Business Expense Cards: The Smart Way to Control Spending

Managing business expenses efficiently is a major challenge for finance teams. A study by the Aberdeen Group found that a significant percentage of companies lack visibility into their spending, leading to challenges in expense tracking, policy enforcement, and reconciliation. Traditional methods like manual reimbursements and corporate credit cards often lead to overspending, delayed reporting, and compliance issues.

Business expense cards are changing the way companies handle spending by offering real-time visibility, built-in controls, and automation. Whether for small teams or growing mid-sized businesses, these cards help enforce budgets, streamline approvals, and integrate seamlessly with accounting systems.

This guide explores how business expense cards work, their key benefits, and how to choose the right one. Plus, we’ll introduce Procurify Spending Cards—a smarter, more controlled way to manage company expenses without the drawbacks of traditional credit cards.

Ready to take control of your business expenses?

Procurify Spending Cards offer the best-in-class solution for managing spending effortlessly.

What are business expense cards?

Business expense cards are financial tools that help organizations manage employee spending while maintaining control and oversight. Unlike traditional corporate credit cards, these cards come with built-in limits, real-time tracking, and automated expense categorization.

There are three main types of business expense cards:

-

Corporate credit cards

- Best for: Large organizations with high credit limits

- How they work: Issued by banks or financial institutions, corporate credit cards provide a line of credit to employees for business expenses.

- Drawbacks: Risk of overspending, complex reconciliation, and potential for fraud if not properly managed.

-

Prepaid business cards

- Best for: Small and mid-sized businesses (SMBs) looking for controlled spending

- How they work: These cards are preloaded with funds, ensuring employees can only spend within assigned limits.

- Benefits: Prevents overspending, eliminates debt risks, and simplifies expense tracking.

-

Employee expense cards

- Best for: Businesses looking to empower employees while maintaining financial oversight

- How they work: Employees receive individual cards with preset spending limits and category restrictions.

- Benefits: Helps enforce expense policies, eliminates reimbursement delays, and provides real-time spending visibility.

Unlike corporate credit cards, prepaid and employee expense cards offer a proactive approach to spending, ensuring finance teams stay in control.

Why businesses need expense cards

Business expense cards solve many financial pain points by offering real-time visibility, automated tracking, and better spend control. Here’s why companies are making the switch:

-

Real-time spend visibility

With traditional credit cards, finance teams only see expenses when statements arrive—weeks after purchases are made. Expense cards provide:

- Instant transaction updates to prevent surprises

- Mobile and web dashboards for real-time tracking

- AI-powered spend categorization to streamline reporting

-

Budget control and policy enforcement

Manual expense tracking makes enforcing budgets difficult. Business expense cards solve this by allowing finance teams to:

- Set spending limits per employee, department, or project

- Restrict expenses to approved vendors or categories

- Receive notifications for unusual or high-risk transactions

-

Streamlined expense reporting

Traditional reimbursement processes are time-consuming and error-prone. With business expense cards:

- Employees no longer need to submit expense reports manually

- Receipts can be captured and attached in real time

- Accounting teams can automate reconciliation and reduce manual work

-

Reduced fraud and unauthorized spending

Business expense fraud costs companies millions annually. Business expense cards help prevent fraud by:

- Allowing pre-approved spending instead of reactive reimbursements

- Restricting where and how cards can be used

- Offering instant transaction alerts to flag suspicious activity

With these benefits, business expense cards give companies more control, security, and efficiency in managing corporate spending.

Key features to look for in a business expense card

Not all expense cards are created equal. Here are the must-have features to look for:

-

Spending controls & limits

- Set custom budgets per employee, team, or department

- Allow category-based restrictions (e.g., travel, office supplies)

- Implement approval workflows for high-value purchases

-

Integration with accounting tools

- Sync with QuickBooks, NetSuite, Sage Intacct, and Xero

- Automate expense categorization and reconciliation

- Provide real-time transaction syncing to avoid delays

-

Virtual & physical card options

- Issue virtual cards for online subscriptions and software payments

- Provide physical cards for in-store purchases and travel expenses

- Allow one-time-use cards for specific vendors to enhance security

-

Automated expense categorization

- AI-driven technology to auto-classify transactions

- Built-in receipt capture and matching

- Generate detailed expense reports with minimal manual effort

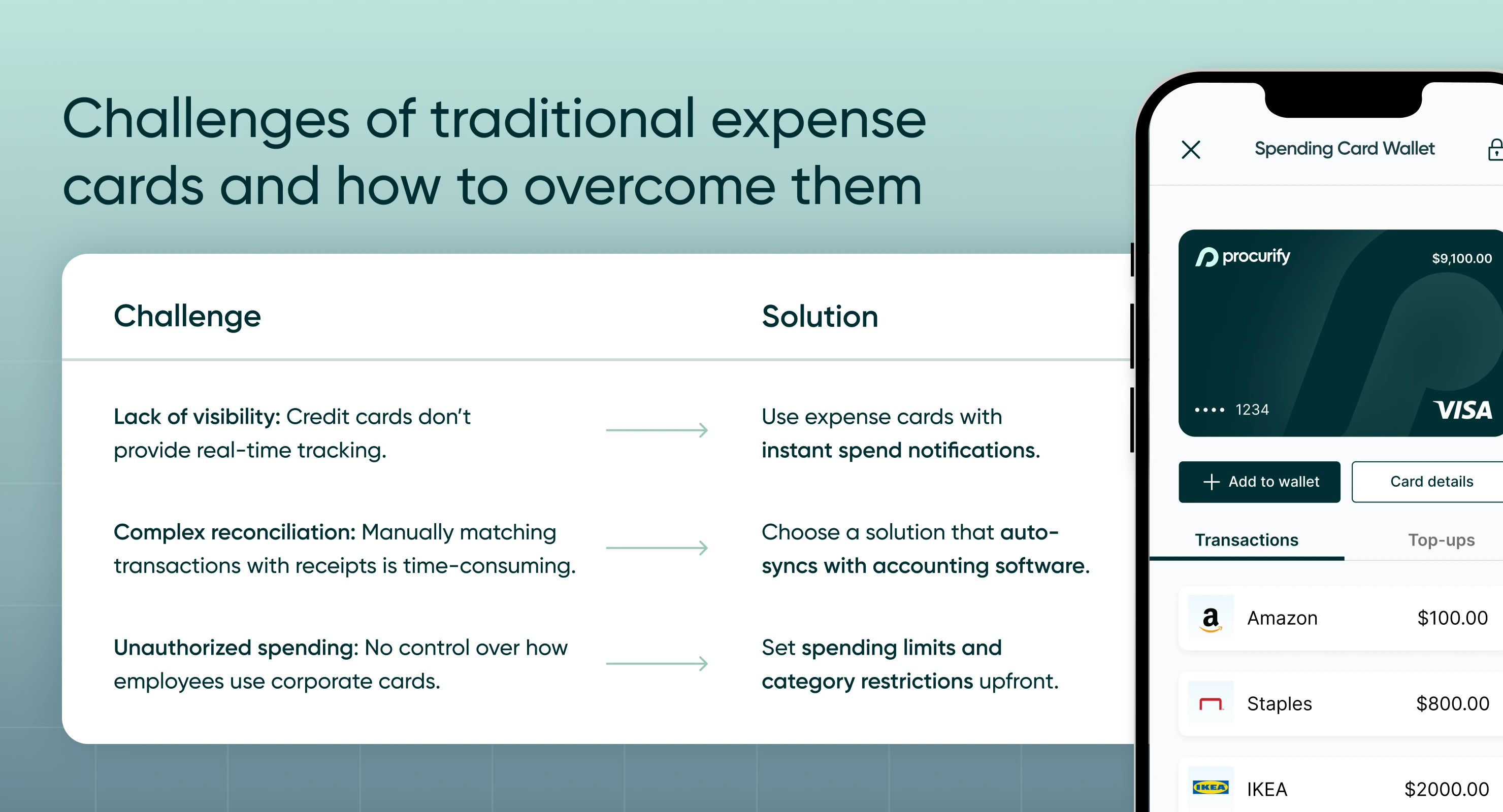

Challenges of traditional expense cards and how to overcome them

While corporate credit cards have been the go-to for years, they come with challenges. Here’s how modern expense cards solve them:

Challenge

Lack of visibility: Credit cards don’t provide real-time tracking.

Solution

Use expense cards with instant spend notifications.

Challenge

Complex reconciliation: Manually matching transactions with receipts is time-consuming.

Solution

Choose a solution that auto-syncs with accounting software.

Challenge

Unauthorized spending: No control over how employees use corporate cards.

Solution

Set spending limits and category restrictions upfront.

These pain points highlight why businesses are moving away from traditional credit cards and embracing smarter alternatives.

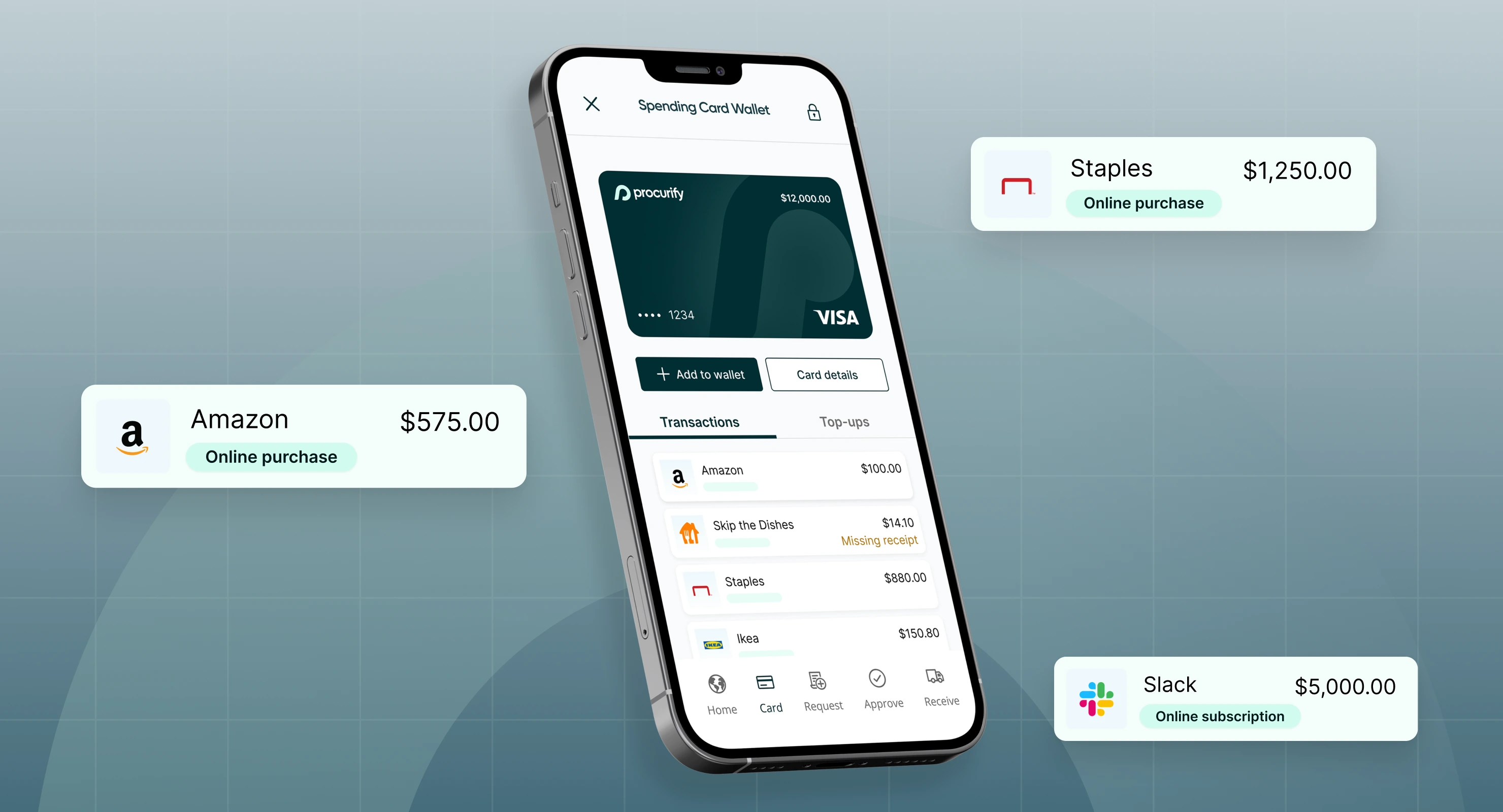

Why Procurify’s Spending Card is the ideal solution

Procurify’s Spending Card offers a pre-approved, controlled approach to business expenses—eliminating the risks and inefficiencies of traditional credit cards.

Pre-approved spend cards

-

Set budgets before transactions happen, ensuring compliance

-

Assign team-specific spending limits for better budget control

Real-time expense visibility

-

See every transaction as it happens—no more surprises

-

Receive instant notifications for every purchase

Instant reconciliation

-

Transactions automatically sync with accounting systems

-

AI-powered expense categorization eliminates manual data entry

Seamless integration

-

Works with Procurify’s spend management platform

-

Integrations with QuickBooks, NetSuite, and other major ERPs

Virtual & physical card options

-

Issue virtual cards for online purchases

-

Provide physical cards for in-store and travel expenses

With Procurify’s Spending Card, finance teams can take full control of company spending—without the risks of overspending, fraud, or reconciliation headaches.

Conclusion

Business expense cards are revolutionizing financial management, offering companies greater control, real-time tracking, and automated reporting. By replacing outdated credit cards with pre-approved, policy-enforced spending solutions, businesses can prevent budget leaks and streamline operations.