The Ultimate Guide to AP Automation Software

Yesterday’s accounts payable (AP) processes are no longer economically viable or sustainable.

In the rapidly evolving business landscape, efficiency and accuracy in financial processes are paramount. Current AP automation software has emerged as a crucial tool for businesses aiming to:

-

Streamline their AP processes

-

Reduce costs

-

Improve overall financial management

But how do you research and choose the right technology for your business needs?

This ultimate guide will explore what AP automation software is, its benefits, key features, how to choose the right solution, implementation steps, case studies, future trends, and frequently asked questions. By the end of this guide, you will have a comprehensive understanding of AP automation software and how it can revolutionize your business operations.

What is AP automation software?

Accounts Payable (AP) automation software is a technology solution designed to automate and streamline the AP processes within an organization. This software replaces manual tasks such as data entry, invoice processing, and payment approvals with automated workflows, significantly reducing the risk of errors and increasing efficiency.

Key components of AP automation software include:

-

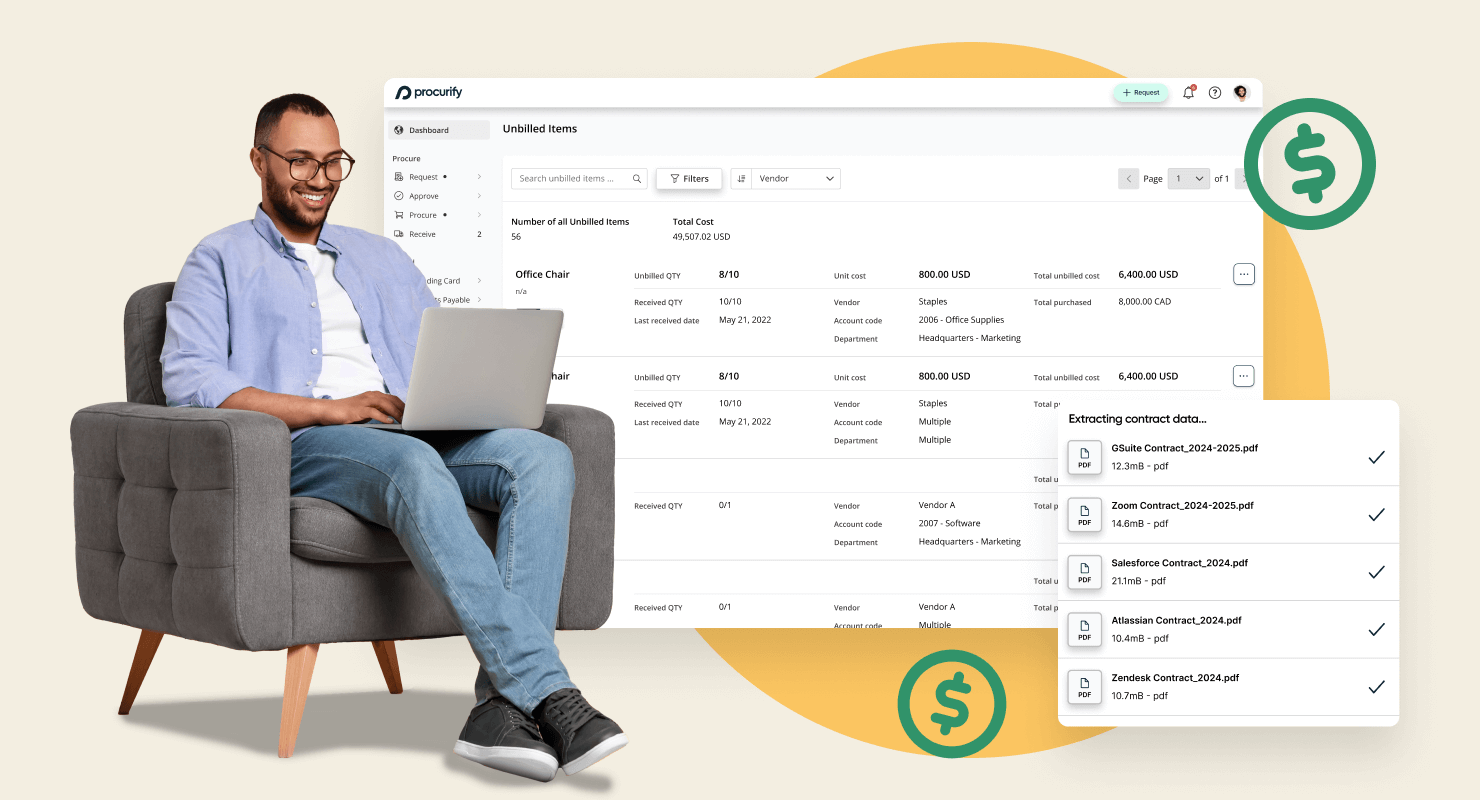

Invoice capture: Automated extraction of invoice data using Optical Character Recognition (OCR) technology.

-

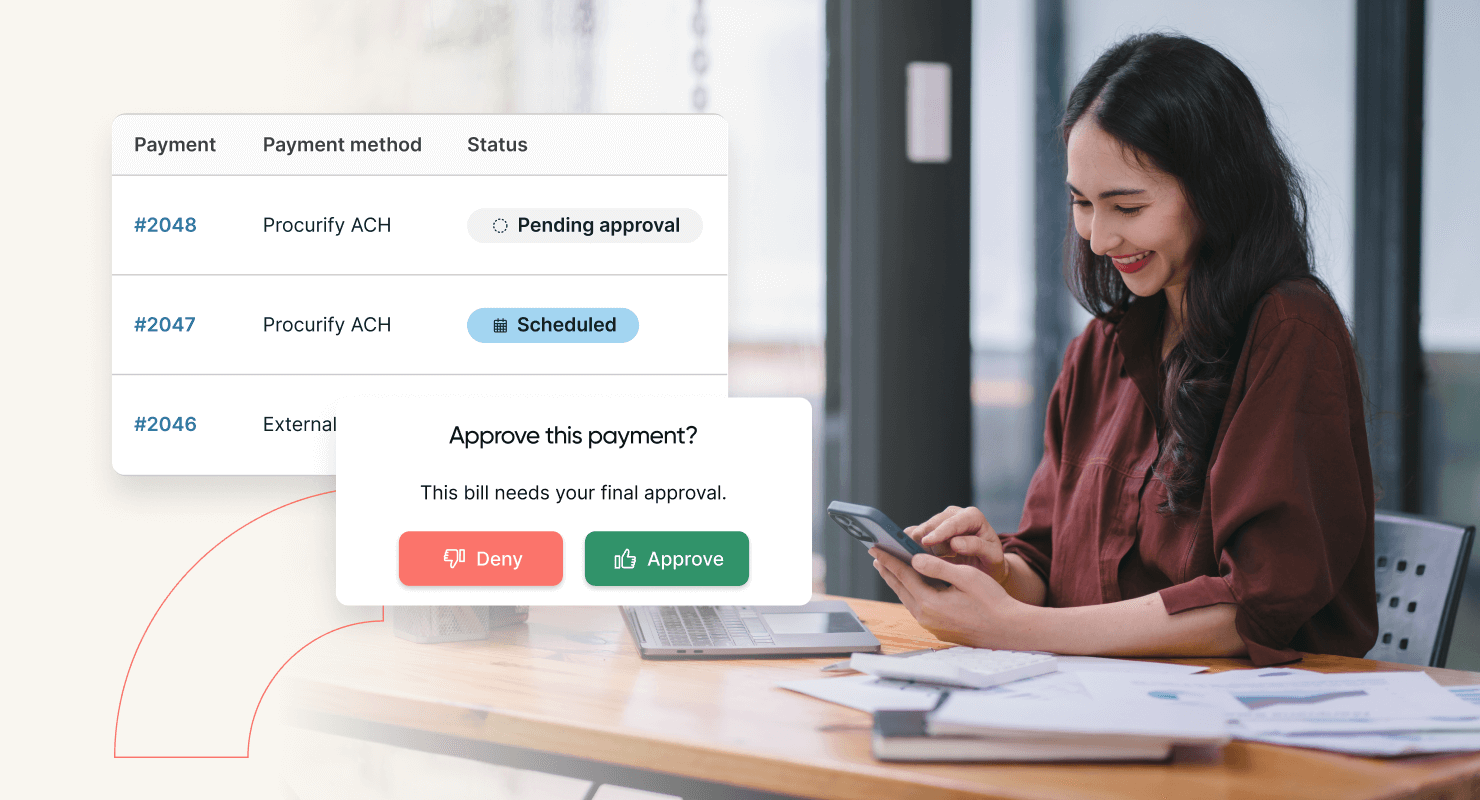

Workflow automation: Predefined workflows that route invoices for approval based on custom criteria.

-

Electronic payments: Facilitation of electronic payments to vendors, reducing reliance on paper checks.

-

Reporting and analytics: Real-time insights into AP processes, enabling better decision-making.

Traditional AP processes are often labor-intensive, time-consuming, and prone to errors. In contrast, AP automation software streamlines these processes, providing greater control and visibility over financial operations.

Benefits of AP automation software

Implementing AP automation software offers numerous advantages that can significantly impact a business’s financial health and operational efficiency. Here are the key benefits:

Efficiency and accuracy

-

Reducing manual errors: Automation minimizes human errors associated with manual data entry and processing.

-

Streamlining AP Processes: Automated workflows accelerate invoice approvals and payment cycles, reducing processing times.

Cost savings

-

Lowering processing costs: Automation reduces the costs associated with paper-based processes, including printing, mailing, and storage.

-

Improving ROI: Faster processing and error reduction lead to cost savings and improved return on investment.

Improved visibility and control

-

Enhanced tracking and reporting: Real-time tracking of invoice statuses and detailed reporting capabilities provide better visibility into financial operations.

-

Better financial management: Automation enables more accurate financial forecasting and budgeting.

Compliance and security

-

Ensuring regulatory compliance: Automated processes ensure adherence to regulatory requirements and internal policies.

-

Strengthening data security: Secure digital storage and processing of financial data reduce the risk of fraud and data breaches.

Key features of AP automation software

To fully leverage the benefits of AP automation, it’s essential to understand the key features that the software should offer:

Invoice Processing

-

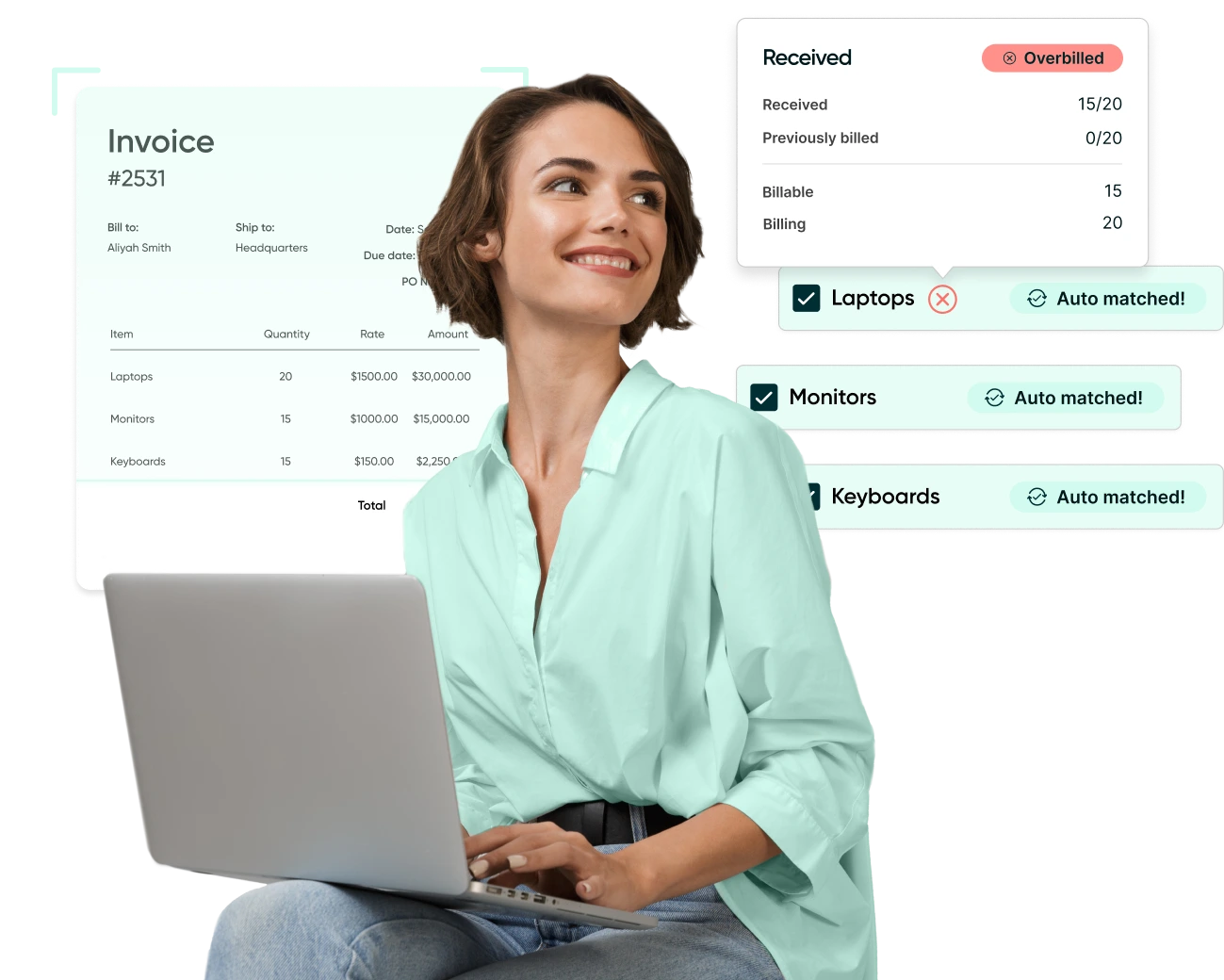

Automated data capture and entry: Utilizes OCR technology to extract data from invoices, reducing manual data entry.

-

Approval workflows: Customizable workflows that route invoices for approval based on predefined criteria, ensuring timely approvals.

Payment processing

-

Electronic payments: Supports various payment methods, including ACH, wire transfers, and virtual credit cards, facilitating faster and more secure payments.

-

Vendor management: Centralized vendor database that streamlines vendor management and payment processes.

Integration capabilities

-

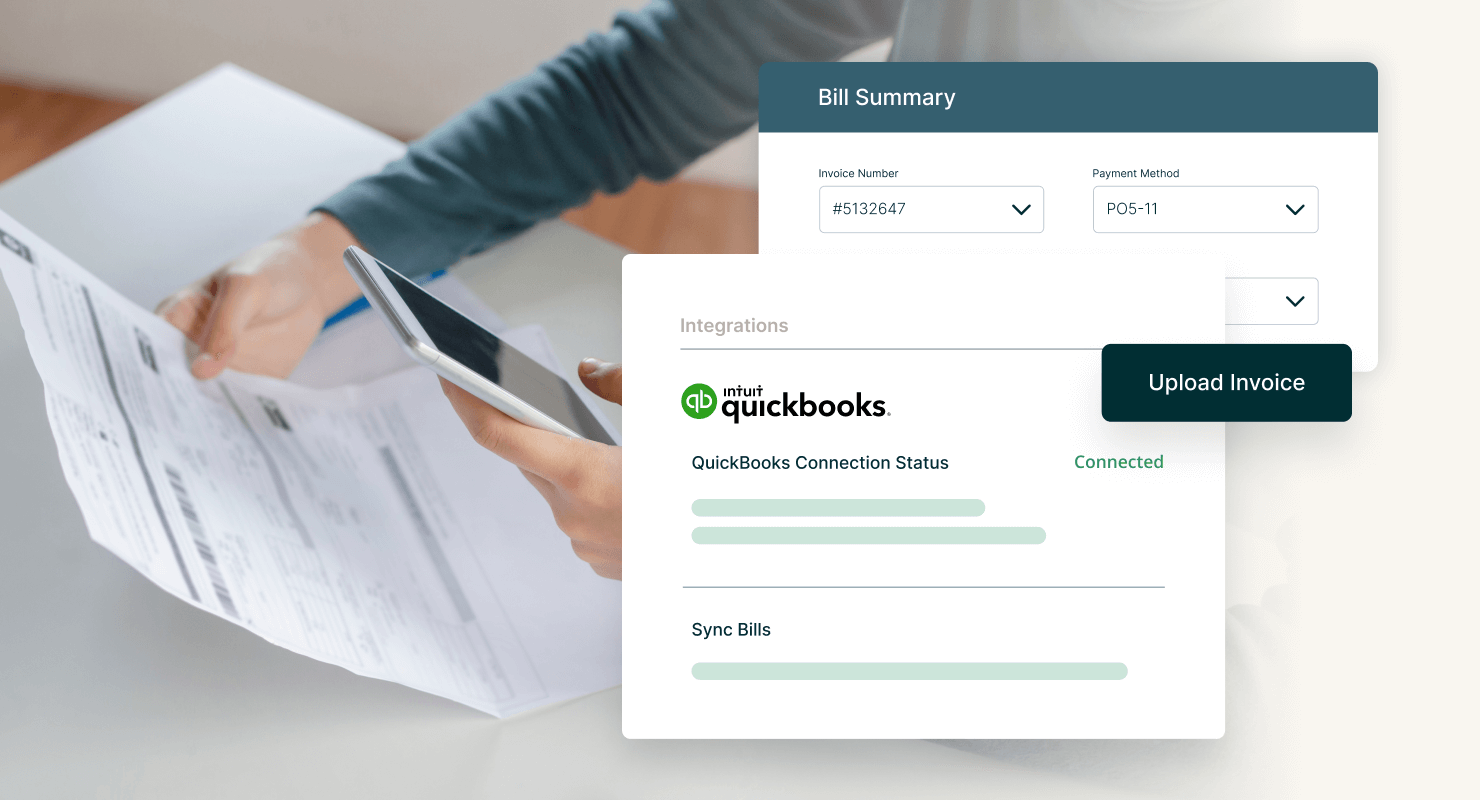

Integration with ERP and accounting systems: Seamless integration with existing ERP and accounting systems ensures smooth data flow and consistency.

-

API functionalities: Provides APIs for custom integrations, allowing businesses to tailor the software to their specific needs.

Analytics and Reporting

-

Real-time analytics: Provides real-time analytics insights into AP processes, helping identify bottlenecks and areas for improvement.

-

Customizable reporting: Enables the creation of detailed, customizable reports to meet specific business requirements.

How to choose the right AP automation software

Selecting the right accounts payable automation software is a critical decision that can significantly impact your organization’s financial efficiency and overall business operations. Here are the key steps to guide you through the selection process:

Assessing your business needs

-

Identifying pain points: Begin by evaluating your current AP processes to identify specific pain points and inefficiencies. Common issues may include manual data entry errors, slow approval times, high processing costs, and lack of visibility into AP operations.

-

Defining goals and objectives: Clearly define what you aim to achieve with AP automation. Objectives might include reducing processing times, improving accuracy, lowering costs, enhancing compliance, and gaining better financial control.

Evaluating Software Options

-

Comparing features and functionalities: Create a list of essential features and functionalities that align with your business needs. Key features to consider include automated invoice capture, customizable workflows, electronic payments, integration capabilities, and advanced analytics.

-

Considering scalability and flexibility: Ensure that the software can scale with your business as it grows. It should be flexible enough to accommodate changes in your AP processes and integrate seamlessly with your existing systems.

Vendor considerations

-

Vendor reputation and support: Research potential vendors to assess their reputation, reliability, and customer support. Look for vendors with a proven track record in AP automation and positive customer reviews. Strong customer support is crucial for addressing any issues that may arise during implementation and beyond.

-

Pricing and ROI analysis: Evaluate the cost of the software, including initial implementation fees, subscription costs, and any additional expenses for support and maintenance. Conduct a cost-benefit analysis to estimate the return on investment (ROI) and ensure that the software provides value for money.

To assist in the selection process, consider creating a detailed comparison matrix that includes the features, benefits, and costs of each software option. This will help you make an informed decision based on your specific business requirements and budget.

Implementation of AP automation software

Implementing accounts payable automation software requires careful planning and execution to ensure a smooth transition from manual to automated processes. Here are the three key steps involved in the implementation process:

Planning and preparation

-

Setting up a project team: Assemble a dedicated project team that includes representatives from finance, IT, and other relevant departments. This team will be responsible for overseeing the implementation process and ensuring that all stakeholders are aligned.

-

Developing an implementation plan: Create a comprehensive implementation plan that outlines the project timeline, milestones, and key deliverables. The plan should include detailed steps for data migration, system integration, testing, training, and go-live.

Steps to successful implementation

-

Data migration and system integration: Begin by migrating existing AP data to the new software system. Ensure that the software integrates seamlessly with your existing ERP and accounting systems to maintain data consistency and accuracy.

-

Testing and troubleshooting: Conduct thorough testing of the software to identify and resolve any issues before going live. This includes testing all automated workflows, data capture processes, and integration points to ensure they function correctly.

Training and change management

-

Training staff and users: Provide comprehensive training to all users, including finance staff, approvers, and vendors. Training should cover how to use the software, navigate the interface, and perform key tasks such as invoice processing and approvals.

-

Managing change and user adoption: Change management is crucial to the success of the implementation. Communicate the benefits of AP automation to all stakeholders and address any concerns they may have. Encourage user adoption by highlighting how the software will improve their daily tasks and overall efficiency.

By following these three steps, you can ensure a successful implementation of AP automation software, leading to improved efficiency, accuracy, and financial control within your organization.

Future trends in AP automation

The landscape of AP automation is continually evolving, with new technologies and trends shaping its future. Here are some of the emerging trends and predictions for the next few years:

Emerging technologies

Artificial intelligence (AI) and machine learning (ML): AI and ML are revolutionizing AP automation by enhancing data capture accuracy, predictive analytics, and decision-making processes. These technologies enable the software to learn from historical data and improve its performance over time, leading to even greater efficiencies and error reduction.

Blockchain technology: Blockchain offers a secure and transparent way to handle transactions and document verification in AP processes. By providing an immutable ledger of transactions, blockchain can enhance the security and traceability of payments, reducing the risk of fraud and ensuring compliance.

Robotic process automation (RPA): RPA can automate repetitive tasks such as data entry, invoice matching, and payment processing, freeing up human resources for more strategic activities. This technology is particularly useful for handling high volumes of transactions with consistent accuracy.

Predictions for the next five years

Increased adoption of cloud-based solutions: Cloud-based AP automation solutions offer scalability, flexibility, and remote access, making them an attractive option for businesses of all sizes. The trend towards cloud adoption is expected to continue, providing organizations with greater agility and cost savings.

Greater integration with financial ecosystems: AP automation software will increasingly integrate with other financial systems, such as procurement, treasury, and expense management, creating a seamless financial ecosystem. This integration will provide better visibility and control over the entire financial supply chain.

Enhanced user experience and accessibility: As user expectations evolve, accounts payable automation software will focus on providing a more intuitive and user-friendly experience. Enhanced accessibility features, mobile capabilities, and user-centric designs will become standard, making it easier for users to interact with the software.

Sustainability and environmental impact: With growing awareness of sustainability, AP automation solutions will emphasize reducing paper usage and promoting environmentally friendly practices. Digital documentation and electronic payments will contribute to lower carbon footprints and more sustainable business operations.

FAQs about AP automation software

Implementing AP automation software can raise several questions and concerns. Here are some of the most frequently asked questions, along with practical tips and advice to address them:

Common questions and concerns

Practical tips and advice

Transform your AP processes

Accounts payable (AP) automation software is a powerful tool that can transform your AP processes, leading to increased efficiency, cost savings, and better financial management.

As technology continues to evolve, staying ahead of trends and adopting advanced AP automation solutions will position your business for long-term success. Whether you are just starting your journey or looking to upgrade your existing system, this guide provides the knowledge and insights you need to make informed decisions and drive positive change in your accounts payable processes.

It’s time to embrace the future of accounts payable and take the first step towards a more efficient and effective financial operation.

Webinar: Automate Your AP Processes with Procurify

Learn how AP automation enhances the efficiency, accuracy, and financial visibility of your accounts payable workflows.