The Future of Accounts Payable Automation with Mary Schaeffer from AP Now

After nearly 30 years, 600-plus YouTube videos, and four books dedicated to thought leadership in the Accounts Payable universe, you would think that Mary Schaeffer has burned out on all things AP – or at least exhausted every topic.

But the Massachusetts-based AP connoisseur has never wavered with her passion or creativity.

“I don’t understand why more people aren’t talking about it,” said Schaeffer in an interview with Procurify.

Schaeffer’s efforts have not gone unnoticed, constantly earning a spot on the Top 100 AP Influencer list over the past half-decade. Her popular AP Now YouTube channel has over 9,500 subscribers and explores everything from AP automation trends to career tips for young AP professionals trying to climb the corporate ladder.

Between curating content and jumping onto an accounts payable webinar (where she was slated to be the guest speaker), Mary Schaeffer jumped on a Zoom call with Procurify to discuss the past, present, and future of AP.

What is the most pressing hot topic in the AP world right now?

MS: The thing that everybody’s talking about is probably the same thing that the rest of the business community is talking about, and that is AI. You can’t turn around without hearing somebody talking about AI.

Secondary to that is AP automation. We’ve been talking about automation in accounts payable for probably 25 years now. And when it started, it was really expensive, we’re talking costing millions of dollars. Today, it’s down to the point where I believe every organization will use some form of accounts payable or invoice automation solution. And these two topics have kind of knocked fraud off its pedestal for being the thing that we talk about. I want to make it clear that even though the industry is talking more about AI and automation, fraud is still really important for protecting both the AP and procurement audiences unfortunately.

Speaking of evolution, how have you seen the practices change over time?

MS: When I started this in the very beginning, the industry had very manual, paper-driven processes. And so, just as the whole business, finance, and accounting community has evolved, there have been a few things that have really taken AP to the next level. First, we saw the introduction of just personal computers and the Internet. You are probably going to laugh at this, but when personal computers first came into the business space, AP at many companies got the hand-me-downs when other departments upgraded to their computers. Now you know that doesn’t happen. When the internet came, that helped interconnectivity in a huge amount.

And then the other thing that really has taken AP to the next level – and it was a horrible thing – but it was Covid-19. We saw two or three key things happen as a result of Covid. Number one, people finally started to realize that paper was a problem. During Covid, companies had to send somebody into the office to get the invoices so they could pay the bills. We’ve seen a big evolution in the last few years of getting rid of paper invoices. And I think we’re going to get to 100% of getting rid of paper invoices. I wish I could say the same thing for paper checks. The rest of the world probably has a good laugh at us, but we’ve finally gotten down in the United States to where less than 40% of the B2B payments are being made with paper. And we’re going to see that number drop even more. Although, I don’t think we’re going to get to zero.

How have companies had to adapt their AP strategies post-pandemic and into this challenging economy?

MS: I had a number of controllers or AP people tell me that when the pandemic basically happened overnight, their controllers said they had to take their AP function home. And in a lot of companies, the executives were astounded at the wonderful job of AP teams and how they didn’t miss a beat. Even though those AP departments were working at a high level, they weren’t getting the recognition. So the pandemic sort of put a positive spotlight on the importance and value of AP teams.

How would you describe the correlation between AP and procurement processes in terms of the financial sustainability of an organization?

MS: It’s really important, because at the end of the day, if there’s friction between AP and procurement, or if the data that goes between AP and procurement isn’t accurate, you’re going to end up spending more money than you should. Not only that, accounts payable have access to a lot of data, like payment data. And there’s a lot of value that can be mined out of that data. So if AP and procurement can work together, not only can they make sure they don’t spend money that they shouldn’t spend, which is money that comes right off of the bottom line, but also, AP can mine that data, give it to procurement, and then procurement can use it to negotiate better contracts. It’s a win-win with everybody.

In your experience, how does collaboration between procurement and AP teams impact supplier relationships and overall supply chain efficiency?

MS: When AP and procurement don’t work together, it provides an opportunity for suppliers to get aggravated, which we don’t want. But more importantly, it provides an opportunity for suppliers to take advantage of the situation – get procurement to make them a promise of, ‘we’ll pay you early’ when the company doesn’t want to pay them early. Or the supplier will call AP and say, ‘Procurement said you would pay me early but they didn’t.’ And then AP goes ahead and pays the supplier early because that is what they thought the agreement was with procurement.

How can organizations leverage the synergy between procurement and AP to enhance their financial performance and operational efficiency?

MS: I’ve kind of alluded to this already, but AP has data and can mine that data with the help of procurement. If the procurement tells AP what they’re looking for, then AP can find a solution. A simple example is a company that has multiple factories and their individual procurement teams are all buying widget A. If one factory buys widget A from store A, another factory buys from store B, and another from store C, then D. They all don’t talk to each other and one of the factories is getting a better price. If AP can pull that data and say, ‘Hey guys, if you all wanted to buy from store B, we’ll all get a better price.’

And of course, you want to factor in freight. And then somebody from procurement has to decide to go to store B and say, ‘Hey, not only are we getting the better price here, but maybe instead of buying 100 widgets from you, we will buy 1,000 widgets at that price.’ And that is a better position for a company to be in financially.

You speak so much about data and making decisions based on data. How important are negotiation skills for an AP or procurement leader?

MS: Negotiation skills in any field are important. You have to know how to talk to people. It’s a special skill. It’s along the lines of being a great public speaker or anything else in the business world. You need to get better at it by practicing and maybe doing a little studying.

How is automation changing how AP teams operate?

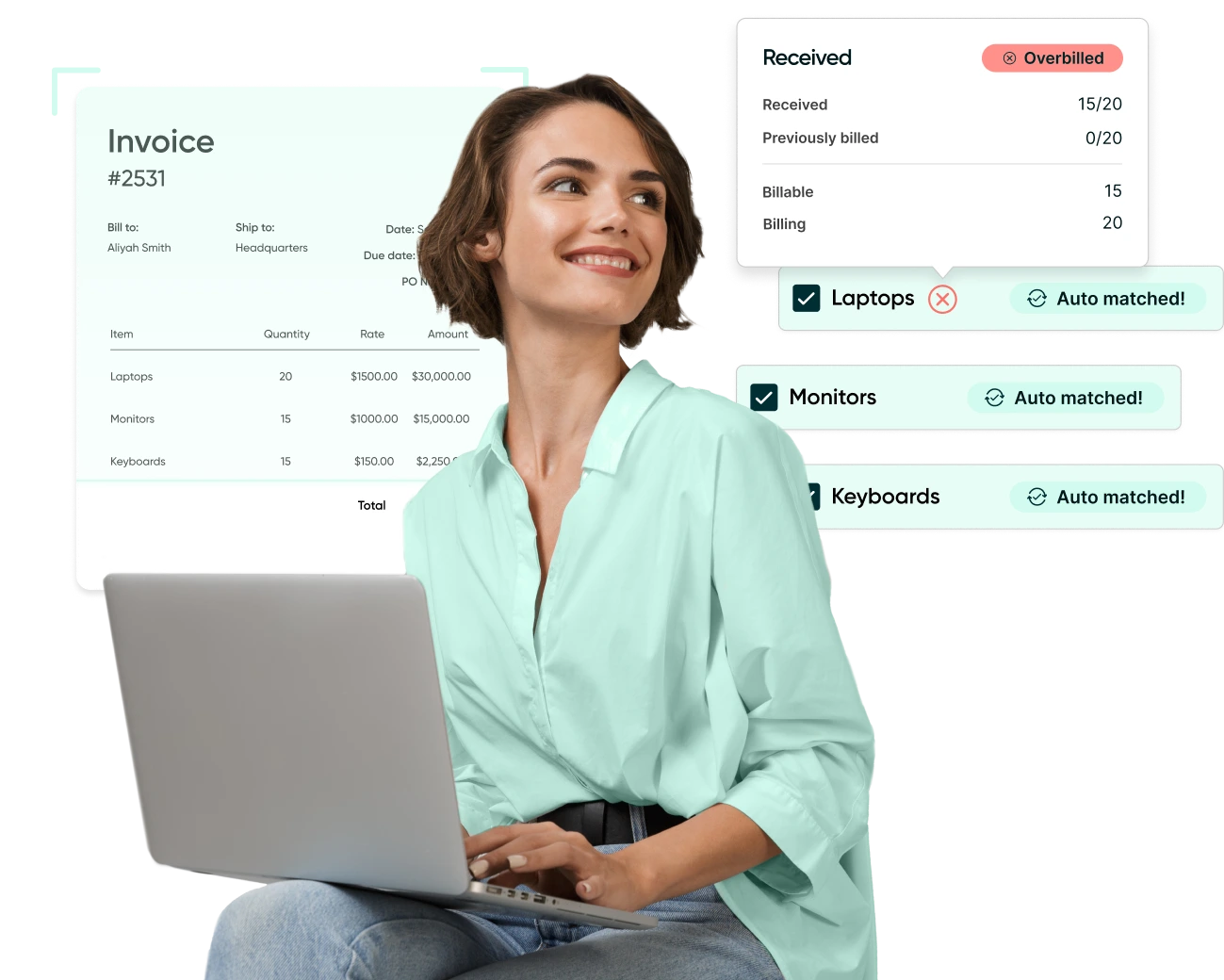

MS: AP automation and invoice automation are greatly changing the accounts payable space. As I mentioned earlier, I think we are fast approaching the point when everybody is going to be using an automation solution. This means that there will be less manual data entry and less transactional work, leaving people available to do more analytical work and other value-added tasks.

The two areas that come to mind are that there are ever-increasing regulatory reporting requirements And then, of course, the ever-present fraud and new fraud protection and how to protect yourself.

Speaking of fraud, one of the things that has happened frequently in the AP space recently is what we call “change my bank account frauds.” These are frauds where someone impersonates a vendor who is expecting ACH payments and sends an email saying, ‘We’ve had to close our bank account, please send my payments to a new bank account.’ The AP staff has to pick up the phone and actually call to verify that they’re correct. And you know what? It’s a value-added task in that you don’t send a million dollars to someone you’re not supposed to. It doesn’t really make the AP process more efficient, but you have to do it, and sometimes you have to make three or four calls. Because you are often verifying a lot of money, there’s some additional work that nobody really talks about that’s coming into AP that they’re not adding staff for.

The other thing, and I’m hoping automation helps with this, but it’s not a guarantee, is that suppliers who are now going paperless are starting to send invoices through email, which is great. Suppliers are sending two, three, and four copies of the invoice, and AP will have to weed those out. Now, that takes time, it just doesn’t happen in a vacuum. So for many companies, about 25% of their invoices are duplicates. That’s 25% of invoices that you have to weed out. And, to add insult to injury, occasionally, some vendors change the invoice number. It’s additional work that nobody is talking about.

Is AP automation something the majority of the industry is currently leveraging? And, if not, why not?

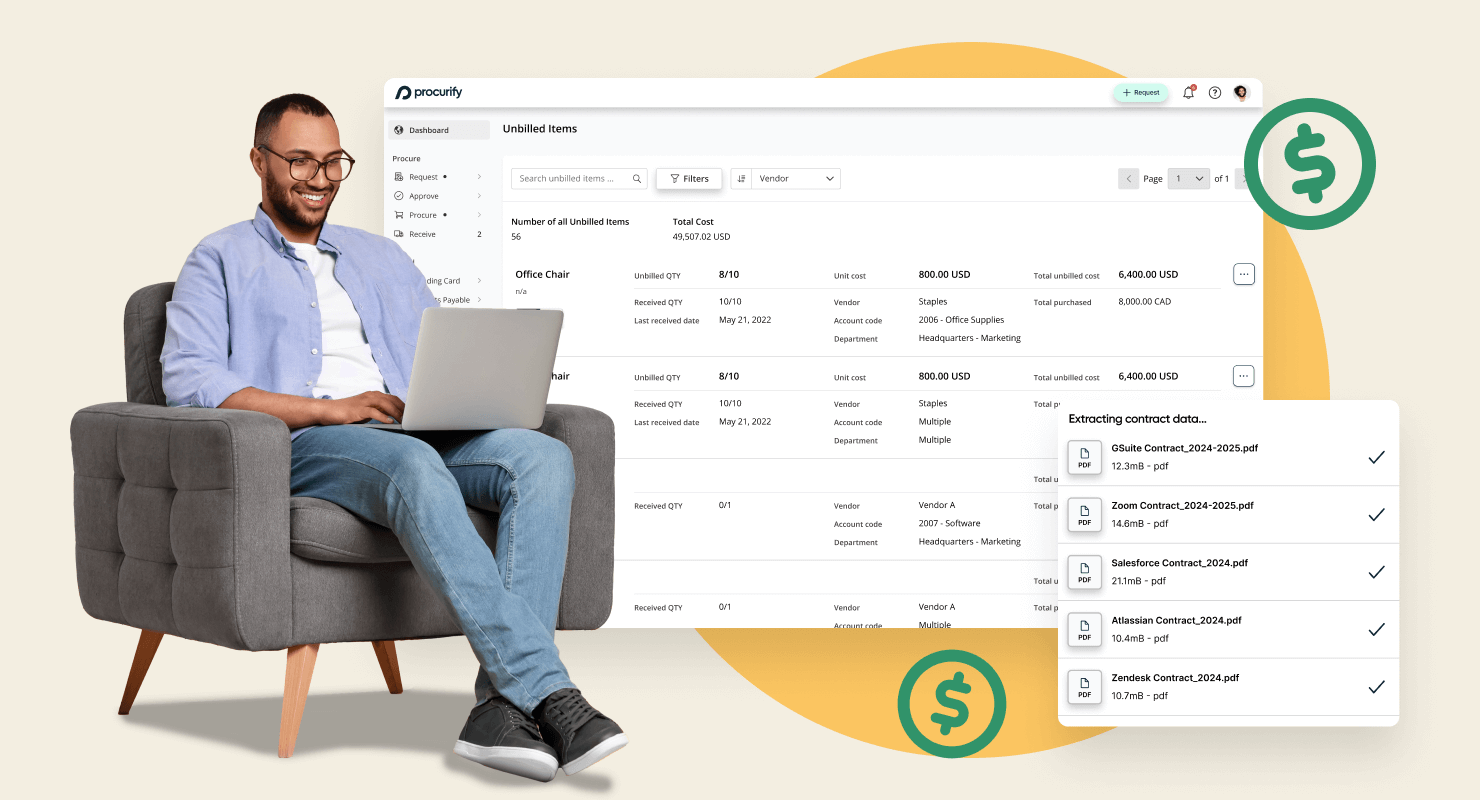

MS: I think we’re getting to the point where most people are either using it or are in the process of obtaining it. When I say the process of obtaining it, that might just mean they’re gathering information about it. Now, what we haven’t talked about is just because somebody buys an automation solution doesn’t mean that they’re using it 100%, and, in fact, you probably can speak to this better than I can. Most AP automation solutions are not anywhere close to being 100% utilized.

It’s a two-step thing, you have to buy the solution first, and then you’ve got to get everybody to use it.

What are your top three AP best practices for medium-sized organizations?

MS: First, I’d encourage organizations to look at internal controls across the board, including appropriate separation of duties. And, when you start using technology, your accounts payable staff starts to get smaller and smaller. We don’t have enough people now to have appropriate separation of duties. And, when you don’t have an appropriate separation of duties, you can have collusion which leads to fraud.

It’s also important to stay up to date on all the latest fraud trends that are going on and how you can protect yourself. Sometimes, it’s just recognizing that the fraud is going on when the email pops up in your box.

I would also say you have to learn how to use AI. There are some free tools out there that you can start using. There was a recent survey done by LinkedIn and Microsoft that stated that 71% of executives said they wanted to hire people who had the ability to use AI, and they’d even hire somebody with less experience if they had that ability. I taught myself to use ChatGPT and Microsoft Copilot AI and your readers can too. It’s not hard.

For more AP insights and thought leadership, check out Schaeffer’s AP Now YouTube channel or AP Now podcast on Apple and Spotify. She also runs fee-based AP Now webinars that take a deeper dive into accounts payable practices.

Webinar: Automate Your AP Processes with Procurify

Learn how AP automation enhances the efficiency, accuracy, and financial visibility of your accounts payable workflows.