10 Reasons to Automate Your Accounts Payable Processes

If you haven’t already automated your accounts payable (AP) processes, you’re missing out. According to The Aberdeen Group, accounts payable automation translates to approximately 18 percent fewer days payable outstanding (DPO). If you don’t know why that’s important, here’s why: that equates to a saving of about 5.55 days on average.

While all well and good, accounts payable automation often sounds daunting. It requires shiny new tools that can sometimes upset the status quo; it asks for time and money; and if implemented incorrectly, it can lead to disaster.

But here’s the thing: disaster is often few and far between. In fact, if you weigh the benefits of implementing AP automation against the costs, you’ll quickly realize that the returns far outweigh the costs.

Here are ten reasons why you should be automating your accounts payable.

1. It’s faster

The words ‘automation’ and ‘faster’ are synonymous with one another. Why else would you turn to technology if not to speed up your day-to-day routines and save time?

With the right automated software, your accountants will have access to all your financial documents at the touch of a button. That means no more hunting down invoices, no more manual data entry, and certainly no more late nights in front of spreadsheets.

What is this important? Well, it means more time to become a strategic influencer at your organization, more time to concentrate on reducing operational costs, and way more time for your morning coffee.

2. It’s more accurate

Manual data entry is rife with inaccuracies. According to Orcolus, manual data entry has an error rate as high as four percent.

Copying and pasting hard-copy documents from paper to machine results in multiple errors. That’s just a fact of life. To really drive this point home, automated AP software won’t just result in more accurate data, it’ll also flag any data that is considered an anomaly so that it can instantly rectify it.

3. It assesses company performance instantaneously

Manual data entry will cost you time. We’ve established that. But entering data is just half of the data puzzle. How you analyze that data is what’s important, and without automation, it also costs you time.

Fortunately, with automated AP software, the technology won’t just help you enter data, it’ll analyze it, too. Save yourself the headaches of shuffling through reports to identify vulnerabilities in your AP processes. With a few keystrokes, you can load up the reports you need in real time and visibly see any issues that are occurring, or that might occur in the future.

4. It saves money on transactions

For small businesses, late payments cost approximately US$3 trillion per year across the globe. Automated account payable sustems cut down not only on penalty costs associated with late payments, they also help your organization take advantage of any early payment discounts offered by your vendors.

5. It cuts down on clutter

Saved time isn’t the only benefit to gain from automated AP technology. Digitizing and automating your accounts payable processes also saves on space, too. After all, cloud storage requires no filing cabinets or paper forms.

As organizations begin returning to the office, many organizations will return to the paper form. If you can, continue to utilize any remote-work processes you implemented in 2020 and keep your paperwork to a minimum. It’ll promote a stress-free work environment.

6. It’s more environmentally-friendly

Speaking of piles of paperwork, imagine all the acres of trees you’ll save with an automated accounts payable system!

Going paperless also reduces the need for expensive toner cartridges, frees up storage space, contributes to cleaner work environments, and boosts your organization’s reputation as an eco-friendly place to work.

7. It reduces budgetary guesswork

One of the greatest aspects of automated AP workflows is easy access to historical data. By recording all your transactions, you benefit from trend analysis. This means you have the information you need to produce well-informed and realistic budgets.

8. It cuts down on fraud

Automated accounts payable processes offer the necessary checks and balances to protect your organization against intentional ‘human error’.

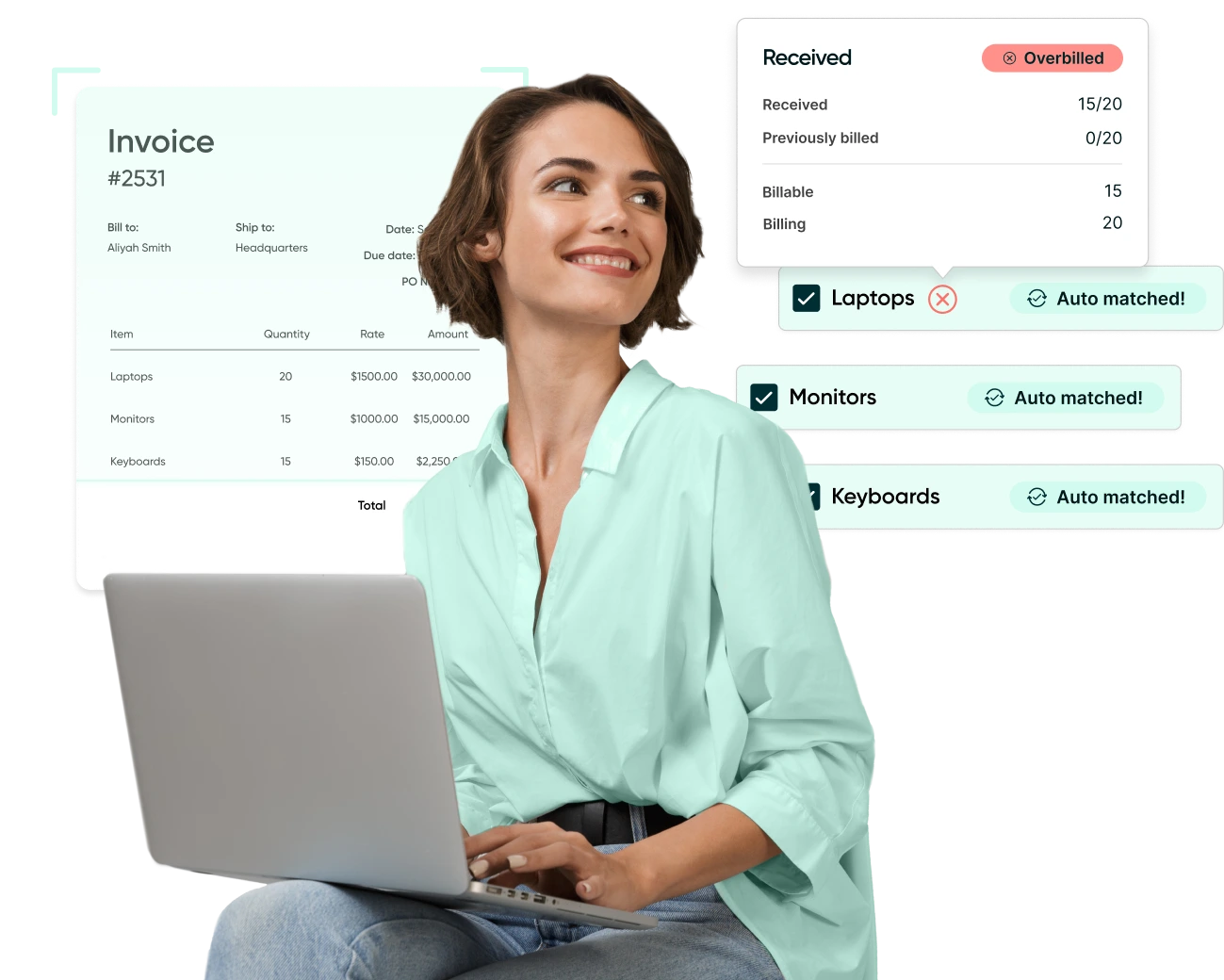

Procurement fraud is a real problem for many organizations. But, the right technology allows you to cross-check invoices against any suspected rogue spending and ensures that no unauthorized purchase orders fly below the radar.

9. You can see the big picture

Data visualization is far easier when left up to technology. User-friendly displays mean that decision makers can clearly understand all stages of the procurement cycle and quickly respond to any performance issues.

At a moment’s glance, you can explore and analyze any part of your accounts payable process and begin to chart performance, quarter to quarter.

10. It makes decision-making easier

Most importantly, accounts payable automation gives you everything you need to make informed and strategic business decisions quickly.

In times as turbulent as these, being able to respond to various extraneous circumstances is more vital than ever, and you can begin to eliminate concerns that may impede your organization and ensure long-term viability.

Ready, set, automate

Digitizing your processes is all well and good, but this only gets you half way towards a smart and responsive accounts payable process. To truly reap the rewards of improved efficiency and to begin leveraging data-driven insights, you need to also include procurement automation processes.

By doing so, your team can benefit from more time, greater adaptability, and improved visibility over the end-to-end AP process. This allows you to become a strategic influencer who drives organizational change, instead of someone who simply manages those transactional chores.

To find out more about how Procurify can help you automate your AP process, explore our website or watch a demo.

Webinar: Automate Your AP Processes with Procurify

Learn how AP automation enhances the efficiency, accuracy, and financial visibility of your accounts payable workflows.