Purchase Orders: All You Ever Need to Know

Using purchase orders (POs) can help an organization regain control of its spending and accelerate the process of acquiring goods and services needed by team members. But purchase orders aren’t just about paperwork; a well-oiled purchase order system will not only help improve your bottom line but also empower teams, especially finance, to monitor and anticipate expenditures.

In this blog, we provide an overview of everything you need to know about purchase orders. You’ll learn how they work, what benefits they can bring, and actionable advice on tailoring a PO system that aligns seamlessly with the needs of your organization.

What is a purchase order?

Before we dig into the ins and outs of purchase orders, let’s start with the basics: what exactly is a purchase order?

Purchase order definition

A purchase order, commonly referred to as a PO, serves as a formal offer from a buyer to a seller to purchase specific products or services at a specified price. It acts as a contractual agreement once accepted by the seller, detailing the items to be sold, their quantities, and the agreed-upon prices.

Beyond just a simple transaction, a PO provides a track record of purchases, aids in financial forecasting, and ensures both parties have clear expectations regarding the transaction. It’s an essential tool in business to ensure clarity, accuracy, and accountability in the procurement process.

Types of purchase orders

Not all purchase orders are the same. Depending on business needs, different types of POs can be used:

-

Standard Purchase Order (SPO) – The most common type, issued for one-time purchases with predefined details like item, quantity, price, and delivery date.

-

Planned Purchase Order (PPO) – Similar to an SPO but used when the exact delivery schedule is unknown. Buyers issue a commitment to purchase, but specific release dates are determined later.

-

Blanket Purchase Order (BPO) – Used when a company needs recurring purchases from the same supplier over time. Pricing and terms are set in advance, but the quantity may not be fixed.

-

Contract Purchase Order (CPO) – A framework agreement outlining terms with a supplier, but without specifying exact items or quantities. It’s useful for long-term supplier relationships.

Choosing the right PO type ensures efficiency and cost savings while preventing procurement errors.

Legal considerations of purchase orders

A purchase order (PO) is more than just a document for tracking orders—it is a legally binding contract once accepted by the supplier. Businesses must ensure that their POs are properly structured to avoid legal complications.

Here are key legal aspects to consider:

-

Contractual obligation: Once a supplier accepts a purchase order, it becomes a legally enforceable agreement. Any changes or cancellations may require mutual consent.

-

Terms and conditions: POs should include clear terms regarding payment, delivery timelines, penalties for late delivery, and dispute resolution mechanisms.

-

Compliance with regulations: Different industries and regions have specific procurement regulations. For example, government contracts often have stricter PO compliance requirements.

-

Legal risks: Errors in purchase orders, such as incorrect quantities or pricing, can lead to disputes. Ensuring clarity and accuracy in documentation is essential.

By understanding the legal weight of POs, businesses can protect themselves from potential risks and ensure smoother transactions.

What problems do purchase orders solve?

When businesses start small they tend to have an organic purchasing process. Many organizations unwisely forego purchase orders because they perceive the paperwork to be a hassle that slows their processes down – or they simply forego purchase orders because they already have a working relationship with vendors. (Learn why purchase orders work for companies of all sizes.)

Over time, however, that process changes as companies develop new or better relationships with their sellers. Once a company grows and the purchasing demands become more specific, urgent, and/or complex, communication challenges can arise if a purchase order isn’t used or certain details are not correct on the order.

It can be a nightmare for both parties to determine where a request went wrong. Common problems can involve situations where a buyer receives their order and it does not comply with the desired specifications or if there is no purchase order to use as a reference. At that point, it’s likely that both the payment and an invoice were sent, which puts both parties in a significantly more complicated legal situation.

A purchase order provides legal clarity and concrete instructions for the sellers. A purchase order will also create a reliable paper trail that can be used as a point of reference when things go wrong.

What information should be on a purchase order?

A purchase order (PO) contains essential details that outline the specifics of a transaction between a buyer and a seller. Here’s a breakdown of the typical information included in a purchase order:

-

Purchase order number:

A unique identifier for each purchase order, aiding in tracking and reference.

-

Date:

The date when the purchase order was created and, often, the expected delivery date.

-

Buyer's information:

This includes the company name, address, contact details, and possibly a company identification number.

-

Seller's information (vendor):

The name, address, and contact details of the supplier or service provider.

-

Description of goods/services:

Detailed listings of items being purchased, including product codes, descriptions, quantities, and unit prices.

-

Total amount:

The cumulative cost of all items/services, often broken down into subtotals, taxes, shipping fees, and the grand total.

-

Payment terms:

Specifies conditions for payment, such as net 30 days, upon receipt, or any discounts for early payments.

-

Shipping details:

Information about the delivery method, shipping address, any associated costs, and expected delivery dates.

-

Terms and conditions:

Any specific terms or conditions related to the purchase, including return policies, warranties, or other stipulations.

-

Authorized signatures:

Signatures or approval from relevant parties in the buyer’s organization, confirming the authenticity and approval of the purchase order.

-

Special instructions or notes:

Any additional information or specific instructions related to the order.

-

Tax information:

Details about applicable taxes, their rates, and total tax amounts.

Remember, while these are standard elements in many purchase orders, the exact content can vary based on the nature of the business, industry standards, and specific company practices.

Purchase orders can be changed to fit what a business needs, so the list I gave isn’t complete. With tools like Procurify, you can put in account codes when you start the order. This makes matching up records easier and helps move info to your bookkeeping system without a fuss.

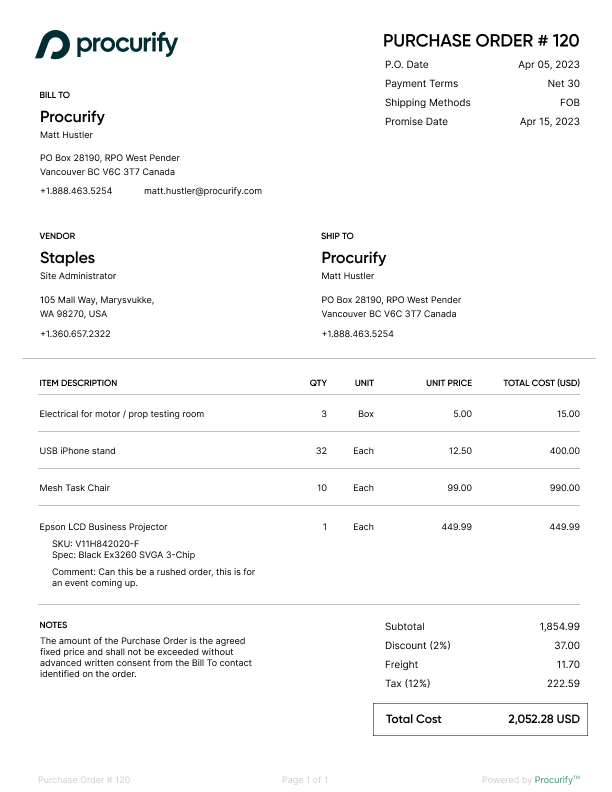

What do purchase orders look like?

Companies typically have a standardized purchase order document with stock information to ensure consistency. Here is an example that shows you what a purchase order looks like:

How do purchase orders work?

Purchase orders formalize the buying process by detailing a buyer’s request for goods or services, which, when accepted by the seller, becomes a legally binding agreement. Purchase orders function as a systematic approach to the buying process. At a high level, here is how purchase orders work:

-

Initiation:

The buyer identifies a need for goods or services and prepares a purchase order detailing the specifics, such as item descriptions, quantities, and prices.

-

Issuance:

The completed purchase order is sent to the seller for consideration.

-

Acceptance:

Upon reviewing the purchase order, the seller can either accept or reject it. If accepted, the purchase order serves as a contractual agreement, setting clear expectations for both parties.

-

Fulfillment:

The seller then prepares and delivers the requested items or services as per the terms outlined in the purchase order.

-

Payment:

After receiving and verifying the goods or services, the buyer processes payment, often referencing the purchase order number to ensure accuracy.

-

Record keeping:

Both parties retain copies of the purchase order for their records, aiding in inventory management, financial accounting, and potential future audits.

In essence, a purchase order streamlines and standardizes the procurement process, ensuring transparency, accuracy, and mutual understanding between buyers and sellers.

Common challenges in the purchase order process

While purchase orders help streamline procurement, they come with challenges that businesses must address:

-

Manual errors: Typos, incorrect pricing, or miscommunication between departments can lead to costly mistakes.

-

Approval bottlenecks: Delays in obtaining approval can slow down the procurement process, affecting project timelines.

-

Lack of supplier compliance: Suppliers sometimes do not adhere to agreed-upon terms, causing inconsistencies in pricing or delivery schedules.

-

PO duplication: Without a centralized system, duplicate POs can be created, leading to over-ordering.

-

Data visibility issues: Without proper tracking, businesses may struggle to monitor spending, budget adherence, and supplier performance.

Overcoming these challenges requires automation, standardized workflows, and clear communication between procurement teams and suppliers.

The benefits of using electronic purchase orders

Using paper-based purchase orders can be cumbersome and error-prone. Electronic purchase orders, on the other hand, simplify the process and reduce mistakes. Platforms like Procurify not only make purchasing more efficient but also offer clear insights into each step. Here’s why you should consider transitioning to an electronic purchase order system:

Speed and efficiency:

E-purchase orders streamline the procurement process. Without the need for physical paperwork, orders can be generated, reviewed, and approved almost instantly. This rapid turnaround can significantly reduce lead times, ensuring that businesses get what they need faster.

Cost savings:

Digital systems eliminate expenses related to paper, ink, mailing, and storage. Over time, these savings can accumulate, allowing businesses to allocate funds to other essential areas.

Accuracy:

Automated entry and processing reduce human errors. Systems can also have built-in checks to ensure that essential fields are filled correctly, leading to more accurate and reliable orders.

Easy access and retrieval:

Digital storage allows for quick searches and retrieval of past purchase orders. This ease of access is especially beneficial during audits or when referencing past transactions.

Real-time tracking:

E-purchase order systems often come with dashboards or tracking features that allow users to monitor the status of an order in real time, providing transparency throughout the procurement process.

Integration with other systems:

E-purchase order systems can seamlessly integrate with other business tools, such as accounting software or inventory management systems. This integration ensures data consistency and reduces the need for redundant data entry.

Enhanced security:

Digital purchase orders offer robust security protocols, including data encryption, secure access controls, and backup systems. This ensures that sensitive business information remains protected from unauthorized access or potential breaches.

Environmental benefits:

By reducing paper usage, businesses not only save money but also contribute to environmental conservation. This shift supports sustainability initiatives and can enhance a company’s eco-friendly reputation.

Centralized record keeping:

A unified digital system ensures that all purchase orders are stored in one place. This centralization aids in data analysis, helping businesses identify purchasing trends or areas for improvement.

Automated workflows:

Many e-purchase order systems support automated approval chains. This means that once a purchase order is generated, it’s automatically routed to the appropriate parties for review and approval, ensuring timely and organized processing.

Improved supplier relationships:

Clear, timely, and accurate orders foster trust with vendors. When suppliers can rely on a streamlined and efficient ordering process, it often leads to better terms, faster fulfillment, and improved overall collaboration.

Scalability:

As businesses grow, the volume of purchase orders can increase. Digital systems are designed to handle this growth, accommodating more extensive operations without the need for significant overhauls or system changes.

The advantages and disadvantages of a purchase order

Advantages of using purchase orders:

-

Order management: Helps prevent duplicate orders and unexpected invoices.

-

Tracking: Allows for monitoring of incoming orders.

-

Price monitoring: Helps in identifying sudden price hikes.

-

Accuracy: Enhances financial and inventory precision.

-

Compliance: Meets auditing requirements.

-

Budget management: Ensures purchases align with available funds and necessitates approvals.

-

Efficient deliveries: purchase orders can optimize and even expedite delivery schedules based on buyer needs.

-

Clear communication: Ensures transparent interactions with vendors.

-

Legal clarity: Serves as legally binding documentation.

Drawbacks of using purchase orders:

-

Administrative load: Introduces extra paperwork, which might be cumbersome for minor purchases or smaller teams.

-

Alternative methods: While not a direct substitute for the contractual nature of purchase orders, credit cards can be used for record-keeping and documenting purchases. However, if credit cards are used, purchase orders can aid the accounting team during the reconciliation process.

Purchase order vs invoice: What’s the difference?

f you’re just getting started with purchase orders, you might ask, “How do they differ from invoices?” The distinction begins with who creates them. Buyers draft the purchase order and forward it to vendors. This action cues the vendor to acknowledge the purchase order and dispatch an invoice to the buyer in response.

While both the purchase order and invoice often share similar details, the invoice will typically cite the purchase order number and have its own unique invoice number. This ensures both documents align and relate to the same transaction. Here’s a breakdown highlighting the main contrasts between purchase orders and invoices:

Purpose:

-

Purchase order:

A purchase order is a document sent by the buyer to the seller, indicating a request to purchase specific products or services. It’s essentially a formal order or a commitment to buy.

-

Invoice:

An invoice is sent by the seller to the buyer after the goods or services have been delivered or provided. It’s a request for payment and indicates what the buyer owes the seller.

Timing:

-

Purchase order:

Issued by the buyer before receiving the goods or services.

-

Invoice:

Issued by the seller after delivering the goods or services, and before receiving payment.

Details:

-

Purchase order:

Contains details like the type and quantity of items, agreed prices, delivery date, and payment terms.

-

Invoice:

Contains similar details as the purchase order but will also include information like invoice date, invoice number, and due date for payment.

Binding nature:

-

Purchase order:

Becomes a binding contract once accepted by the seller, even before any money changes hands.

-

Invoice:

Represents a legal claim for payment. Once the buyer receives an invoice, they are legally obligated to pay the amount due.

Initiator:

-

Purchase order:

Issued by the buyer.

-

Invoice:

Issued by the seller.

In essence, while both purchase orders and invoices are integral to the procurement process, a purchase order confirms an intention to buy, and an invoice confirms a request to get paid for what’s been sold.

Is a purchase order a contract?

Yes, a purchase order is considered a contractual agreement, but with a specific context:

When a buyer issues a purchase order to a seller, it represents the buyer’s intention to purchase certain goods or services under specified terms. Once the seller accepts the purchase order, it becomes a binding contract between the two parties. This means that the seller is obligated to deliver the specified goods or services at the agreed-upon price, and the buyer is obligated to pay for them as per the terms outlined in the purchase order.

However, it’s essential to note that the contractual nature of a purchase order might vary based on jurisdiction, industry practices, and the specific terms and conditions included in the purchase order. In some cases, additional formal contracts might accompany or supersede the purchase order, especially for more complex or high-value transactions.

Why automate the purchase order process?

Efficient procurement is essential for businesses, and manual purchase order processes can slow things down and introduce errors. Automating the purchase order process addresses these challenges head-on by accelerating PO cycle times.

With automation, companies can quickly generate, track, and manage purchase orders, reducing delays and mistakes. This streamlined approach offers real-time insights, making it easier to monitor spending and manage vendor relationships.

Additionally, automated systems store all purchase order data centrally, simplifying data retrieval and analysis. Integration with other business tools is another advantage, ensuring a cohesive operational flow. In short, purchase order automation is a practical solution that enhances efficiency, accuracy, and oversight in procurement.

Should your organization use purchase orders?

Purchase orders can transform a company’s spending habits from being reactive to proactive. But how can you be sure they will deliver value to your organization?

Before adopting a purchase order system, consider the following factors for your organization.

How Procurify can streamline your purchase order process

Many organizations avoid using purchase orders because they don’t want to deal with extra paperwork or slow their existing processes down. But unless your business is small and makes just a few purchases from a handful of vendors each month, you’re probably not leveraging the many benefits that a purchase order system can bring to your company and its bottom line.

Learn more about how Procurify can streamline your purchase order process for:

- Improved budget visibility and control

- Flexible, traceable processes

- Greater credit card expense visibility

- More informed decision making

- Budget-informed PO approvals

- Centralized context and documentation

- Automated processes with catalogs and PunchOuts

- And more

Webinar: 5 Strategies for Cost Reduction and Value Creation

Learn how best-in-class procurement leaders are leveraging the right technology to streamline operations, reduce costs, and improve the effectiveness of their purchasing.