Accounts Receivable vs. Accounts Payable: Two Sides of the Same Coin

There’s often a lot of confusion that comes with accounts receivable vs accounts payable. While these two accounting practices are extremely similar, there are a few subtle differences that you should know. After all, one account is responsible for assets, while the other is responsible for liabilities. And lacking a clear insight into either of these accounts will impact your financial statements and could lead to false accounting.

Here’s what you need to know about accounts payable vs accounts receivable.

Accounts payable vs accounts receivable: A quick overview

If you’re a TL;DR sort of reader, here’s a quick overview of the difference between accounts payable vs accounts receivable:

Accounts receivable is money ‘to be received’ by your business from a client or customer.

Accounts payable is money ‘to be paid’ by your company for a product or service provided by a vendor.

Fairly straightforward, right? Now let’s examine the subtleties of these two types of accounts and what they mean from the perspective of running and growing your business.

What is accounts receivable?

Here’s a quick definition of account receivable:

Accounts receivable is the account which houses all more owed to you.

If this number is growing, it means deals are closing and business is growing. A good example of accounts receivable is money earned from the sale of a good or service.

On a financial statement (or chart of accounts), you will see all accounts receivable, even if the payment is outstanding and hasn’t yet been received.

So, how do you go about collecting payments from your customers (or anyone else you’ve borrowed money from like banks and family or friends)? Better yet, how do you transform your accounts receivable into a cash inflow?

This is where payment terms come in. Your terms are a vital part of an accounts receivable success story.

Let’s say you’ve opted to give your customer 30 days to repay you for the product or service you’ve provided. In this case, 30 days is the payment term.

For your customer, you’ve effectively granted credit (or a short-term loan) from the date the product or service is provided until the date payment is remitted. The longer the payment term, the more credit you are extending to the customer.

Establishing payment terms through a clear-cut contract offers your customers the convenience to pay within a set timeframe, and it ensures that you get paid on time.

A good to know:

Longer credit terms equate to a longer interval before customers pay, which extends your operating cycle.

What is accounts payable?

On the contrary, accounts payable is a liabilities account that shows all money you owe to other people or businesses. This account will house your overhead operating expenses that your organization owes, including:

- Salaries

- Taxes

- Advertising

- Utilities

- Insurance

Of course, there are many other supplies and services you need to keep your organization running, and which cost money. Accounts payable represents a balance sheet liability, which means that the cash is in hand, but the debt to the vendor or supplier at the end of the set payment term remains outstanding.

Keeping a close eye on accounts payable is critical to maintaining an unvarnished perspective on your organization’s finances. Without this account, it becomes extremely difficult to organize your budgets and forecast for growth. With accounts payable, you can begin to set a clear way to track who you owe, how much, and when it’s due.

But growth isn’t just about financial improvement. It also means securing good credit and maintaining strong relationships with vendors. To do this, you need to pay bills on time (or even before the contract ends) to establish trust. You can then leverage this trust should you need to work out an alternate payment arrangement in the future.

A good to know:

Examine whether your budget allows for cash negotiations or payment terms extended by a supplier. Longer payment terms shorten the operating cycle because your organization can delay paying out cash. However, this is generally done at the cost of interest.

Accounts payable vs accounts receivable: How to build healthy practices

Sound cash flow management is critical to your company’s success. And this includes competent cash flow forecasting for receivables and payables.

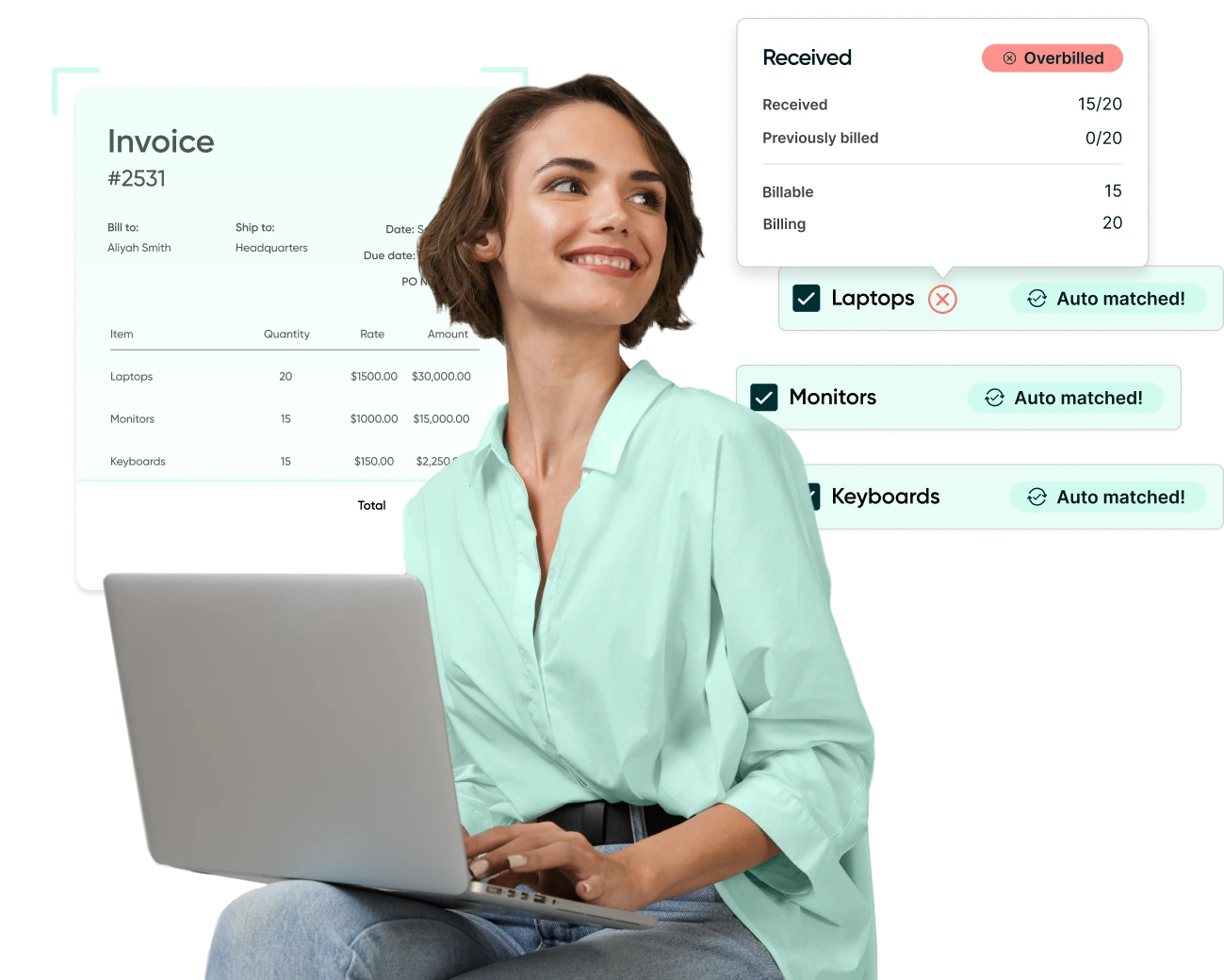

You should maintain careful tracking and active management for both accounts and develop a system for organizing the short- or long-term credit you owe and extend. To do this efficiently and effectively, consider deploying an AP Automation tool. Procurify, for example, gives your organization the ability to manage and monitor all assets and liabilities.

Of course, monitoring these accounts is the key to success, so be sure to set calendar alerts several days prior to payment to confirm there’s sufficient cash in the account from which the payment will be drawn. Should you find yourself anticipating difficulties with making a timely payment, reach out to the vendor as quickly as possible to negotiate an alternate payment arrangement.

It’s important that you pay down high-interest debts in a short timeframe with maximum cash flow to avoid any late-payment fees. That just makes sense for your bottom line.

Staying on top of your accounts receivable and accounts payable fuels the actions of your organization. Inconsistent or spotty attention to either can starve growth, while a uniform process results in a well-fed machine capable of achieving all of its goals.

Want to discover more tips on how to manage accounts receivable and accounts payable? Check out this blog post: Tips for Managing Accounts Payable & Accounts Receivable.

To find out more about Procurify, visit our website.

Editor's note: Original author: Tracy Ortleib Original publish date: 26 July 2016 This blog has since been updated with new information and was republished on 19 April 2021.

Webinar: Automate Your AP Processes with Procurify

Learn how AP automation enhances the efficiency, accuracy, and financial visibility of your accounts payable workflows.