The Drawbacks of Company Credit Cards (And What To Use Instead)

For business owners and managers who have team members in remote locations, issuing purchasing cards seems like the right choice.

After all, they eliminate the issue of red tape, they streamline the purchasing process, and they offer purchasing autonomy to everyone, not just executives. On the other hand, the wrong type of company-issued purchasing card can lead to a lack of control, limited visibility over purchases, and more administrative and financial concerns for the organization.

Here’s what you need to know.

Should you use a company credit card?

If you don’t know already, company credit cards are different to spending cards (find out more about the difference between company credit cards and spending cards here). Although you use both types of cards to purchases goods and services for an organization, one card offers spend control and complete transparency, and the other, well, doesn’t.

The latter refers to company credit cards. These types of cards work in the same way as a personal credit card, and they’re most frequently used at small businesses where the owner is the sole cardholder. In this instance, company credit cards work quite well – the owner is solely responsible for purchasing on behalf of the organization and retains full control over the organization’s bank account.

When a business owner adds more people to the company credit card, however, problems begin to arise. Dishing out credit cards to team members can lead to disastrous consequences. During your month-end close, you’ll be busy trying to work out who purchased what, and when; you’ll be chasing receipts for those anonymous purchases; and you’ll be left in the dark about whether you’ve spent to your budget, or whether you owe the bank a fistful of cash.

If your business is bigger than just you, we’d advise erring on the side of caution when issuing company credit cards. And here’s why.

Company credit cards: what’s wrong with them?

Quite simply, issuing multiple company credit cards can lead to abuse by team members, regardless of their authority. Having unfettered access to company resources is an offer too good to resist for certain individuals, even in the course of normal business activity. It can lead to:

Indulgent and excessive spending

Not to discredit your teams (we assume you hire responsibly!), but in some instances, team members can throw caution to the wind if issued a company credit card. Unless you spend every waking minute tracking your business spending, maverick spending is a real risk when handing out company-issued credit cards. Without controls, a team member may splurge on that fun and hair-raising Mazda MX5, rather than that economical Ford Focus with good mileage.

Personal and business overlap

Another major issue, probably the most recurrent, is the blurring of lines between personal and business expenses. The old adage of ‘give an inch, take a mile’ rings true here. Chances are, team members will expense personal purchases and write them off as business expenses.

Lack of spend tracking

The last issue is a subtle one that is often overlooked. Although you have some limited control over spending limits with company credit cards, it’s hard to ensure that purchases are compliant and from trustworthy vendors. To mitigate this risk, you might explicitly state that teams can only purchase from supplier X or Y. However, there’s still every chance that a stealthy team member will purchase a gift card for themselves from a trusted vendor like Amazon.

So, what’s the alternative?

Used at organizations where multiple team members are responsible for purchasing, spending cards offer a far smarter approach to company spending. Instead of issuing cards to team members and letting them run rampant with the company bank account, spending cards let you proactively control who spends what, where, and when.

Here are a few benefits of company spending cards.

Proactive spend control

With the right spending cards program, you can approve purchases before money is committed. You can also see that spend against your budget in real-time, so you know exactly how much is coming out of the pot, and how much you have left before it’s too late to do anything about it.

Centralized administrative control

Spending cards aren’t directly linked to your organization’s bank account. Instead, those who approve purchases can load money onto individual cards to enable those purchasing to buy what they need, and no more.

Efficiency on the go

Company spending cards give team members the freedom and autonomy to buy what they need, when they need it. This reduces the red tape of purchasing and means everyone can make critical business transactions that help drive growth, without going through the rigamarole of expense reimbursement.

A level of checks and balances

Despite removing bureaucracy, spending cards retain the necessary scrutiny needed to ensure purchases are smart and business-critical. By proactively approving business spend before it is made (and by building personalized purchase workflows), every single business expense is checked over and either approved or denied. In short, you can reduce the amount of frivolous expenses made in the name of ‘running company errands’.

Financial awareness

A by-product of such transparent spending is that teams become consciously aware of the organization’s spend culture. This helps those requesting purchases think twice about what they’re buying, and whether or not it aligns to business objectives and will contribute to growth.

“[It is up to the] team members to take it upon themselves to spend and use their card with integrity. I think that is the biggest thing that happens when I would see card users in our company. It’s just making sure that you are using them properly.

But that [in itself] is a big challenge. It’s a big challenge for fast-running companies to control spending, keep their internal controls in place, and have it be efficient.”

– Lindsey Head, CFO, JPublic Relations

Deploying spending cards: a few considerations

There are a few things to consider when deploying spending cards. For example:

Compulsory financial awareness training

It’s best to hold training to educate teams on company expectations. Be sure to outline the limits and cutoffs imposed on certain expenses. Advocate for spending that is in the best interest of the company. And deploy a smart spend policy to ensure everyone knows how to purchase effectively.

Approval thresholds and spend limits

You also have a duty to install controls and spending limits to proactively deter against abuse. Prior to issuing cards, make sure your purchasing workflows are optimized for smart spending. For example, you could increase the spend thresholds or reduce the number of approvers for trustworthy team members.

Build a spend culture for everyone, not just purchasing teams

Everyone at your organization requires something to do their job. From a software license, to a company car, to a new desk for their home office. Ultimately, purchasing is no longer the responsibility of the purchasing department.

With that said, everyone should be able to purchase what they need to do their job, when they need it. Only then can your organization do what it does best: grow.

To find out more about Procurify spending cards, read up on how Procurify customer, Graduation Solutions, transformed their spend culture with spending cards.

Editor's note Original author: Dani Hao Original publish date: 8 Jan 2019 We've since updated and republished this blog post with new content.

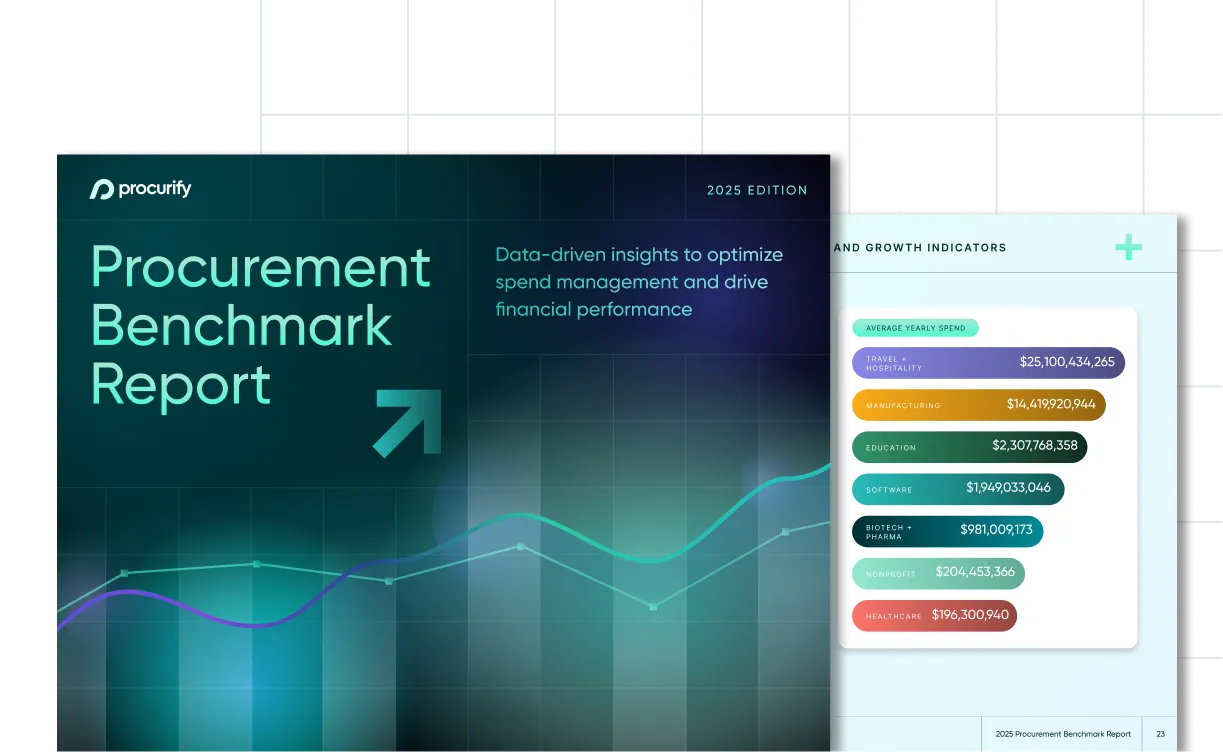

2025 Procurement Benchmark Report

Powered by $20B+ in proprietary data you won’t find anywhere else.