Best Accounts Payable Automation Software 2025 – Comparison List

Wow, we are already near the end of the year!

With 2025 around the corner, organizations of all sizes are working to plan and finalize their budgets, product road maps, and changes to their tech stacks before the holiday season.

For accounts payable (AP) teams, there is a major opportunity to upgrade their AP automation solution. With the rise of AI and automation, this emerging technology has not only expedited and simplified the AP workflows for companies but has simplified the lives of AP professionals.

Unlock the power of Procurify’s AI-enhanced AP automation

Discover how AI can expedite and automate your invoice process while saving time and reducing errors.

Choosing the best accounts payable (AP) automation software is crucial for businesses looking to streamline financial processes, save time, and reduce errors. The right software can transform how your business handles:

-

Invoices

-

Approvals

-

Supplier payments

It can take your AP process from manual, time-consuming tasks to a seamless, automated workflow.

In this article, we’ll help you find the best accounts payable automation software to match your business needs. Whether you are a mid-sized business or a larger enterprise, we’ll compare some of the leading accounts payable automation software available in 2025 and help you choose the best solution to drive efficiency and cost savings.

Why choosing the best accounts payable automation software matters

Accounts payable is one of the core financial functions for any business, yet it’s often burdened with outdated, manual processes that result in inefficiencies. Delayed invoice approvals, data entry errors, and missed early payment discounts are just some of the challenges businesses face with traditional AP management. The “best” AP automation software eliminates these pain points and brings additional value through:

-

Automation of repetitive tasks: Software that ranks as the best AP automation solution will streamline data entry, invoice matching, and payment approval processes, significantly reducing the manual workload on your finance team.

-

Cost savings and early payment discounts: The best AP automation solutions enable faster invoice processing and approvals, allowing businesses to capitalize on early payment discounts and avoid late payment penalties.

-

Visibility and control: Leading AP automation software provides real-time visibility into invoice status, cash flow, and spending trends, allowing for better financial planning and informed decision-making.

Common challenges with traditional accounts payable management

Businesses looking for the best accounts payable automation software are often trying to solve key challenges with their existing, manual processes:

-

Manual errors: Data entry errors are common with manual AP processes and can lead to costly financial mistakes.

-

Time-consuming approvals: Without automation, invoice approvals can be delayed, impacting cash flow and supplier relationships.

-

High cost per invoice: Processing invoices manually can cost businesses significantly more compared to automated solutions.

Why an automated solution is essential today

With an increasing need for agility and efficiency, businesses must adopt the best technology available. Choosing the best accounts payable automation software allows your company to:

-

Reduce processing times: Automation cuts down invoice processing times, accelerating approvals and helping you meet payment deadlines.

-

Improve supplier relationships: Timely payments foster stronger relationships with suppliers, which can lead to better payment terms or strategic partnerships.

-

Scale efficiently: The best solutions can grow with your business, handling higher invoice volumes as your company expands without adding significant headcount or manual labor.

Whether you’re a growing mid-sized business or a large enterprise looking to optimize efficiency, finding the right AP automation tool can make all the difference.

Key criteria for choosing the best accounts payable automation software

Selecting the best accounts payable automation software for your business involves evaluating several important criteria that can significantly impact how well the solution meets your operational needs. Here are the key factors to consider:

-

Ease of use and user experience

When evaluating AP automation software, ease of use is a major deciding factor, especially for teams with varying levels of technical expertise. The best accounts payable automation software offers an intuitive, user-friendly interface that minimizes the learning curve and allows users to quickly understand its functionalities.

A clean dashboard and easy navigation make it easier for your AP team to handle tasks such as invoice approvals, viewing payment status, and generating reports. If users are struggling with the software, it can slow down the entire AP process, negating the benefits of automation.

-

Integration with existing systems

Your accounts payable automation software should integrate seamlessly with your existing enterprise resource planning (ERP) and accounting systems. The best AP automation tools provide integration capabilities with popular ERPs like QuickBooks, NetSuite, Sage Intacct, and others, ensuring that data flows smoothly across platforms without manual intervention.

Good integration means your AP automation solution can pull data from procurement, synchronize invoices, and update accounting records automatically. Procurify, for example, integrates well with multiple ERPs, allowing for a truly seamless procure-to-pay workflow.

-

Mobile accessibility

In today’s increasingly mobile work environment, having a software solution that offers mobile support is crucial. The best accounts payable automation software allows finance team members to access critical data, approve invoices, and manage workflows directly from their mobile devices. Mobile-friendly platforms give managers the flexibility to approve payments while on the go, ensuring timely invoice processing and better vendor relationships.

Procurify’s mobile capabilities, for instance, enable users to complete the AP cycle remotely, helping organizations maintain efficiency, regardless of where their team members are.

-

Automation features and AI capabilities

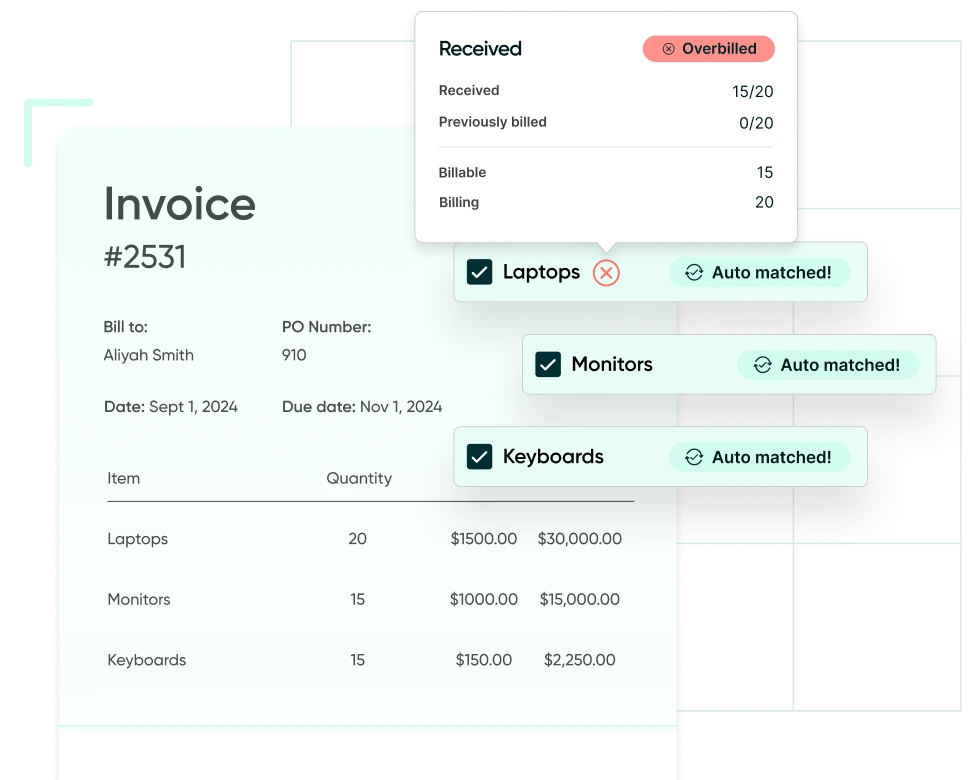

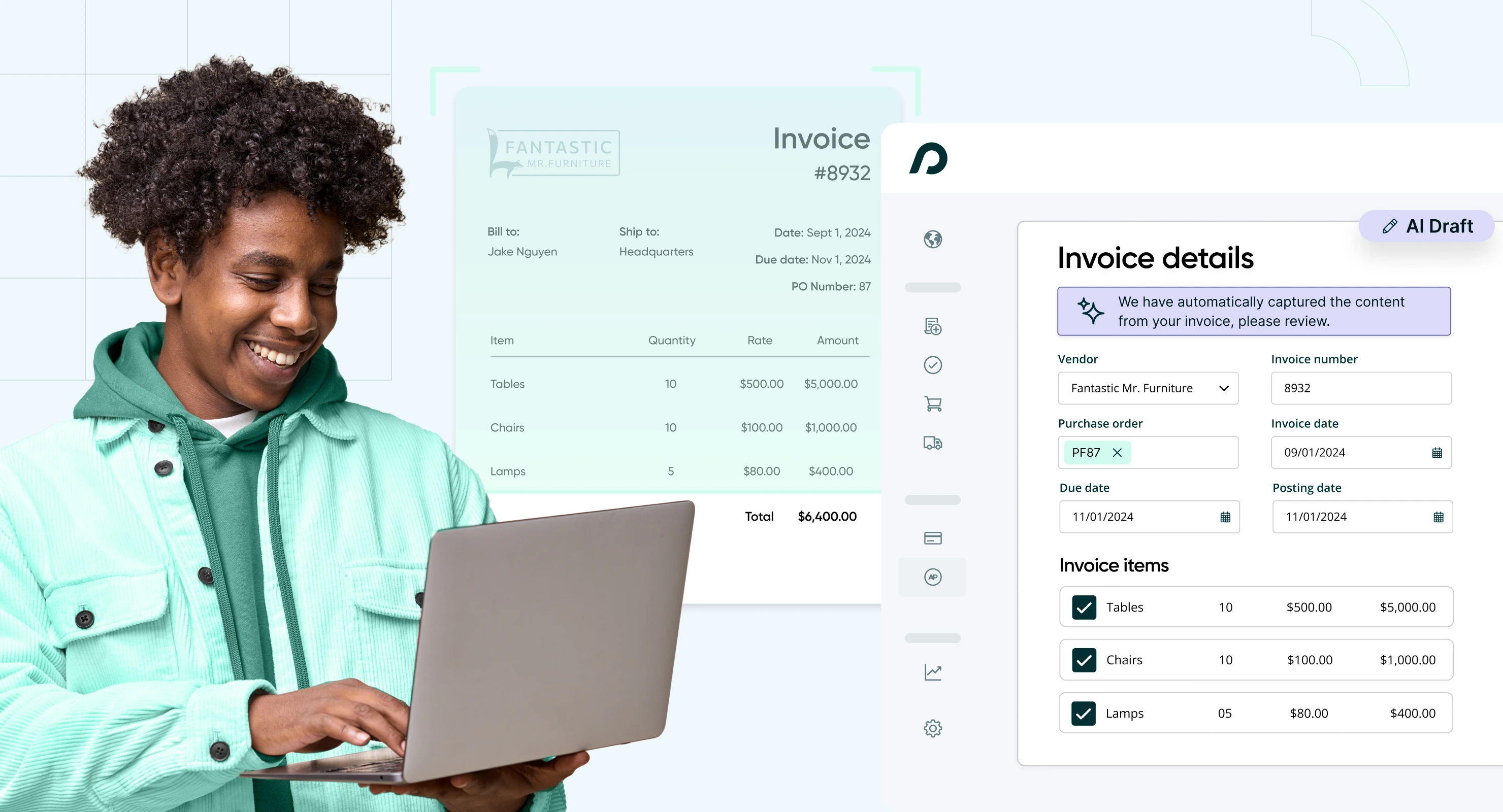

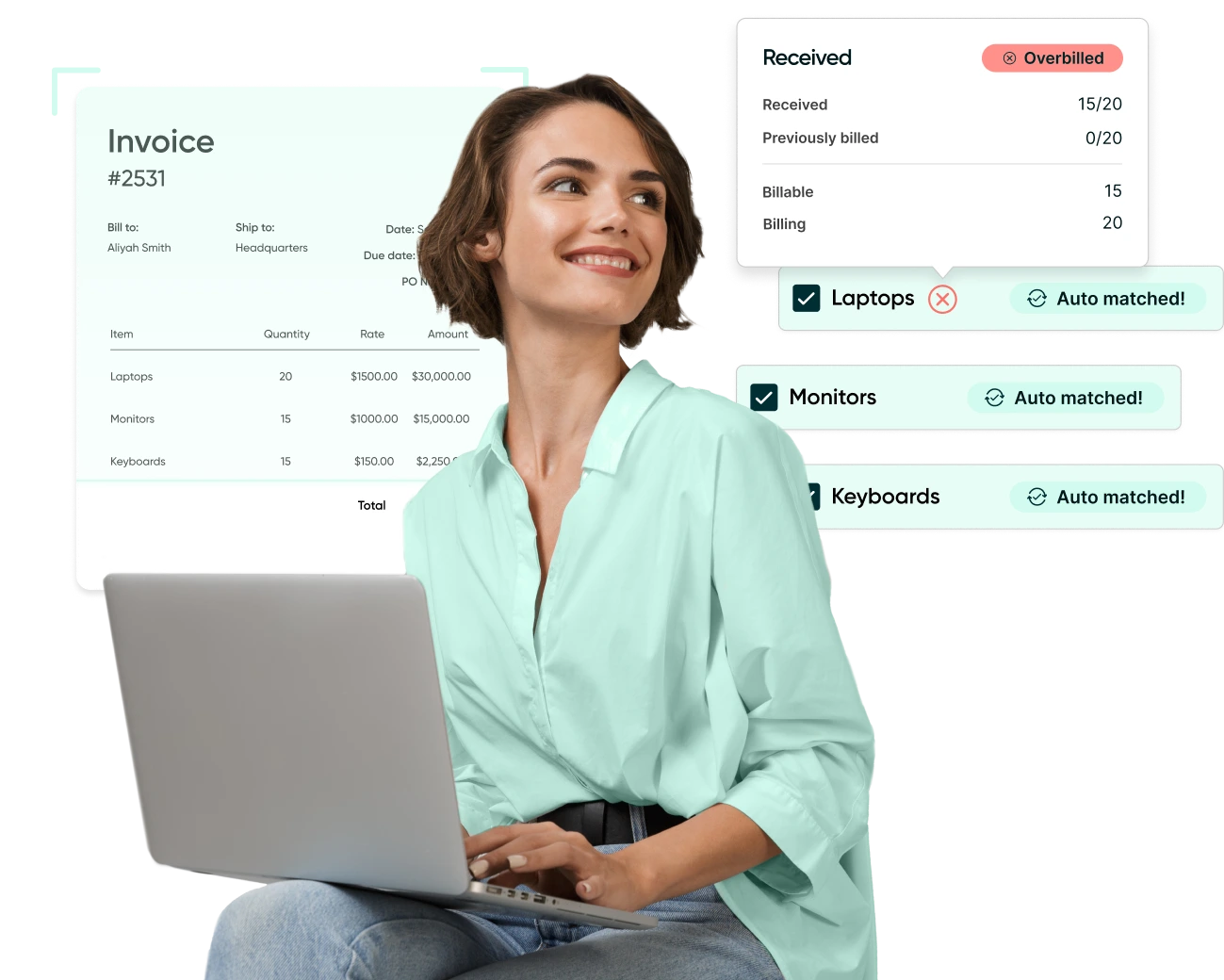

A key feature of the best accounts payable automation software is its ability to automate routine tasks. This includes invoice data capture using OCR (optical character recognition), automatic GL coding, and AI-based invoice matching. The more your AP process can be automated, the fewer manual tasks your team has to deal with, resulting in fewer errors and lower costs.

For example, advanced software solutions like Coupa or Tipalti use AI for smart data extraction and 2-way or 3-way matching, ensuring that invoices are properly validated before payments are approved. Procurify also leverages OCR to automatically extract invoice details, streamlining the process while reducing the risk of manual entry errors.

-

Scalability and suitability for your business size

Not all AP automation solutions are a good fit for every business size. While some tools are designed specifically for large enterprises with extensive financial operations, others are well-suited for mid-sized businesses looking for a cost-effective solution. The best accounts payable automation software for your business should be scalable, meaning it can grow alongside your business without requiring substantial changes to the core system.

For example, Coupa and Precoro are known for offering features that cater to larger enterprises, while Procurify and Airbase offer more flexible options that can work well for both mid-sized companies and larger businesses.

-

Reporting and analytics

One of the most valuable benefits of using AP automation software is access to real-time data and powerful reporting capabilities. The best AP automation software provides robust reporting and analytics tools that allow you to track invoice processing times, payment statuses, cash flow, and spend patterns.

Detailed reports help finance leaders make data-driven decisions, identify bottlenecks, and understand how well the AP process is working. ZipHQ, for instance, has customizable reporting tools that help businesses create detailed spend reports, while Procurify’s built-in analytics provide valuable insights to optimize the procure-to-pay cycle.

-

Security and compliance

Ensuring that financial data is handled securely is a top priority for any business. The best accounts payable automation software provides advanced security features such as role-based access, two-factor authentication, and encryption to protect sensitive financial information. In addition, compliance with industry standards and regulatory requirements (such as SOC 1, SOC 2, PCI DSS) should be a key consideration.

Tipalti, for instance, places a strong emphasis on security and compliance, making it suitable for businesses managing sensitive supplier payments and looking to reduce compliance risks.

-

Cost efficiency

The best accounts payable automation software provides a strong ROI, with features that help reduce manual effort, minimize errors, and ultimately lower operational costs. However, cost is also about value. Evaluating the price against the features offered, ease of adoption, and the efficiency gains provided is key to determining the real value.

For mid-sized companies, Procurify stands out by offering robust AP automation as part of a complete procure-to-pay solution, which ultimately drives greater efficiency and cost savings without the hefty price tag associated with some enterprise-level solutions like Coupa.

The top accounts payable automation software of 2025

In this section, we’ll review some of the best accounts payable automation software options available in 2025. We’ll highlight each solution’s key features, pros, cons, and how they stand out compared to others. Our goal is to help you make an informed decision by understanding the strengths and weaknesses of each software.

Our winner: Procurify - seamless procure-to-pay management

While we may be biased, Procurify does offer a complete procure-to-pay solution, including a new AI-enhanced AP Automation solution. Its integration of procurement, purchasing, and accounts payable automation into a single, intuitive platform makes it a preferred choice for mid-sized businesses.

Key features:

-

AI-enhanced invoice processing

-

Automated three-way matching

-

Deposit billing

-

Seamless integration of procurement and AP automation.

-

Real-time budget tracking to prevent overspending.

-

Multi-level approvals for better internal control.

-

Cloud-based platform with mobile support for on-the-go access.

Pros:

-

Leverage AI to speed up invoice processing

-

Automate three-way matching to improve accuracy

-

Unlock deposit payments to increase the flexibility of their financial management processes

-

User-friendly interface that reduces the learning curve.

-

Easy integration with existing ERP systems like NetSuite, QuickBooks, Sage, and many more.

-

Robust spend tracking and analytics tools for better visibility.

-

Offers a complete procure-to-pay process, not just AP automation.

Cons:

-

Requires initial training to fully understand all available features.

Coupa: advanced spend management for enterprises

Coupa is a well-known spend management solution that integrates procurement, invoicing, and payment functions. It is often used by large enterprises seeking a comprehensive approach to managing all aspects of spend.

Key features:

-

AI-driven invoice processing for faster approvals.

-

Seamless integration with major ERP systems.

-

Spend analysis and optimization tools.

Pros:

-

Extensive feature set covering all aspects of spend management.

-

Advanced analytics and reporting capabilities for in-depth insights.

-

Highly customizable workflows suitable for large enterprises.

Cons:

-

Steeper learning curve due to the complexity of features.

-

Expensive for mid-sized businesses.

Precoro: Comprehensive procurement and AP integration

Precoro provides a streamlined solution for managing procurement and accounts payable workflows, making it suitable for businesses looking for comprehensive process management.

Key features:

-

Procurement, budgeting, and AP automation.

-

Integration with QuickBooks and Xero.

-

Customizable approval workflows for flexibility.

Pros:

-

Offers real-time budget control and detailed spend analysis.

-

Simplifies the approval process with customizable workflows.

-

Transparent pricing model.

Cons:

-

Limited reporting customization.

-

Some users find it challenging to configure advanced workflows.

ZipHQ: User-friendly spend control

ZipHQ simplifies procurement and AP automation while providing strong spend visibility and control. Its intuitive design makes it appealing for businesses looking for ease of use.

Key features:

-

Centralized procurement and AP management.

-

Real-time budget tracking and approvals.

-

Mobile-friendly interface.

Pros:

-

Easy to navigate and user-friendly.

-

Strong focus on spend control and visibility.

-

Robust integration with ERP systems.

Cons:

-

Limited advanced customization for larger enterprises.

-

Requires onboarding for optimal usage.

Tipalti: Best for global supplier payments

Tipalti stands out for its capabilities in global payments and tax compliance, making it ideal for businesses with international supplier relationships.

Key features:

-

Automated global payments with support for multiple currencies.

-

Built-in tax compliance management.

-

Supplier self-service portal.

Pros:

-

Handles tax compliance and regulatory requirements effectively.

-

Suitable for companies managing global supplier payments.

-

Automated payment reconciliation to reduce manual tasks.

Cons:

-

Primarily focused on payment processing, which may limit its functionality in full procure-to-pay management.

-

Higher costs for smaller businesses with simpler AP needs.

Airbase: Centralized spend management for growing businesses

Airbase combines accounts payable automation, expense management, and corporate card management into one platform, making it well-suited for businesses looking for an all-in-one solution.

Key features:

-

AP automation, corporate cards, and bill payments in one platform.

-

Customizable approval workflows.

-

Integration with accounting systems like QuickBooks and NetSuite.

Pros:

-

Centralizes all spending activity, making it easier to manage company-wide expenses.

-

Corporate card issuance for better expense control.

-

Scales with growing businesses.

Cons:

-

May offer more features than needed for businesses seeking only AP automation.

-

Setup can be complex due to the range of features.

Detailed comparison

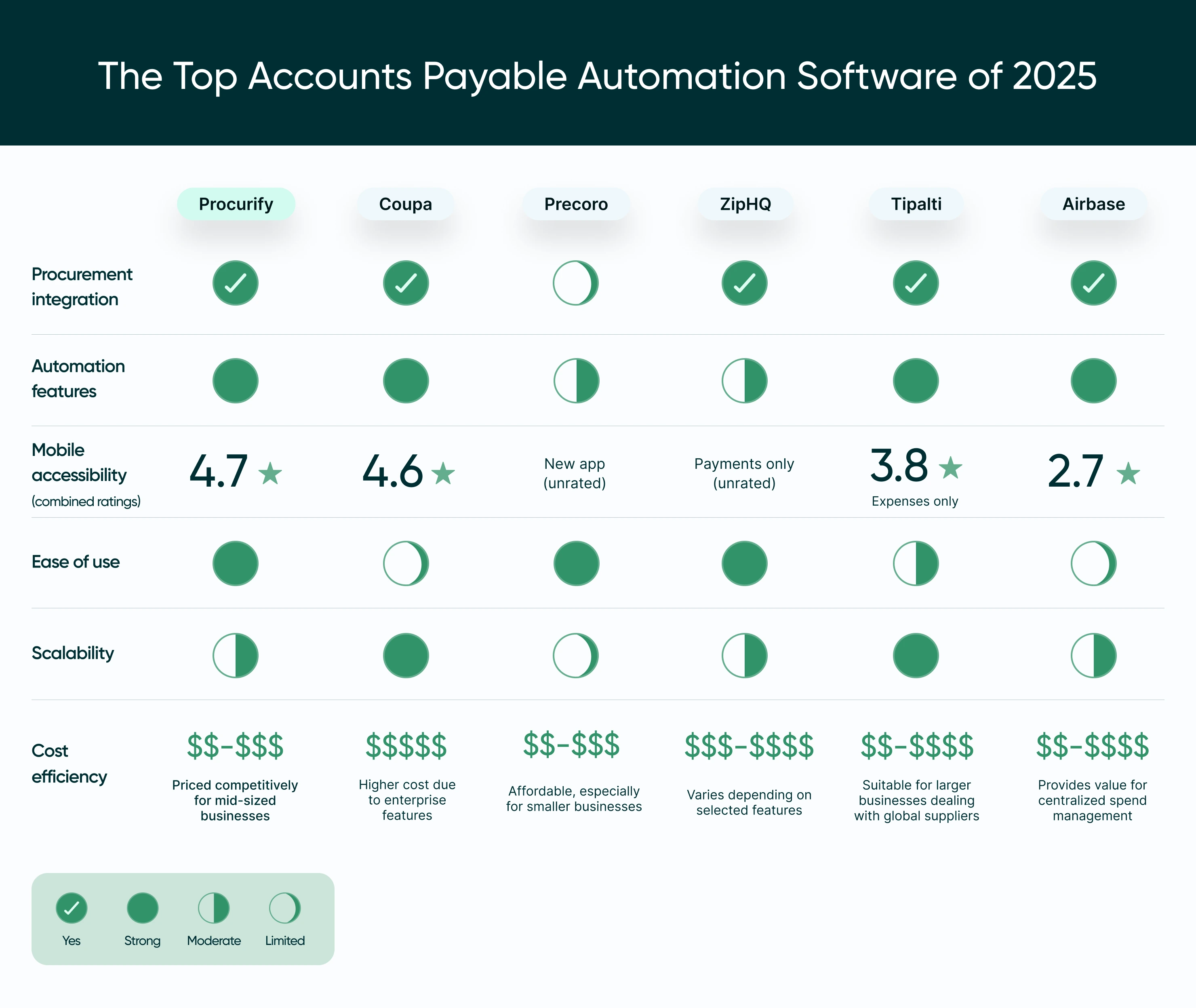

To help you make an informed decision, we’ve compiled a detailed comparison of the best accounts payable automation software available in 2025. This table breaks down key features, integration capabilities, cost considerations, and more, offering an at-a-glance view of what each solution provides.

Feature comparison table

Procurement integration

When looking at procurement integration, Procurify excels in providing a unified procure-to-pay solution. Unlike Tipalti, which focuses primarily on accounts payable, Procurify allows businesses to manage procurement, purchasing, and accounts payable seamlessly in one platform. This integration helps businesses achieve greater control over spending and improve efficiency, making Procurify one of the best accounts payable automation software options for mid-sized companies.

Automation features

The best AP automation solutions are those that minimize manual effort through advanced automation features. Coupa and Procurify both offer AI-based invoice processing and approval workflows, making them highly effective for streamlining AP operations. Precoro also provides strong automation features, but the customization level may not match that of Coupa. If full procure-to-pay functionality is essential for you, Procurify’s integration with procurement workflows can offer significant added value.

Mobile accessibility

Mobile accessibility is becoming increasingly important for businesses, particularly as remote work continues to gain popularity. Procurify, Coupa, ZipHQ, and Airbase all offer mobile-friendly platforms, allowing AP team members to access approvals and track spending on the go. In contrast, Tipalti lacks the same level of mobile capabilities, making it less suitable for teams that require flexibility.

Ease of use

Ease of use is crucial when deciding on the best accounts payable automation software. Procurify offers a user-friendly platform that is easy to implement, even for teams with minimal experience using AP software. Coupa, on the other hand, may require extensive training due to the complexity of its features, which is why it’s generally better suited for larger enterprises with dedicated resources. For those prioritizing ease of implementation and daily use, Procurify and ZipHQ stand out as top options.

Scalability

Scalability is important if you plan to grow your business or expand your AP operations. Coupa is ideal for large enterprises, but for growing mid-sized companies, Procurify offers the right balance of scalability and cost-effectiveness. It can handle larger invoice volumes without requiring a complete overhaul of the system, making it a flexible choice for businesses anticipating growth.

Integration

Seamless integration with existing ERP systems is another critical consideration. Procurify, Coupa, Precoro, and Airbase all provide strong integration capabilities, allowing them to sync smoothly with popular ERPs such as QuickBooks, NetSuite, and Sage. Tipalti focuses more on banking and payment integrations, which may be a limitation if you’re seeking a solution that can connect with other financial systems beyond AP.

Cost efficiency

The cost of AP automation software varies greatly depending on the features offered, the size of your business, and integration needs. Procurify strikes a good balance for mid-sized businesses by offering a comprehensive procure-to-pay solution without the high costs associated with enterprise software like Coupa. Precoro provides an affordable option for smaller businesses, while Airbase offers centralized spend management at a reasonable price point for mid-sized and growing companies.

Why Procurify stands out

In a crowded market of accounts payable automation solutions, Procurify stands out by offering a comprehensive procure-to-pay platform that leverages the latest AI and automation technologies. Procurify is easy to use, effective, and cost-efficient. Below, we’ll discuss why Procurify is the best accounts payable automation software for mid-sized businesses looking to improve efficiency, control, and visibility in their procurement and AP processes.

AP automation as part of a complete procure-to-pay solution

One of the most significant strengths of Procurify is that it is more than just AP automation software—it’s an entire procure-to-pay platform. By integrating AP automation into a complete procurement solution, Procurify allows businesses to handle the entire purchasing process, from creating purchase requests to generating purchase orders, and finally to processing supplier invoices.

This integrated approach drives efficiency in several ways:

-

Seamless data flow: Since procurement, purchasing, and AP are managed on the same platform, data flows effortlessly from one stage to the next without the need for manual input or multiple systems. This reduces errors and saves time.

-

Centralized control and visibility: Having all stages of the procure-to-pay process in one place allows finance teams to maintain complete visibility and control over spending. From purchase requests to invoice approvals, businesses can track every step of the process, ensuring that budgets are adhered to and reducing instances of rogue spending.

-

Efficient invoice matching: Procurify supports automated 2-way and 3-way matching, helping businesses validate invoices against purchase orders and receipts. This automated matching saves time, reduces errors, and makes it easier for finance teams to approve invoices and initiate payments.

Ease of adoption

While many accounts payable automation solutions are complex and require significant resources to implement, Procurify is known for its user-friendly interface and ease of adoption. This makes it especially appealing for mid-sized companies that may not have extensive IT resources.

-

User-friendly interface: Procurify’s intuitive design means that finance, procurement, and other stakeholders can quickly learn how to use the platform. Its simple and straightforward interface helps users get up to speed without long training sessions, which can often be a roadblock with other enterprise-level AP automation tools like Coupa.

-

Mobile Accessibility: Procurify offers mobile access, allowing users to approve invoices, track purchase orders, and manage spending on the go. This flexibility ensures that key tasks can be completed in real-time, even when decision-makers are out of the office.

Cost efficiency for mid-sized businesses

Another reason why Procurify is one of the best accounts payable automation software options is its cost efficiency. Unlike some of the larger enterprise-level solutions, which can be cost-prohibitive for smaller teams, Procurify offers a more accessible pricing structure without sacrificing essential features.

-

Affordable, scalable solution: Procurify’s pricing is structured to provide value for mid-sized companies that need robust AP automation and procurement management without the high price tag of enterprise-focused solutions. Its scalability means that businesses can start with what they need and add more features or users as they grow.

-

Reduced processing costs: By automating key parts of the accounts payable workflow—such as data capture, invoice matching, and payment approvals—Procurify helps reduce the costs associated with manual processing. This, in turn, frees up finance staff to focus on strategic activities rather than spending time on repetitive manual tasks.

Improved collaboration and spend control

Procurify’s integrated platform also improves collaboration between departments, which is often a challenge in traditional AP workflows. Teams can easily create and track purchase requests, while finance teams can approve invoices and make payments—all within a single platform.

-

Multi-level approvals: Procurify supports customizable, multi-level approval workflows, allowing businesses to set up rules that align with their internal controls. This ensures that all expenditures are reviewed by the right people before payments are made, reducing the risk of unauthorized spending.

-

Real-time budget tracking: Procurify provides real-time budget tracking, giving decision-makers the visibility they need to ensure that purchases align with budgets. This feature is critical for businesses aiming to control costs and prevent over-spending.

The Procurify advantage

Ultimately, Procurify stands out as one of the best accounts payable automation software solutions for mid-sized companies because it combines AP automation with procurement management, ease of use, cost efficiency, and powerful control features—all in a single platform. By choosing Procurify, businesses can ensure that they are not only automating AP processes but also optimizing their entire procure-to-pay workflow.

Use cases and industries

Procurify is a versatile tool that caters to a wide range of industries and use cases. Its robust capabilities as both an accounts payable automation tool and a complete procure-to-pay solution make it suitable for businesses across different sectors. Below, we’ll explore some common use cases and industries that benefit most from Procurify’s features.

Use cases for Procurify

Streamlining procurement and accounts payable workflows

-

Problem: Many companies face challenges in keeping procurement and accounts payable aligned. Traditional processes often involve disconnected systems, which can lead to inefficiencies, errors, and delays.

-

Solution: Procurify provides a unified procure-to-pay platform, enabling businesses to streamline procurement, purchasing, and accounts payable workflows. This helps companies eliminate redundant steps, automate repetitive tasks, and reduce human error.

Managing high invoice volumes efficiently

-

Problem: For businesses dealing with a high volume of supplier invoices, managing approvals and payments manually can be time-consuming and error-prone. Traditional accounts payable processes make it difficult to track the status of invoices, leading to delays in payment or missed opportunities for early payment discounts.

-

Solution: Procurify’s accounts payable automation features, including automated invoice capture, 2-way and 3-way matching, and customizable approval workflows, allow companies to manage high invoice volumes efficiently. By automating manual tasks, finance teams can process invoices faster and reduce the risk of late payments.

Improving spend visibility and control

-

Problem: Businesses often struggle to maintain visibility into their spending, which can lead to budget overruns and a lack of control over procurement activities.

-

Solution: Procurify provides real-time visibility into spending patterns and budget tracking, giving businesses better control over their finances. Its intuitive dashboard helps finance leaders monitor purchases, manage budgets, and identify opportunities for cost savings—all in one place.

Multi-level approval workflows

-

Problem: Organizations with complex approval structures require an accounts payable solution that can handle multi-level approval workflows without bottlenecks or delays.

-

Solution: Procurify’s customizable approval workflows ensure that all purchase requests and invoices are reviewed and approved by the right people at the right time. This not only speeds up the approval process but also ensures compliance with internal control policies, reducing the risk of unauthorized spending.

Remote access and mobile capabilities

-

Problem: As remote work becomes more common, companies need solutions that provide mobile access to critical financial processes. Traditional AP systems often lack the flexibility required for remote approvals and management.

-

Solution: Procurify’s mobile app enables finance teams and decision-makers to approve invoices, track purchase orders, and manage spending from anywhere. This flexibility is especially beneficial for companies with remote or distributed teams.

Industries that benefit most from Procurify

Education

-

Challenge: Educational institutions must manage various expenses, including classroom supplies, facility maintenance, and administrative costs. Manual procurement and AP processes can be inefficient, leading to delays and budget overruns.

-

Benefit: Procurify streamlines procurement and accounts payable for educational institutions, ensuring that spending is tracked in real-time and all expenses are approved according to budget guidelines. The intuitive platform helps educational administrators manage requests efficiently, avoiding

unnecessary delays.

Nonprofits

-

Challenge: Nonprofit organizations operate with tight budgets and often need to justify every expense to stakeholders. Manual AP processes can make it difficult to maintain transparency.

-

Benefit: Procurify provides nonprofits with an easy-to-use platform for tracking spending and ensuring that every purchase aligns with the organization’s budget. The multi-level approval workflows allow nonprofits to maintain accountability and demonstrate financial responsibility to donors and stakeholders.

Manufacturing

-

Challenge: Manufacturing companies often manage numerous suppliers and purchase a variety of raw materials, making it critical to have a streamlined procurement and AP process.

-

Benefit: Procurify’s procure-to-pay solution helps manufacturing companies efficiently handle large volumes of purchase orders and supplier invoices while maintaining visibility into spending. Automated invoice matching and real-time budget tracking ensure smooth operations without overspending.

Healthcare

-

Challenge: Healthcare organizations face unique procurement challenges, including the need to manage medical supplies, equipment, and pharmaceuticals while adhering to strict budget constraints.

-

Benefit: Procurify provides healthcare facilities with real-time visibility into procurement activities, ensuring that medical supplies are purchased efficiently while keeping spending under control. The software’s mobile capabilities also allow healthcare administrators to approve spending on the go, which is crucial in fast-paced environments like hospitals and clinics.

Construction

-

Challenge: Construction companies often manage multiple projects simultaneously, each requiring materials, subcontractor services, and equipment. Manual AP processes can create inefficiencies and increase the risk of delayed payments.

-

Benefit: Procurify helps construction firms manage procurement and accounts payable across multiple projects. Its real-time budget tracking and automated invoice processing ensure that project costs are managed effectively, allowing businesses to complete projects on time and within budget.

Hospitality

-

Challenge: Hospitality businesses, such as hotels and resorts, deal with a wide range of suppliers for food, amenities, and equipment. Delays in procurement or AP can directly impact guest satisfaction.

-

Benefit: Procurify provides hospitality businesses with a centralized platform to manage procurement and accounts payable activities. The ability to automate repetitive tasks, track spending, and approve invoices remotely helps ensure that operations run smoothly, ultimately enhancing the guest experience.

Procurify's versatility across industries

One of the reasons Procurify is the best accounts payable automation software option is its versatility. It’s built to serve the needs of a wide range of industries, from healthcare and education to construction and hospitality. The platform’s ability to adapt to different operational needs, streamline procurement, and automate accounts payable processes makes it an ideal choice for businesses looking to enhance efficiency, improve visibility, and maintain control over spending.

FAQs

Conclusion

Choosing the best accounts payable automation software for your organization can be a challenging task, but can offer an impactful ROI if the right solution is selected.

Each software solution has its own unique strengths, catering to different business needs and industry requirements. The key is to find a solution that not only automates the accounts payable workflow but also adds value to your organization through increased efficiency, better visibility, and cost savings.

Ultimately, Procurify combines accounts payable AI and automation, procurement integration, and user-friendly features into a single, comprehensive solution. It empowers finance teams to automate repetitive tasks, maintain control over budgets, and improve collaboration across departments—all while saving time and reducing costs. For mid-sized businesses looking for a powerful, easy-to-adopt, and cost-effective AP automation tool, Procurify stands out as the best choice.

Webinar: Automate Your AP Processes with Procurify

Learn how AP automation enhances the efficiency, accuracy, and financial visibility of your accounts payable workflows.