform. Each card can be customized with spending limits, expiration dates, and merchant restrictions.

-

Assignment: A card is assigned to a specific employee, department, or vendor. The finance team controls where and how the card is used.

-

Usage: The recipient uses the virtual card details for authorized transactions, either online or over the phone. Cards can also be added to digital wallets for seamless purchasing.

-

Real-time Monitoring: Every transaction is tracked in real time. Finance teams receive instant updates, allowing them to flag unauthorized purchases and ensure compliance.

-

Reconciliation: Virtual debit card transactions sync automatically with accounting and ERP systems, eliminating the need for manual expense reports and improving financial accuracy.

This streamlined workflow not only reduces administrative overhead but also strengthens financial oversight.

The benefits of virtual debit cards for mid-market Companies

-

Greater control over spending

Traditional corporate cards give employees broad spending authority, often leading to overages and unapproved purchases. Virtual debit cards solve this problem by allowing finance teams to issue cards with predefined limits. Businesses can ensure that every transaction aligns with company budgets and policies, preventing unauthorized expenses before they happen.

Take control of company spending

Ditch the fraud risks and manual tracking of traditional corporate cards. Procurify’s virtual spend cards give you real-time visibility, built-in controls, and seamless automation.

-

Fraud prevention and security

Card fraud is a growing concern for businesses. Virtual debit cards reduce exposure to fraud by providing:

- Single-use or vendor-specific cards to prevent misuse

- Spending caps to limit unauthorized charges

- The ability to instantly deactivate or regenerate card numbers if a security issue arises

Because virtual cards exist only in digital form, they also eliminate the risk of physical card loss or theft.

-

Reduced administrative burden

Tracking and reconciling expenses manually is inefficient. Virtual debit cards eliminate the need for paper receipts and traditional reimbursement processes. Finance teams can see transactions in real time, reducing the time spent on approvals, expense reports, and reconciliations.

-

Faster procurement and expense approvals

Waiting for corporate card approvals or reimbursements can slow down procurement and create unnecessary bottlenecks. Virtual debit cards provide employees with immediate access to funds within pre-approved limits, allowing teams to move quickly without sacrificing oversight.

-

Seamless integration with financial systems

Virtual debit cards integrate directly with ERP and accounting software, ensuring that every purchase is automatically recorded and categorized. This removes the need for manual data entry, improves audit trails, and provides finance teams with a clearer picture of company spending.

Real-world impact: How Anakeesta used virtual spend cards to improve financial oversight

Anakeesta Theme Park faced a common challenge—managing company spending across multiple teams without losing control. With a mix of corporate credit cards and employee reimbursements, keeping track of expenses was becoming increasingly complex and time-consuming.

By switching to Procurify’s virtual spend cards, Anakeesta achieved:

-

Stronger spending controls by assigning pre-approved cards with set limits

-

Faster approvals with real-time transaction tracking instead of monthly statement reviews

-

Improved visibility into company spending, eliminating financial blind spots

The result was a more streamlined, efficient, and accountable financial operation. Finance teams gained full oversight of spending while employees had the flexibility they needed to make necessary purchases.

Read the full case study here:

The cost of inaction

Many mid-market companies hesitate to update their financial processes, relying on traditional corporate cards and outdated approval workflows. But failing to adapt comes at a cost.

-

Every unauthorized expense eats into company profits.

-

Manual reconciliation wastes valuable time that could be spent on strategic finance initiatives.

-

Limited visibility leads to financial surprises that disrupt cash flow.

Waiting to modernize spend management means continuing to deal with inefficiencies, fraud risks, and unnecessary administrative work. Virtual debit cards offer a proven way to prevent these issues while giving finance teams the control and insight they need to make smarter spending decisions.

Is it time to rethink your spend management strategy?

Traditional corporate cards and manual expense tracking are no longer enough for mid-market companies looking to scale efficiently. Virtual debit cards offer the flexibility, security, and automation needed to take control of corporate spending.

Companies that embrace this shift will see immediate benefits—reduced fraud, faster approvals, and real-time visibility into every transaction. Those that wait will continue to struggle with financial blind spots and inefficiencies.

The question isn’t whether virtual debit cards are the right solution—it’s how much longer your company can afford to go without them.