The Benefits of Integrating AP Automation Software with Your Existing ERP System

With so much emerging technology at organizations’ disposal, from automation to AI, every advantage is needed to thrive in an ultra-competitive landscape.

One area where businesses are seeing opportunities for cost reduction and improved efficiency is in their accounts payable (AP) departments. But it always hasn’t been that way.

Traditionally, AP processes have been time-consuming and prone to errors due to the manual handling of invoices, payments, and approvals. However, with the advent of AP automation, businesses now have the tools to streamline these processes, resulting in faster, more accurate outcomes.

But what if your AP automation workflows could do even more? By integrating your AP automation software with your existing enterprise resource planning (ERP) system, you can unlock a new level of operational efficiency. ERP systems are already central to managing various business functions, including finance, procurement, and supply chain management. Integrating AP automation software with your ERP system ensures that data flows seamlessly between these critical areas, eliminating the need for redundant data entry and reducing the risk of errors.

Unlock the power of Procurify integrations

Learn how Procurify’s integrations with your ERP or accounting software can help your organization automate and streamline processes, boost compliance and reporting, and access real-time spend data.

In this article, we will explore the specific benefits of integrating AP automation software with your ERP system. We’ll discuss how this integration can improve data accuracy, enhance financial visibility, streamline workflows, and more.

Understanding AP automation

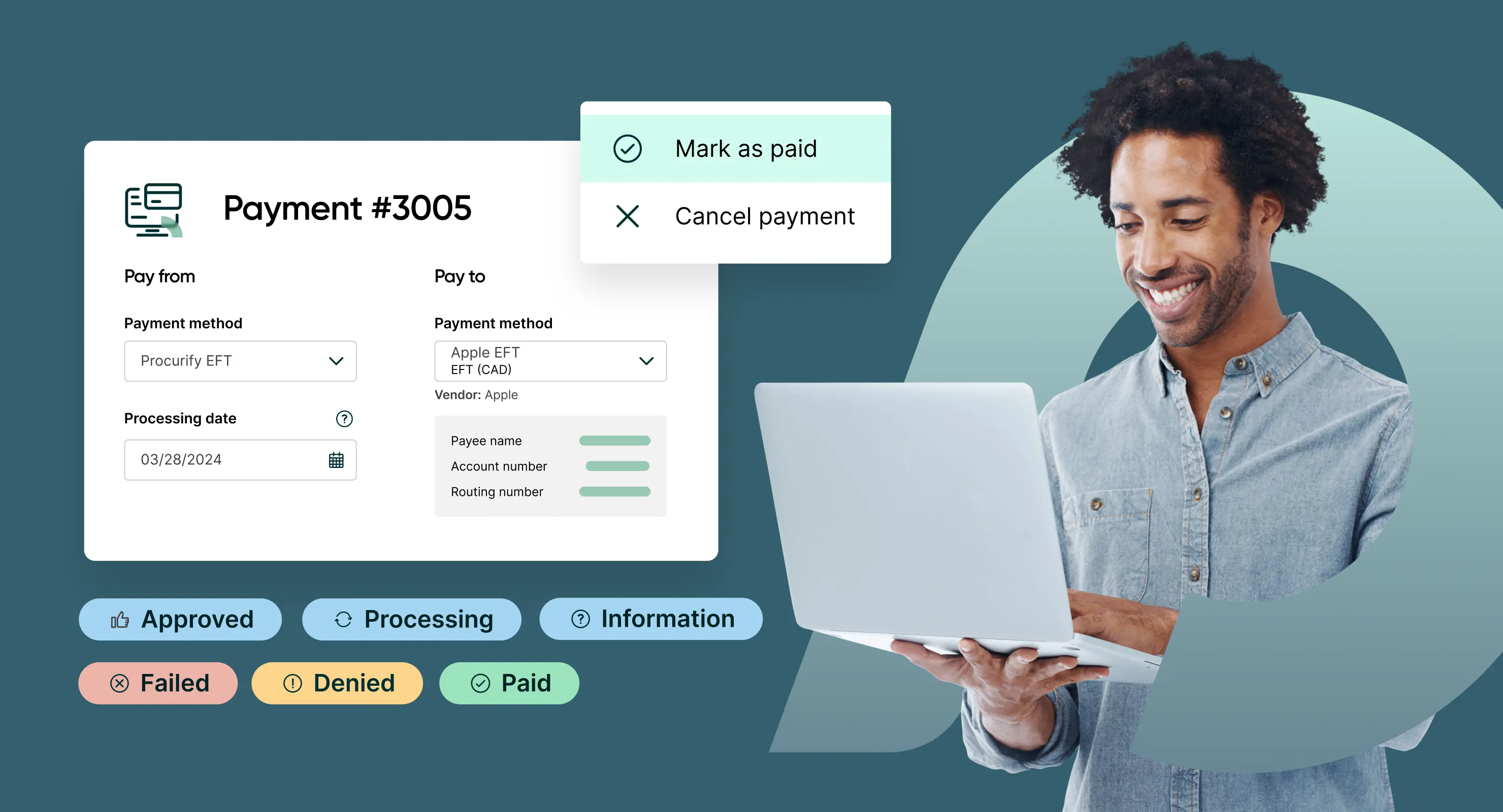

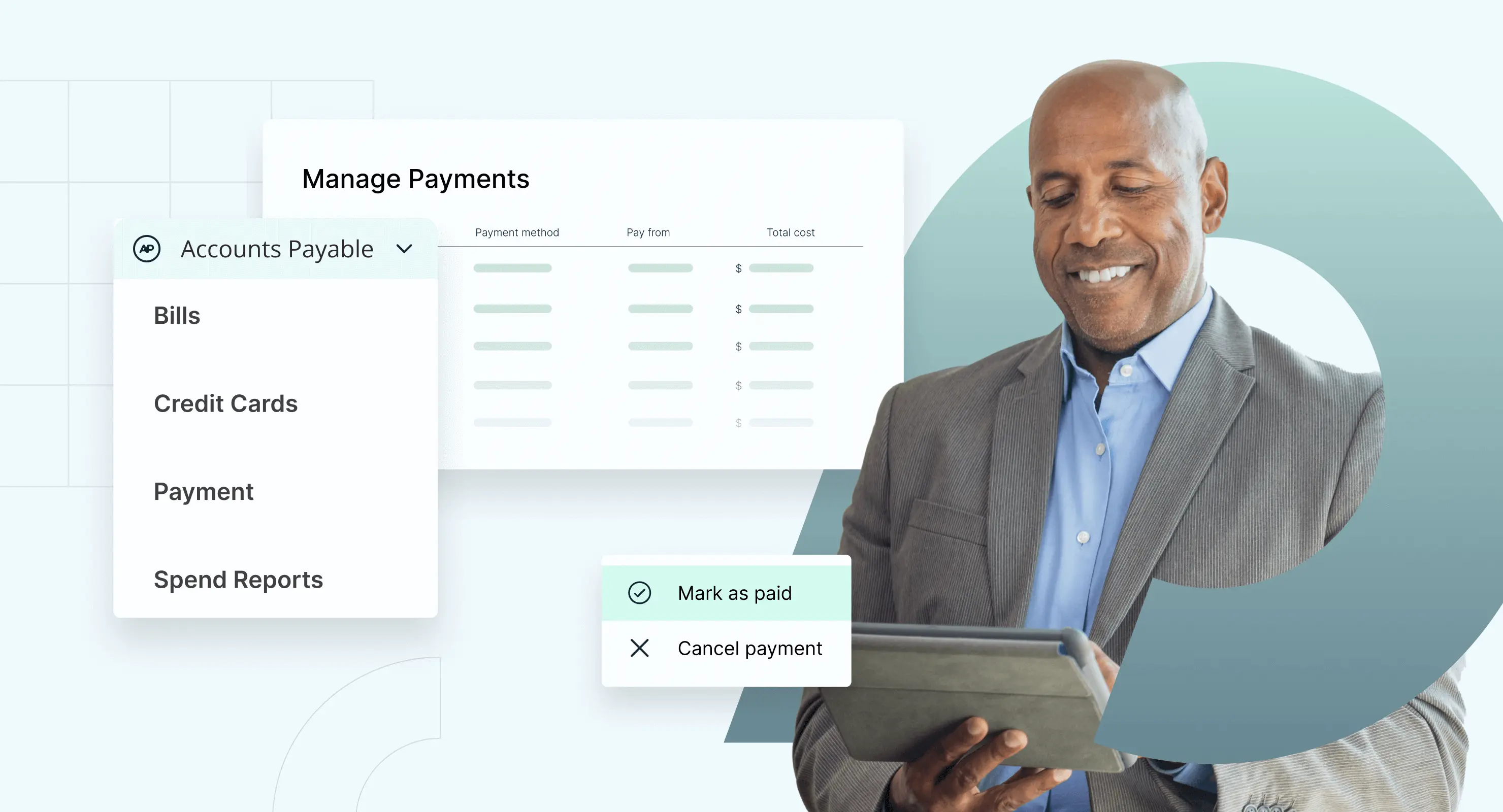

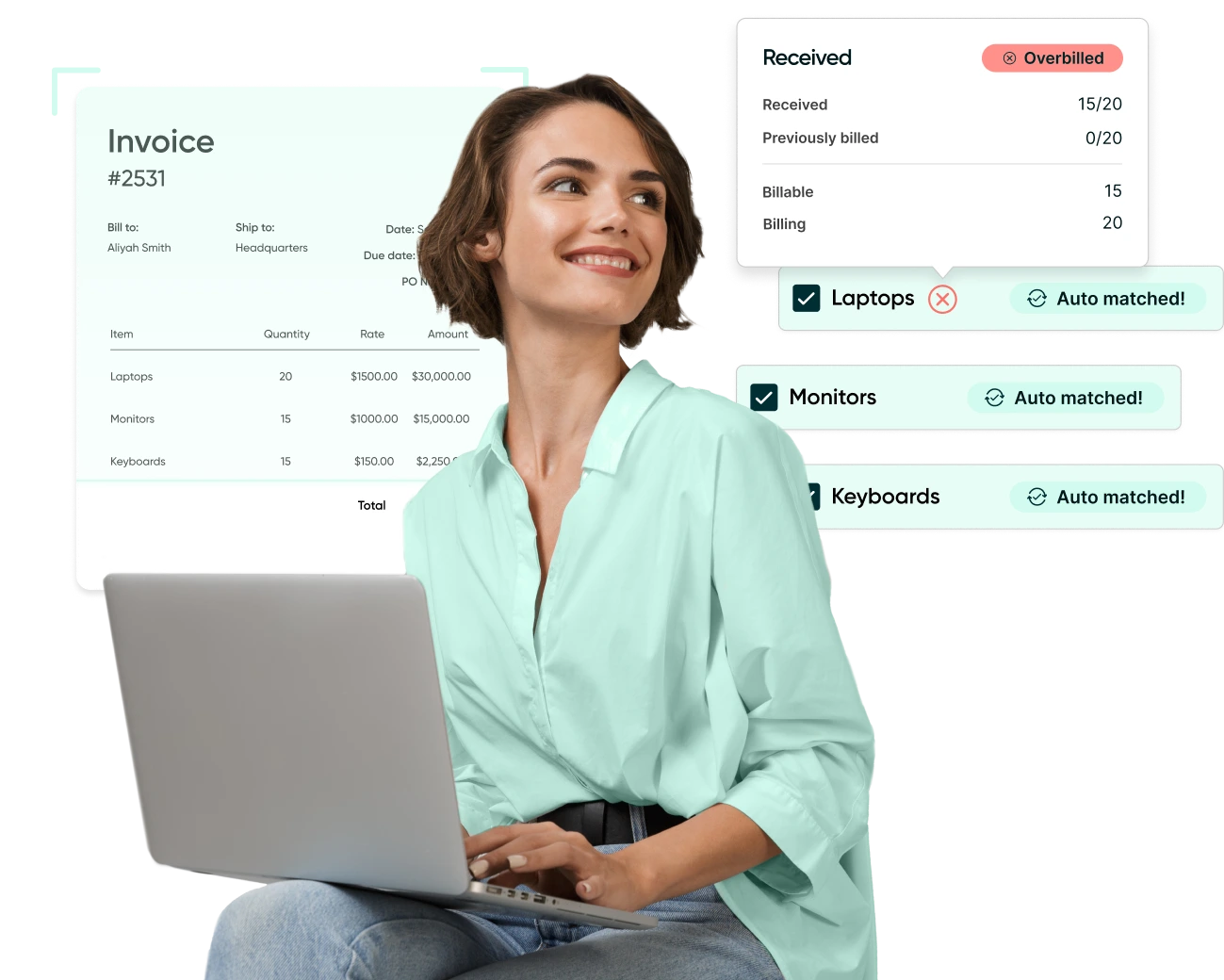

Accounts payable (AP) automation refers to the use of technology to automate and streamline the processes involved in managing a company’s accounts payable. This typically includes tasks such as invoice processing, approval workflows, and bill payments. By reducing the need for manual intervention, AP automation helps businesses improve efficiency, reduce errors, and gain better control over their cash flow.

Traditionally, accounts payable processes involved a significant amount of manual work. Invoices would arrive in paper form or as PDF attachments via email. AP staff would need to manually enter data into the accounting system, route invoices for approval, and ensure that payments were made on time. This manual approach is time-consuming and prone to errors such as data entry mistakes or lost invoices, ultimately leading to late payments, missed discounts, and strained vendor relationships.

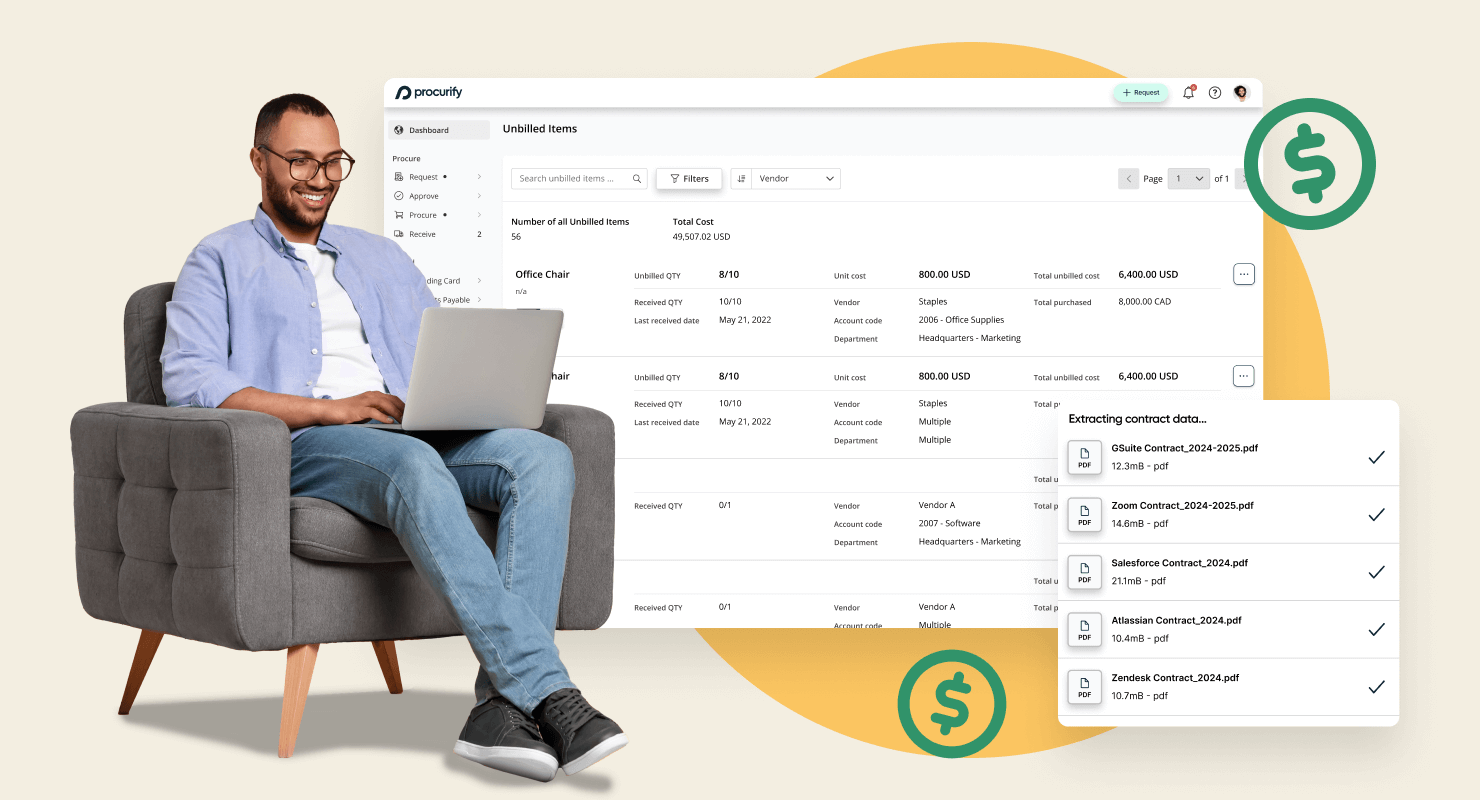

AP automation addresses these challenges by digitizing and automating key aspects of the AP process. For example, invoices can be automatically captured and digitized using optical character recognition (OCR) technology, which extracts relevant data and populates it directly into the accounting system. Automated workflows can route invoices to the appropriate approvers based on predefined rules, such as invoice amount or vendor type. Once approved, payments can be scheduled and executed automatically, with the system sending notifications to vendors and updating the company’s financial records in real-time.

Beyond just speeding up processes, AP automation also provides businesses with enhanced visibility into their accounts payable operations. Dashboards and reporting tools allow finance teams to track the status of invoices, monitor cash flow, and identify bottlenecks in the approval process. This increased transparency helps in managing day-to-day operations and supports better decision-making by providing timely and accurate financial data.

AP automation is about more than just making existing processes faster—it’s about transforming how those processes are managed, leading to improved accuracy, efficiency, and control. When integrated with an ERP system, the benefits of AP automation can be even more pronounced, as we will explore in the following sections.

Understanding ERP systems

Enterprise resource planning (ERP) systems are comprehensive software platforms that integrate various business processes and functions into a unified system. These systems are designed to centralize and streamline the management of key business areas, such as finance, human resources, procurement, supply chain management, and more. By bringing together data from different departments, ERP systems provide organizations with a holistic view of their operations, enabling better decision-making and more efficient use of resources.

At their core, ERP systems serve as the backbone of an organization’s technology infrastructure. They facilitate the flow of information across different business units, ensuring everyone has access to the most up-to-date and accurate data. For example, when a purchase order is created, the ERP system automatically updates inventory levels, generates a corresponding financial entry, and notifies the procurement team. This level of integration reduces the need for manual data entry and minimizes the risk of errors, as all departments are working from a single source of truth.

ERP systems are typically modular, allowing businesses to choose the specific functionalities that meet their needs. Common modules include:

-

Financial management: Handles accounting, budgeting, and financial reporting.

-

Supply chain management: Manages procurement, inventory, and logistics.

-

Human resources management: Oversees employee records, payroll, and benefits administration.

-

Customer relationship management (CRM): Tracks customer interactions, sales, and service activities.

-

Manufacturing and production: Coordinates production schedules, quality control, and maintenance.

Because ERP systems are so central to an organization’s operations, they are often customized to fit the specific needs of the business. This customization can involve integrating the ERP system with other software solutions such as customer portals, e-commerce platforms, or specialized industry applications. These integrations ensure that the ERP system can provide a complete and accurate picture of the business, without requiring users to switch between multiple systems.

One of the key advantages of using an ERP system is the ability to streamline workflows across the organization. By automating routine tasks and providing real-time access to data, ERP systems help businesses operate more efficiently and make more informed decisions. For instance, an ERP system can automatically match purchase orders with invoices and delivery receipts, ensuring that payments are only made for goods that have been received and approved.

In addition to improving internal processes, ERP systems support better compliance with regulatory requirements. By maintaining a comprehensive record of all transactions and activities, ERP systems make it easier for businesses to generate reports, conduct audits, and ensure they are meeting all necessary legal and regulatory standards.

In conclusion, ERP systems are vital to modern business operations, providing the tools and data needed to manage complex processes and make informed decisions. When integrated with other systems, such as AP automation software, the benefits of an ERP system can be even greater, as it allows for seamless data flow and more efficient operations across the entire organization.

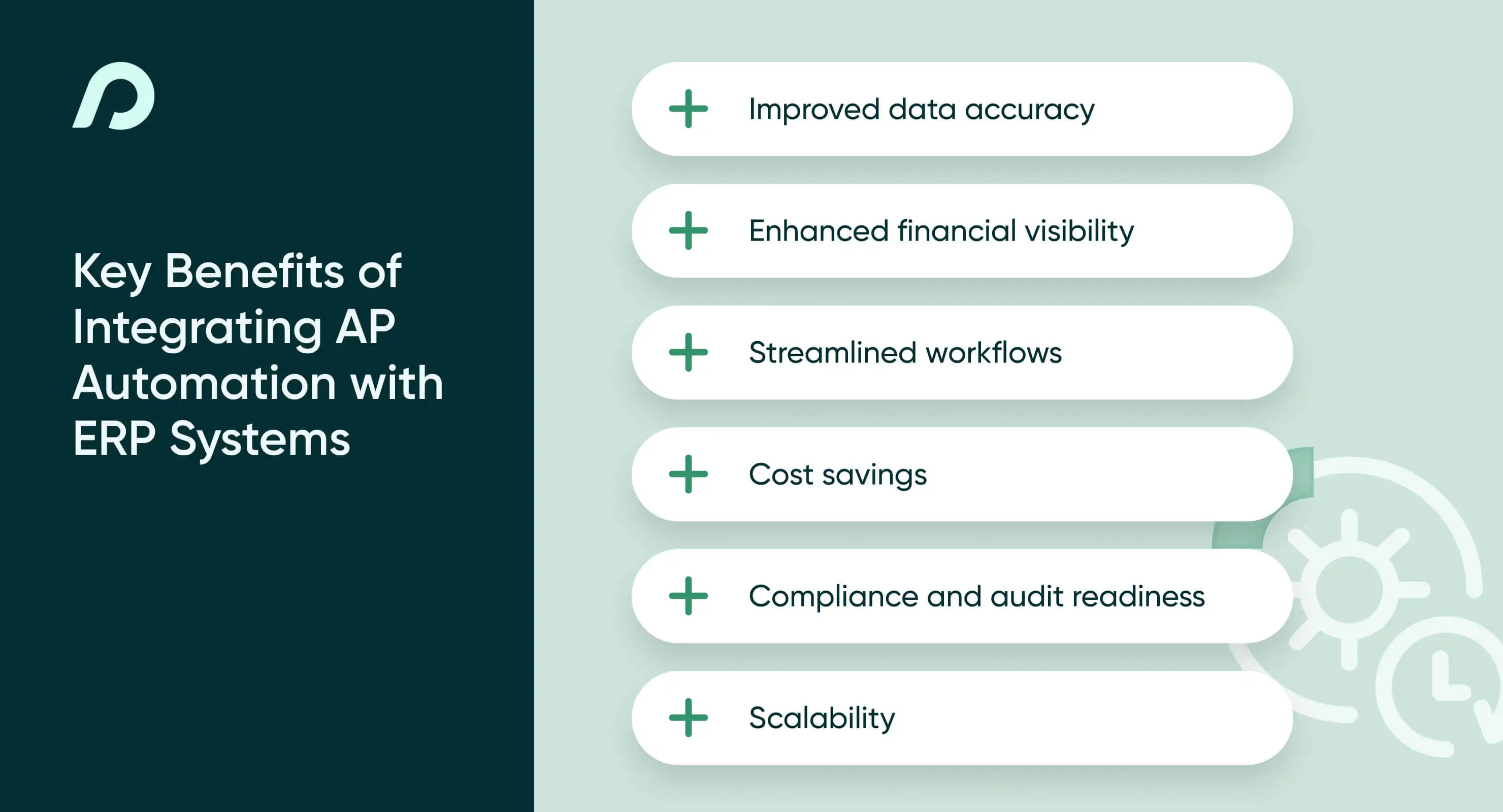

Key benefits of integrating AP automation software with ERP systems

While both AP automation software and ERP systems offer substantial benefits on their own, the true potential of these technologies is realized when they are integrated. Integrating AP automation software with an ERP system creates a seamless flow of information between accounts payable and other critical business functions, eliminating silos and enhancing overall operational efficiency. This section will explore why such integration is essential and the key challenges it addresses.

-

Elimination of redundant data entry

In a non-integrated environment, AP processes often require data to be entered manually into both the AP and the ERP systems. This redundancy not only consumes time but also increases the risk of errors. For instance, discrepancies can occur if an invoice is entered incorrectly in either system, leading to issues such as duplicate payments or delayed processing. By integrating AP automation software with your ERP system, data such as invoice details, payment status, and vendor information are automatically synchronized between the two systems. This ensures consistency and accuracy across your financial records, reducing the need for manual intervention.

-

Improved data accuracy

Manual data entry is inherently prone to errors, no matter how diligent the staff may be. Even a small mistake in entering an invoice number or amount can have significant consequences, potentially leading to payment delays, vendor disputes, or compliance issues. Integration between AP automation software and ERP systems ensures that data is captured accurately at the source and flows through to the ERP system without re-entry. This improves data accuracy and enhances trust in the financial data used for decision-making.

-

Enhanced financial visibility

Without integration, obtaining a complete view of the company’s financial status can be challenging. AP data might reside in a separate system or require manual compilation before it can be analyzed alongside other financial data in the ERP system. This fragmentation makes it difficult for finance teams to gain real-time insights into cash flow, outstanding liabilities, or payment statuses. When AP automation software is integrated with the ERP system, all relevant data is available in one place, providing a comprehensive view of the company’s financial health. This enhanced visibility supports better decision-making, allowing finance leaders to identify trends, manage cash flow more effectively, and plan for the future.

-

Streamlined workflows

In a manual or non-integrated environment, AP processes can become bottlenecked due to inefficiencies in workflow management. For example, invoices might be delayed in the approval process because approvers are unaware they are waiting for action, or payment schedules might be disrupted because critical information wasn’t communicated promptly. Integration automates these workflows by ensuring the necessary data is available to all stakeholders in real-time. Approvers can be notified automatically, payment schedules can be managed more effectively, and exceptions can be flagged immediately for resolution. This streamlining of workflows speeds up the AP process and reduces the likelihood of errors and delays.

-

Better compliance and audit readiness

Compliance with regulatory requirements is a critical concern for any organization. Whether adhering to tax laws, maintaining accurate financial records, or ensuring that payments are made on time, compliance can be challenging without the right systems in place. Integration between AP automation software and ERP systems ensures that all financial data is stored in a single, accessible location, making it easier to generate reports, conduct audits, and demonstrate compliance with relevant regulations. Moreover, the automated nature of these systems reduces the risk of non-compliance due to human error.

Integrating AP automation software with your ERP system addresses several critical challenges, from improving data accuracy to enhancing financial visibility and streamlining workflows. Eliminating redundant data entry ensures that all financial data is accurate and up-to-date. Integrating supports better decision-making and a more efficient, compliant accounts payable process. The next section delves into the benefits your organization can expect from this integration.

Best practices for integrating AP automation software with ERP systems

Integrating AP automation software with an ERP system can bring substantial benefits, but successful integration requires careful planning and execution. This section outlines best practices that will help ensure a smooth and effective integration process, enabling your organization to fully realize the potential of both systems.

-

Assess your current systems and processes

Before embarking on the integration, a thorough assessment of your current AP and ERP systems is essential. This includes evaluating the functionality of your existing software, identifying any gaps or inefficiencies in your current processes, and understanding your organization’s specific needs. Consider questions such as:

- What are the pain points in your current AP process?

- How well does your ERP system currently support AP tasks?

- What features and capabilities do you need from the integration?

This assessment will help you determine the scope of the integration and ensure that the chosen AP automation solution is compatible with your ERP system.

-

Choose a reliable accounts payable software provider

Selecting the right accounts payable software provider is crucial for a successful integration. Look for a company that offers a robust AP automation solution and emphasizes ease of use and customer support. The software should have an intuitive interface that allows your team to adapt quickly. Additionally, a provider with strong customer support can be invaluable during the integration, offering guidance, troubleshooting, and training to ensure everything runs smoothly.

When evaluating potential providers, consider the following:

- Ease of use: Is the software user-friendly and easy to navigate? Can your team quickly learn how to use it without extensive training?

- Customer support: Does the provider offer responsive and knowledgeable customer support? Are there resources such as tutorials, documentation, and live assistance available to help you through the integration process?

- Integration capabilities: Does the software integrate seamlessly with your existing ERP system? Are there pre-built connectors or integration modules that simplify the process?

- Reputation and reviews: What do other customers say about the provider’s software and support? Look for testimonials and case studies that highlight successful integrations.

Choosing a reliable provider that prioritizes ease of use and offers excellent customer support will make the integration process smoother and increase the likelihood of a successful outcome.

-

Involve key stakeholders early

Successful integration requires buy-in and collaboration from key stakeholders across the organization. This includes the finance and IT departments as well as other teams that may be affected by the integration, such as procurement, compliance, and operations. Involve these stakeholders early in the planning process to gather their input, address any concerns, and ensure the integration aligns with the organization’s broader goals. By fostering cross-departmental collaboration, you can help ensure a smoother implementation and greater acceptance of the new system.

-

Plan for data migration and cleanup

Data migration is a critical aspect of the integration process. Before migrating data from your existing AP system to the new integrated solution, it’s important to clean up and standardize the data to ensure accuracy and consistency. This may involve removing duplicate records, correcting inaccuracies, and ensuring that data fields match between the AP and ERP systems. A well-planned data migration strategy will minimize disruptions and help ensure that the integration process is smooth and error-free.

-

Define clear workflows and rules

One of the key benefits of integrating AP automation software with an ERP system is the ability to automate workflows based on predefined rules. To fully leverage this capability, it’s important to define clear and consistent workflows for tasks such as invoice approval, payment scheduling, and exception handling. Consider the following when setting up workflows:

- What criteria will trigger an automated workflow?

- Who needs to be involved in the approval process, and what are their roles?

- How will exceptions, such as discrepancies between invoices and purchase orders, be handled?

By establishing these workflows and rules upfront, you can ensure that the integrated system operates smoothly and efficiently from day one.

-

Provide training and support

Even the best integration will fail if users are not properly trained on the new system. It’s important to provide comprehensive training to all users who will be interacting with the integrated AP automation and ERP systems. This training should cover not only the technical aspects of the system but also the new workflows and processes that will be in place. Additionally, consider providing ongoing support, such as helpdesk assistance or refresher training sessions, to help users adapt to the new system and address any issues that arise. Partnering with an accounts payable software provider that offers robust customer support can make a significant difference in this phase, ensuring that your team feels confident and supported throughout the transition.

-

Monitor and optimize post-integration

Integration is not a one-time event but an ongoing process. After the initial integration is complete, it’s important to continuously monitor the performance of the system to identify any issues or areas for improvement. Regularly review key performance indicators (KPIs), such as invoice processing time, payment accuracy, and system uptime, to ensure that the integrated solution is delivering the expected benefits. Additionally, be open to making adjustments or optimizations as needed to adapt to changing business needs or to take advantage of new features and capabilities.

Common challenges and how to overcome them

While integrating AP automation software with an ERP system offers substantial benefits, it’s not without its challenges. Understanding these potential obstacles and having strategies in place to overcome them will help ensure a smooth and successful integration. This section outlines some common challenges organizations face during integration and offers practical solutions for each.

-

Technical challenges: compatibility and data integration

Challenge: One of the most common technical challenges is ensuring that the AP automation software is compatible with the existing ERP system. Differences in data formats, communication protocols, or system architecture can create hurdles that complicate the integration process.

Solution: To overcome these challenges, it’s essential to choose an AP automation solution that is designed to integrate seamlessly with your ERP system. Look for software that offers pre-built connectors or APIs specifically for your ERP platform. Additionally, involve your IT team early in the process to assess compatibility issues and plan for any necessary customizations. Thorough testing of the integration in a controlled environment before full deployment can help identify and resolve technical issues before they impact your operations.

-

Resistance to change: adoption by staff

Challenge: Introducing a new system or process can lead to resistance from employees, especially if they are accustomed to the old way of doing things. Concerns about job security, increased workload, or the complexity of the new system can hinder adoption.

Solution: Address resistance by involving key stakeholders and end-users early in the process. Provide clear communication about the benefits of the integration, such as reduced manual work, improved accuracy, and more efficient workflows. Offering comprehensive training and ongoing support will help employees feel more comfortable with the new system. Additionally, highlighting how the integration will empower them to focus on more strategic tasks rather than mundane data entry can help shift perceptions positively.

-

Ensuring data security and compliance

Challenge: Integrating AP automation software with an ERP system involves the transfer and processing of sensitive financial data, which raises concerns about data security and compliance with regulations.

Solution: To ensure data security, choose an AP automation solution that offers robust security features, such as encryption, secure data transfer protocols, and role-based access controls. Work closely with your IT and compliance teams to ensure that the integration meets all relevant regulatory requirements, such as GDPR or industry-specific standards. Regularly update and patch both the AP automation and ERP systems to protect against vulnerabilities. Additionally, conduct regular audits to ensure that data security measures are being maintained and that compliance is being upheld.

-

Managing disruptions during implementation

Challenge: Any major system integration can disrupt business operations, particularly if unexpected issues arise during the implementation phase. This can lead to delays, errors, or downtime that impact day-to-day activities.

Solution: Minimize disruptions by thoroughly planning the integration process and setting realistic timelines. Consider implementing the integration in phases, starting with a pilot program in a specific department or business unit before rolling it out company-wide. This approach allows you to identify and address any issues on a smaller scale before they affect the entire organization. Additionally, having a detailed contingency plan will enable you to respond quickly if unexpected disruptions occur, ensuring that your business operations remain as smooth as possible.

-

Maintaining post-integration performance

Challenge: After the integration is complete, maintaining the performance of the integrated system can be challenging, particularly as your business grows or changes. Over time, new software updates, changes in business processes, or increased transaction volumes can strain the system.

Solution: To maintain post-integration performance, establish a routine for monitoring the system’s performance and making adjustments as needed. Regularly review key performance indicators (KPIs) to ensure the integrated system are meeting your expectations. Stay in close contact with your AP automation provider and ERP vendor to keep the system up-to-date with the latest patches and updates. Additionally, be prepared to scale your system as your business grows, whether by adding additional capacity, optimizing workflows, or implementing new features to meet evolving needs.

-

Balancing customization with standardization

Challenge: While customization can make the integration more tailored to your specific business needs, too much customization can complicate the integration process and make future updates or changes more difficult.

Solution: Strike a balance between customization and standardization by focusing on essential customizations that provide significant value while avoiding unnecessary complexities. Work with your software providers to identify best practices and standard configurations that have been successfully implemented in other organizations. By keeping the integration as simple and standardized as possible, you can reduce the risk of complications and ensure that the system remains flexible and adaptable to future needs.

Future trends in AP automation and ERP integration

As technology continues to evolve, so too do the capabilities and possibilities of AP automation software and ERP integration. Keeping an eye on emerging trends can help your organization stay ahead of the curve, ensuring that you continue to reap the benefits of this integration for years to come. This section explores some of the most promising future trends in AP automation and ERP integration.

-

Artificial intelligence and machine learning

Artificial Intelligence (AI) and Machine Learning (ML) are transforming many aspects of business operations, and accounts payable is no exception. In the context of AP automation, AI and ML can further streamline and optimize processes by learning from past data and making intelligent decisions. For example, AI can automatically categorize and prioritize invoices, predict payment times based on historical patterns, and even flag potential fraud or errors before they occur. When integrated with an ERP system, these AI-driven insights can provide even greater value by enhancing the accuracy and efficiency of the entire financial process.

In the future, we can expect to see more advanced AI and ML capabilities being integrated into AP automation software, allowing for even greater automation and decision-making support. This will enable organizations to speed up their AP processes and make more informed financial decisions.

-

Blockchain technology

Blockchain, the technology behind cryptocurrencies like Bitcoin, is gaining traction in the business world for its potential to enhance security, transparency, and trust in transactions. In the realm of AP automation, blockchain could be used to create immutable, tamper-proof records of all transactions, from invoice issuance to payment. This would provide a clear and indisputable audit trail, reducing the risk of fraud and making compliance with regulations easier.

When integrated with an ERP system, blockchain could streamline the processes for multiple parties, such as supply chain management or cross-border payments. For example, a blockchain-enabled AP system could automatically verify the authenticity of an invoice and its corresponding payment, reducing the need for manual checks and increasing trust between business partners.

-

Cloud-based solutions

While cloud-based solutions are already widely adopted, their role in AP automation and ERP integration is expected to grow even further. Cloud-based AP automation software offers several advantages, including easier scalability, lower upfront costs, and the ability to access data and manage processes from anywhere with an internet connection. As more businesses move their ERP systems to the cloud, integrating these cloud-based systems with AP automation software will become increasingly seamless and efficient.

In the future, we can expect to see more cloud-native AP automation solutions designed from the ground up to work in the cloud, offering even greater flexibility and integration capabilities. These solutions benefit organizations with distributed teams or those looking to scale their operations quickly.

-

Enhanced user experience and interface design

As AP automation and ERP systems become more advanced, there is a growing emphasis on user experience (UX) and interface design. The goal is to create powerful systems that are easy to use, with intuitive interfaces that require minimal training. This trend is driven by the recognition that even the most advanced features are of little value if users find the system cumbersome or difficult to navigate.

Future AP automation and ERP integration solutions feature more personalized and customizable interfaces, with dashboards that can be tailored to the specific needs of different users. This will enable employees to access the information and tools they need quickly and efficiently, further enhancing productivity and satisfaction.

-

Integration with other emerging technologies

As new technologies emerge, there will be increasing opportunities to integrate them with AP automation and ERP systems. For example, the Internet of Things (IoT) could be used to automate the tracking of physical assets, with AP systems automatically generating invoices based on data from IoT devices. Similarly, natural language processing (NLP) advancements could enable voice-activated AP automation, where users can manage invoices and payments through voice commands.

By staying open to these new technologies and exploring how they can be integrated into your existing systems, your organization can continue to innovate and improve its financial processes.

Integrating AP automation software with your ERP system offers a powerful way to streamline your accounts payable processes, improve data accuracy, and enhance overall financial management. By merging these two critical systems, organizations can eliminate redundant data entry, reduce errors, and gain real-time visibility into their financial operations. This integration supports better decision-making and provides the scalability needed to grow and adapt as business needs evolve.

By choosing a reliable accounts payable software provider, involving key stakeholders, and following best practices, your organization can ensure a successful integration that delivers lasting benefits.

Webinar: Automate Your AP Processes with Procurify

Learn how AP automation enhances the efficiency, accuracy, and financial visibility of your accounts payable workflows.