How Forward-Thinking Accounting Teams are Adapting In The New Normal – Ryan Lazanis

In this episode, Ryan Lazanis, the forward-thinking founder of Future Firm shares his insights as a veteran fully remote accounting firm owner on how accounting and finance teams can adapt to the changes to remote work, and how to modernize processes for the future.

This interview is taken from an episode of the Spend Culture Stories podcast.

Speakers: Ryan Lazanis, CPA, CA – Founder, Future Firm

Ryan Lazanis, CPA, CA founded Xen Accounting in 2013, a 100% cloud-based accounting firm.

Following its acquisition in 2018, Ryan started Future Firm, which provides resources to firms looking to modernize and stay on the cutting edge. He has a free weekly email called Future Firm Weekly Top 5 that curates the top 5 pieces of content that firm owners need to know about each week to help modernize their firm.

Listen to the Episode Here:

Listen to Spend Culture: Stories of CFOs and Company Culture

Notable Quotes:

What are some of the trends that you’ve seen so far in accounting firms when transitioning to a completely remote model?

[01:19] I think there are a few trends happening leading up to this whole COVID-19 situation, and really, during this downturn, we’ve just seen that increase at an incredible pace now.

For example, we’ve seen firms moving to the cloud, we’ve seen accounting and accountants moving to the cloud over the past few years. We’ve seen firms and accountants moving to a remote work model. You know, businesses now are leaving. Businesses like accounting firms have been leveraging online marketing channels a little bit more heavily. But I think this pandemic really just exasperated the entire situation and has really forced a lot of businesses to act quickly to help move their model into the future. Otherwise – they just won’t be able to operate.

So I think some of the things that we saw leading up to this were certain certainly about moving to the cloud, implementing technology to automate processes online, and hiring and managing a remote workforce. These are some of the things that are really top of mind for the firms that I was working with and some of the firms I was speaking to leading up to this. And certainly, now this is becoming a much hotter issue.

I know you were already at the forefront when you founded your own firm in 2013, which was 100 percent cloud-based. What do you think are some of the things that keep accounting firms behind the trends? What are some of the things that you think people are not willing to let go of yet?

[02:56] It’s really, for the most part, change management. You know, I think accountants, in general, are a conservative bunch. I think we’ve been taught to be conservative and that doesn’t go well, usually with innovation. So, you know, accounting firms and a lot of businesses have had a model that has worked very well for them for the last few decades. So sometimes there’s not a huge incentive to change. But now what we’re seeing is that if you don’t change, you know what they say – adapt or die.

I think that’s almost quite literal at the moment. Your business cannot exist if you do not adapt right now.

How do you think these accounting firms can really change their processes to make sure that they’re servicing their clients within remote work and also making sure that they’re implementing the right tools?

Firms are Now Re-Evaluating Their Service Offerings and How They Serve Their Customer

[04:13] Right now a lot of people have their heads down and a lot of them are in crisis, in survival mode, so they’re just trying to keep their head above water. But I think it’s also shining light in areas of the business that weren’t functioning properly before this whole crisis. And certainly, if you look at it from a client perspective, clients have wanted to work remotely and wanted to work online. They wanted all this automation before, and a lot of firms weren’t providing that.

So now firms and a lot of other businesses are going to have to re-evaluate how they offer their service and really think about it from the customer’s standpoint. How could they offer a service in this day and age that’s going to provide spectacular customer experience and answer all these need their needs and do it from a completely remote standpoint? I think that that’s going to really be the key.

What do you think are some of the tools that accounting firms will now start using in spite of this whole remote work situation?

Communication Tools are Critical

The first category is the basic tools you need to be able to communicate. Right. So you have the basic communication tools like Slack and Zoom and pretty much everyone’s using this right now. But then, you know, if you’re looking at it from an accounting firm standpoint or if you’re running an accounting department, you won’t be able to do everything you need from your office.

Cloud-Based Accounting Software

You won’t be able to collaborate with your team using desktop accounting software. You won’t be able to continue your work if you’re a paper-based operation still. It’s just not feasible anymore. So you’re going to have to look at digitizing your workflows from A to Z, basically. It’s going to really be dependent on the business to business. But, you know, all 100 percent of workflows are going to have to be digitized. And there’s a variety of tools that will be needed to help accomplish that.

What about tools to help manage spend and keep budgets in check due to reduced cash flow during this downturn?

[07:55] Yeah, I think, like, you know, the biggest thing right now is that cash is really king right now. You’re seeing a lot of firms and a lot of accountants really being laser-focused on how they could ensure that they’re maximizing every dollar coming in or any dollar going out.

Get a Tool to Manage Approvals and Spending

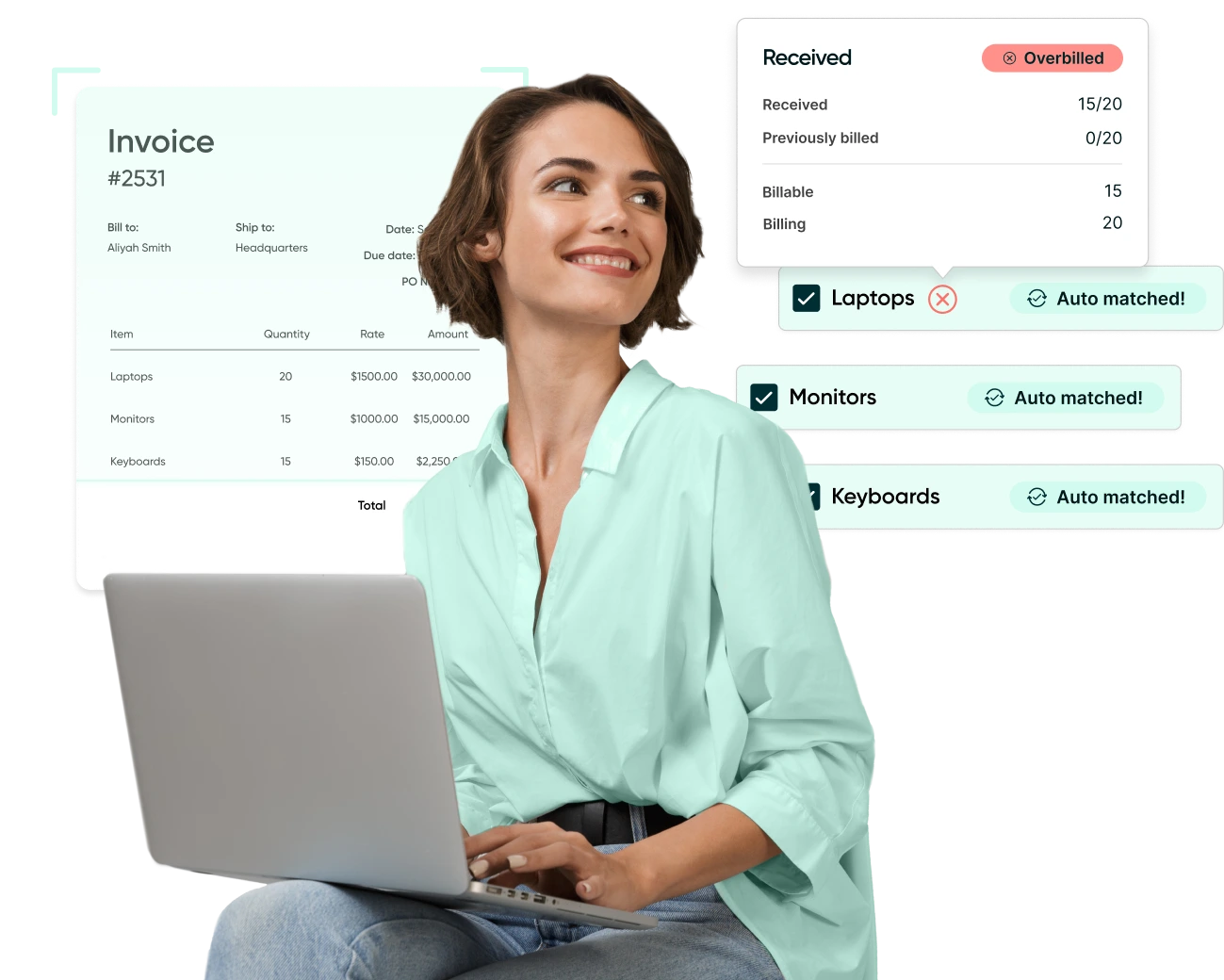

You know, there are tools like Procurify, for instance, or there that could help ensure that there are the proper approval processes for anything going out the door.

Consider a Cash Flow Management Tool

But there’s other tools out there that are going to be necessary to manage cash flow and to make sure that you’re really conserving what you have on hand as much as possible. Based on a lot of the firms that I’m speaking with right now and a lot of the discussions that I’m seeing online, firms are really more focused than ever on helping their clients with cash flow. So anything that could help there is is really a hot topic at the moment.

Let’s talk about that a little bit more. What are the biggest pain points when it comes to cash flow when firms go remote?

Cash and Scenario Planning is More Important Than Ever

When you look at what most firms provide as a service to their clients – it’s normally around tax compliance and making sure that the tax returns go out on time and bookkeeping is performed appropriately. That’s the bread and butter typically, and cashflow planning was kind of a bit of an afterthought. Yes, it’s useful. Yes, everybody wants it. But now, more than ever, you’re seeing more and more businesses in desperate need of cash, full planning. You’re now seeing the accounting firms and the accountants act as real financial advisors to help map out cash flow in the future and map out different kinds of scenarios. For example, conservative scenarios, aggressive scenarios, and most likely scenarios – to really plan what their cash reserves are going to look like down the road.

I read one of your blog posts on your future firm blog that talks about some of your learnings from moving from a physical office to a remote accounting firm. Can you give us a roundup of some of these learnings that you’ve had throughout the times?

The Difficulties of a Hybrid Work Model

In particular with that article that you mentioned, I started my firm fully cloud-based based. I never met any clients in person. Everything was remote and virtual. The whole team was centralized in a physical location, and I always felt that was the only way with how you can kind of build a team culture and collaborate and work together. I felt that was the best way to work with the team. But very quickly I realized that more and more of the people I was hiring wanted that flexibility and they wanted to work from different locations, so we slowly grant gravitated to a hybrid model and then finally a fully remote model.

And what I noticed was that, first off, a hybrid model is one of the most difficult models to operate because now you’re managing two cultures instead of one. You can have a 100 percent in office setup, no problem. Everyone’s also together in a 100 percent remote setup. Everyone’s distributed.

Challenges of Building a Culture and Team Belonging

But in a hybrid setup, you have some people in the office and some people distributed. So the dynamic is a lot different there. So a hybrid model is actually very difficult to manage. It’s not impossible, but it’s very difficult. Other things that I noticed is that there’s none of that water cooler talk. If you’re completely remote without being intentional about building processes around keeping the team together and managing culture, the culture will just dissipate. And, you know, you might find people feeling very distant to the company. So you have to be very intentional about building processes around culture.

Webinar: Automate Your AP Processes with Procurify

Learn how AP automation enhances the efficiency, accuracy, and financial visibility of your accounts payable workflows.