The 2025 Guide to Invoice Approval Software: Streamline Your AP Processes

The ability to scale is always a positive sign for a business.

But with growth usually adds complexity. And in accounts payable (AP) departments, that usually means a surge in invoices.

Relying on manual workflows becomes unsustainable at a certain point – especially for businesses managing multiple vendors and payment cycles. Without a streamlined system, organizations face risks such as:

-

Duplicate payments

-

Missed deadlines

-

Difficulty in tracking approvals across departments

Unlock the power of Procurify’s AI-enhanced AP automation

Discover how AI can expedite and automate your invoice process while saving time and reducing errors.

Among the benefits of invoice approval software:

-

Efficiency: Automation eliminates time-consuming manual tasks like data entry and follow-ups, allowing teams to process invoices faster.

-

Accuracy: Built-in validation features reduce errors by flagging discrepancies, duplicate invoices, or incomplete information before approvals.

-

Compliance: Centralized records and automated workflows ensure businesses meet regulatory requirements and maintain an audit trail for financial reporting.

-

Cost Savings: Faster approvals can help companies take advantage of early payment discounts and avoid late payment penalties.

-

Transparency: With real-time visibility into the approval process, stakeholders can track the status of invoices and maintain accountability.

By investing in invoice approval software, businesses can enhance their AP workflows, improve vendor relationships, and allocate more resources to strategic financial management. It’s a solution that addresses current operational challenges and scales to meet future growth.

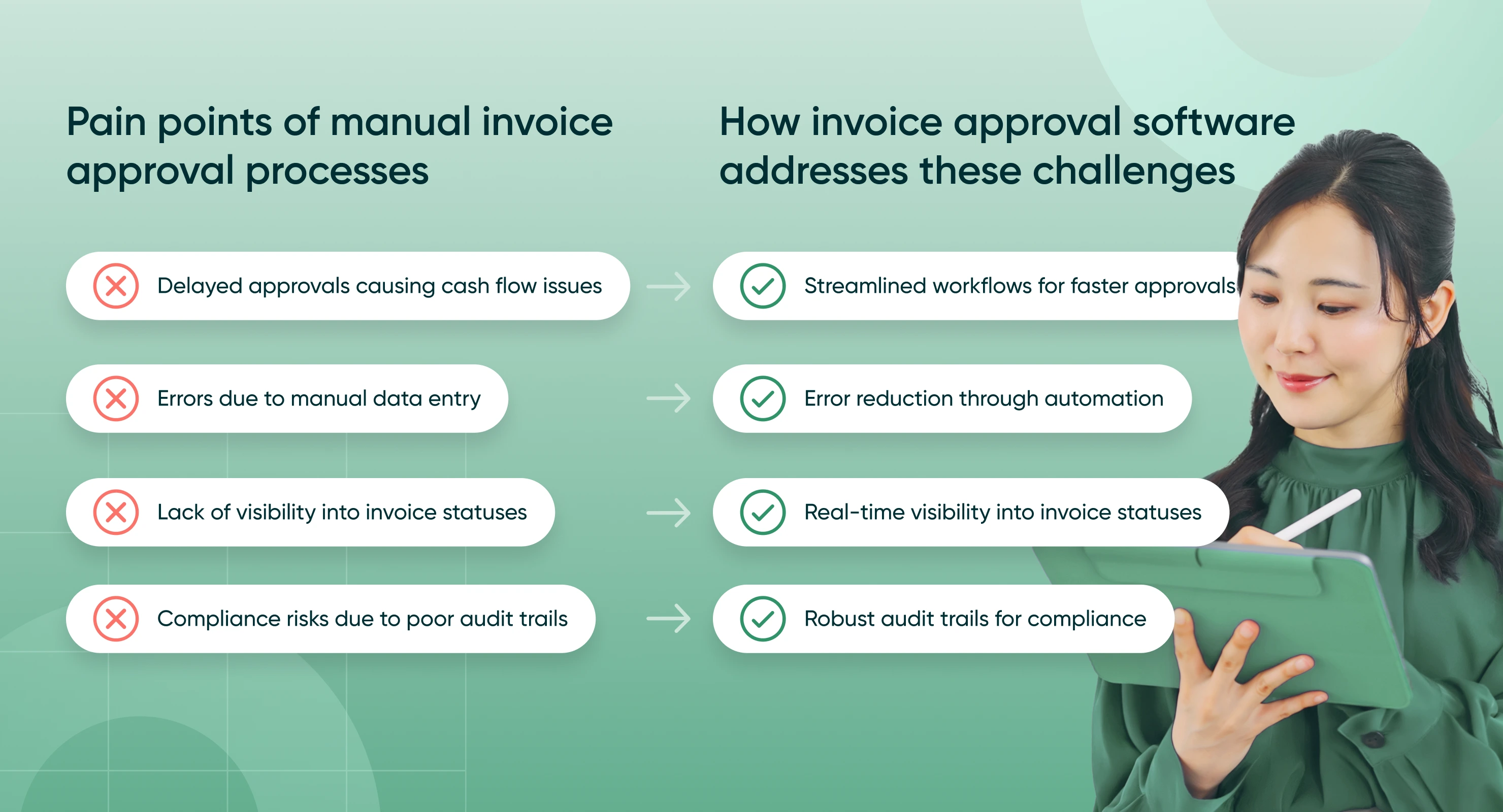

The challenges of manual invoice approval processes

Managing invoices manually might seem manageable in smaller organizations, but as a business grows, the limitations of these processes become glaring. Here are some of the most common pain points businesses face with manual invoice approvals and how they impact overall operations:

Pain points of manual invoice approval processes

-

Delayed approvals causing cash flow issues

Manual invoice approvals often involve paper-based workflows or back-and-forth emails, which can lead to significant delays. A single missing signature or misplaced invoice can stall the entire process, resulting in late payments. These delays disrupt cash flow, hinder vendor relationships, and can lead to missed early payment discounts or costly late payment fees. -

Errors due to manual data entry

Human error is an unavoidable risk in manual data entry. Typos, incorrect amounts, and duplicate entries can lead to disputes with vendors, payment inaccuracies, or compliance issues. Correcting these errors after they occur is time-consuming and may require reconciling multiple systems or records. -

Lack of visibility into invoice statuses

Without a centralized system, tracking the status of an invoice is challenging. Teams may spend hours chasing updates across departments, relying on spreadsheets, emails, or verbal confirmations. This lack of transparency not only wastes time but also makes it difficult for managers to prioritize critical invoices or gain real-time insights into outstanding liabilities. -

Compliance risks due to poor audit trails

Manual processes often lack proper documentation or centralized record-keeping, making it difficult to provide accurate audit trails. This creates compliance risks, especially for organizations subject to regulatory standards like SOX or GDPR. A missing or incomplete paper trail can lead to penalties, reputational damage, or failed audits.

How invoice approval software addresses these challenges

-

Streamlined workflows for faster approvals

Invoice approval software automates workflows by routing invoices to the appropriate approvers based on predefined criteria. Notifications and reminders ensure timely actions, significantly reducing delays. -

Error reduction through automation

With automated data extraction and validation, the software minimizes errors that arise from manual entry. For example, duplicate invoices are flagged, and amounts are cross-checked with purchase orders to ensure accuracy before approval. -

Real-time visibility into invoice statuses

A centralized dashboard provides real-time insights into where invoices are in the approval process. Managers and finance teams can quickly identify bottlenecks, monitor outstanding invoices, and prioritize approvals to maintain healthy cash flow. -

Robust audit trails for compliance

Every action taken within the software is logged, creating a complete audit trail. This ensures compliance with regulatory requirements and simplifies audits by providing a transparent history of invoice approvals, from submission to payment.

By addressing these challenges, invoice approval software enhances operational efficiency and helps businesses build trust with vendors, ensure compliance, and maintain financial control. For companies seeking scalable solutions, it’s a vital tool for modernizing their AP processes.

What is invoice approval software?

Invoice approval software is a digital tool designed to automate and optimize the process of reviewing, approving, and managing invoices within an organization. It streamlines the traditional, often manual, workflows involved in accounts payable (AP), enabling businesses to process invoices faster, reduce errors, and maintain better control over their finances.

At its core, the purpose of invoice approval software is to eliminate the inefficiencies and risks associated with manual invoice handling. By digitizing the process, it ensures that invoices are routed to the right approvers, reviewed in a timely manner, and appropriately recorded for compliance and financial reporting.

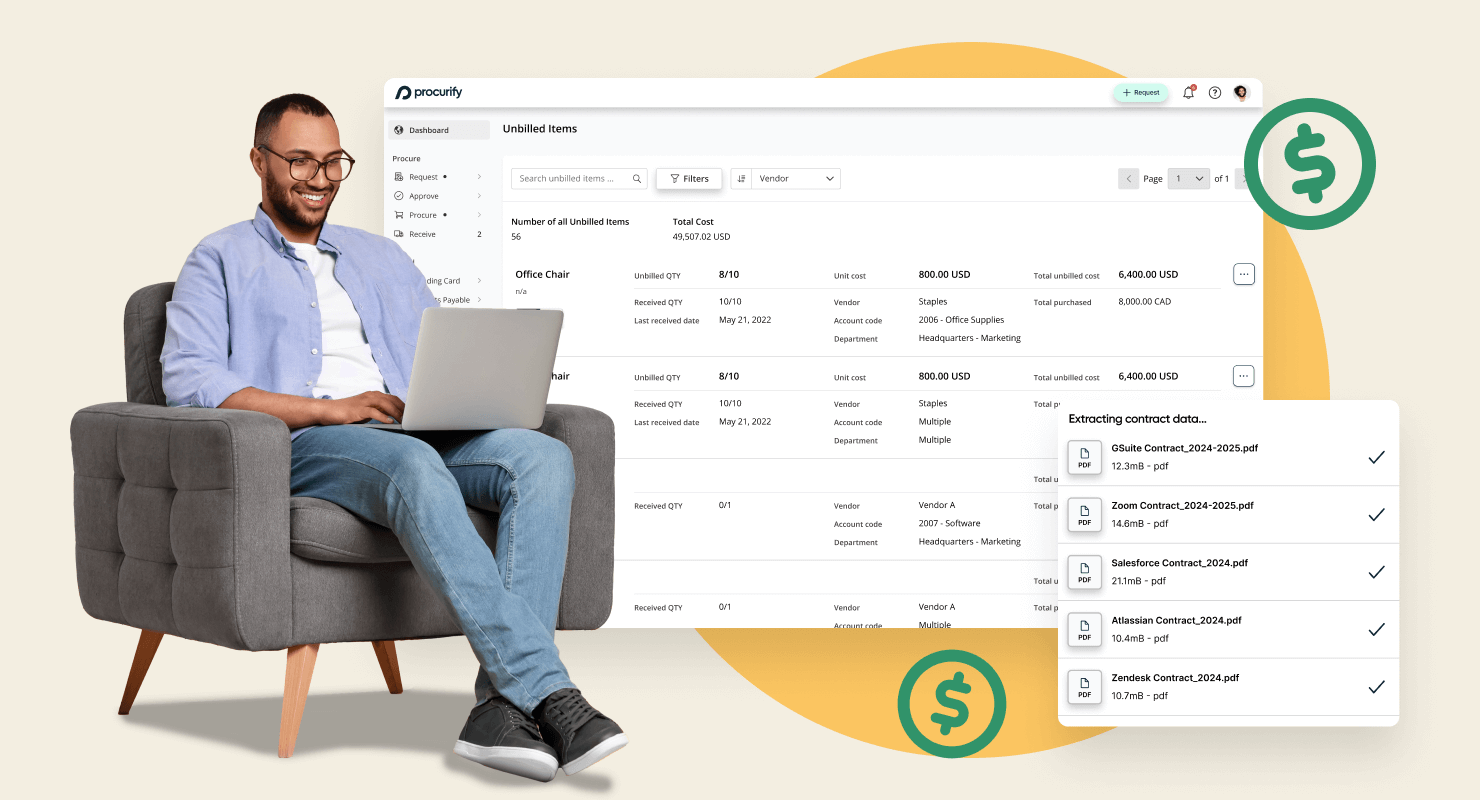

How invoice approval software works

The software automates key aspects of invoice processing, removing the need for paper-based systems or reliance on spreadsheets. Once an invoice is received—whether via email, a vendor portal, or scanned document—it is uploaded to the system. From there, the software:

-

Extracts key data using optical character recognition (OCR) or other data capture methods.

-

Matches invoices to purchase orders (POs) and receipts, ensuring all details align.

-

Routes invoices to designated approvers based on predefined workflows.

-

Notifies stakeholders of pending actions, deadlines, or discrepancies.

-

Generates a comprehensive audit trail, recording every action taken on the invoice.

By automating these steps, invoice approval software minimizes human intervention, reduces the risk of errors, and accelerates the entire process.

Key functionalities of invoice approval software

-

Automated workflows

The software uses rules-based workflows to route invoices to the appropriate approvers, ensuring compliance with company policies. For example, invoices above a certain amount may require multiple approvals. Notifications and reminders keep the process moving, preventing delays. -

Real-time tracking and notifications

A centralized dashboard provides visibility into every invoice’s status—whether it’s pending approval, flagged for review, or completed. Automatic notifications alert stakeholders to pending tasks, helping avoid bottlenecks or missed deadlines. -

Audit trail generation

Every action taken within the system is recorded, from the moment an invoice is uploaded to the final payment. This creates a robust audit trail, ensuring transparency and simplifying regulatory compliance and financial audits.

By leveraging these functionalities, businesses can enhance efficiency, reduce costs, and improve relationships with vendors by ensuring timely and accurate payments. Invoice approval software is not just a convenience—it’s an essential component of a modern, scalable AP process.

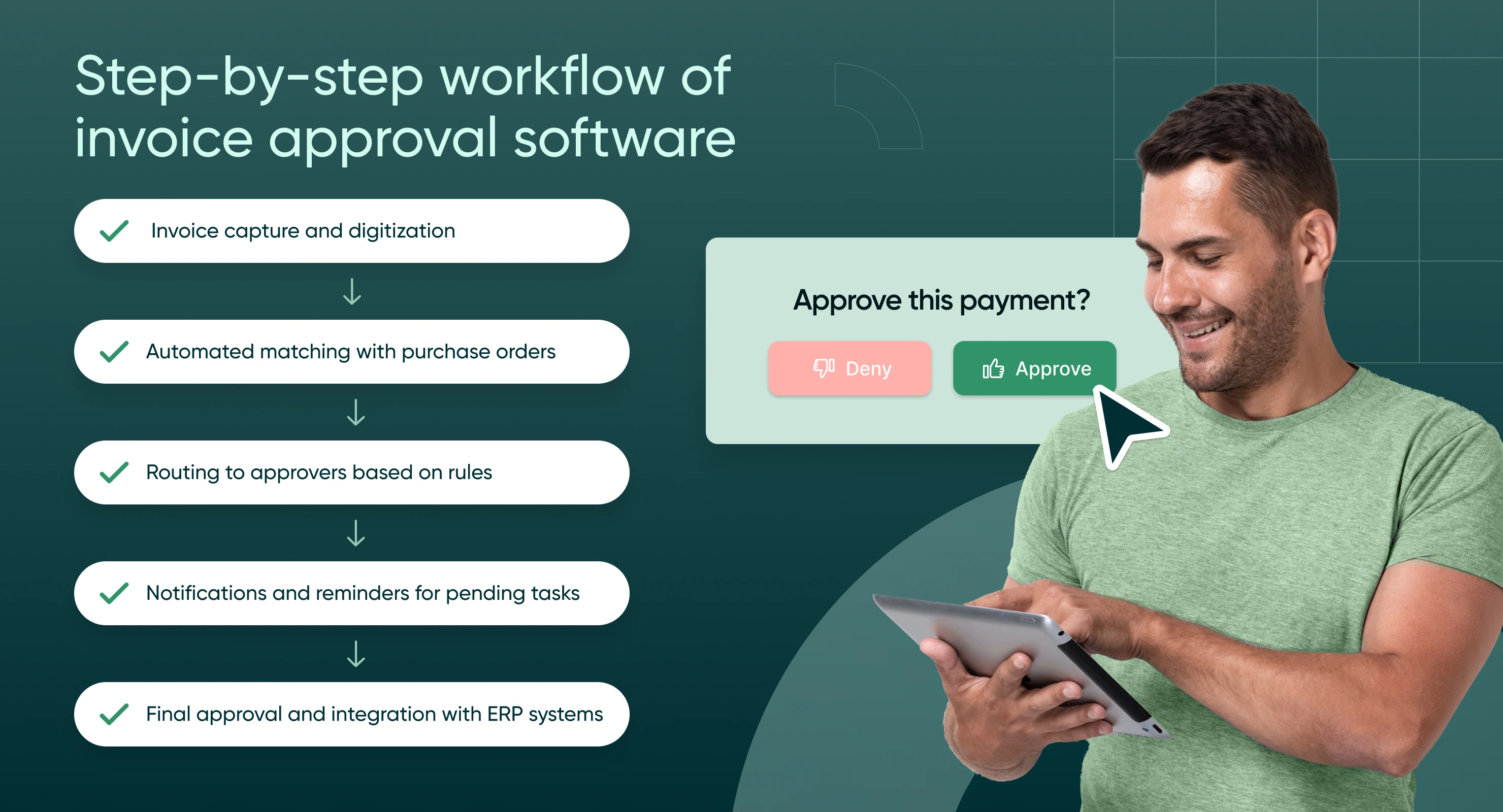

Step-by-step workflow of invoice approval software

Invoice approval software simplifies and automates the end-to-end invoice processing journey, ensuring accuracy, compliance, and timeliness. Here’s a detailed breakdown of how the software typically operates:

-

Invoice capture and digitization

- Process: Invoices are uploaded into the system through various channels, such as email, vendor portals, or by scanning paper documents.

- Technology used: Optical Character Recognition (OCR) or other intelligent data capture tools extract key details, such as invoice numbers, vendor names, amounts, and payment terms.

- Outcome: A digital record of the invoice is created, eliminating the need for physical storage and reducing the risk of lost documents.

-

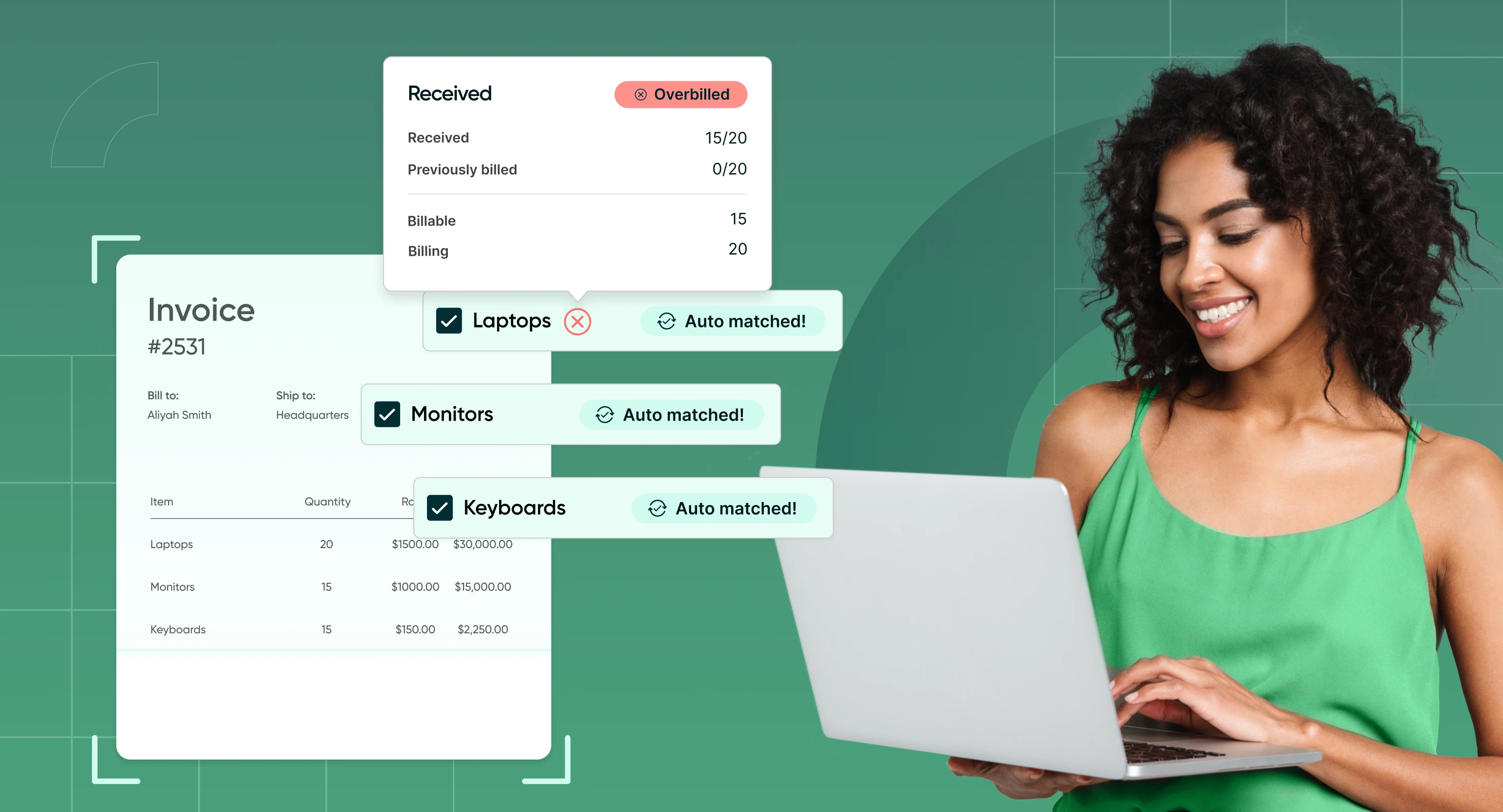

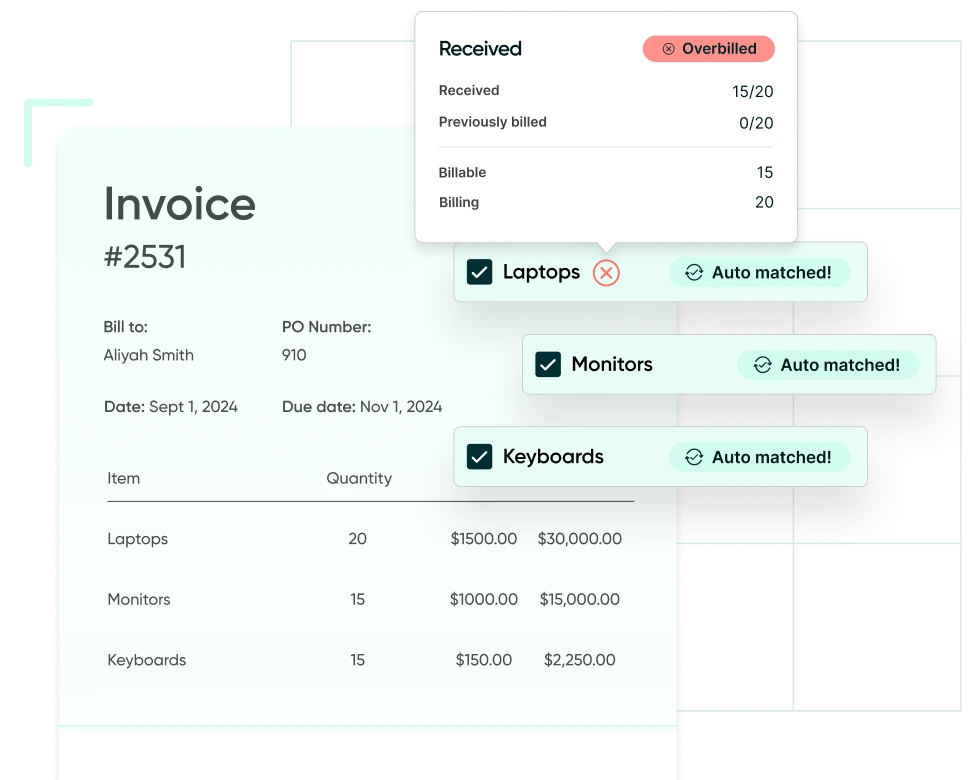

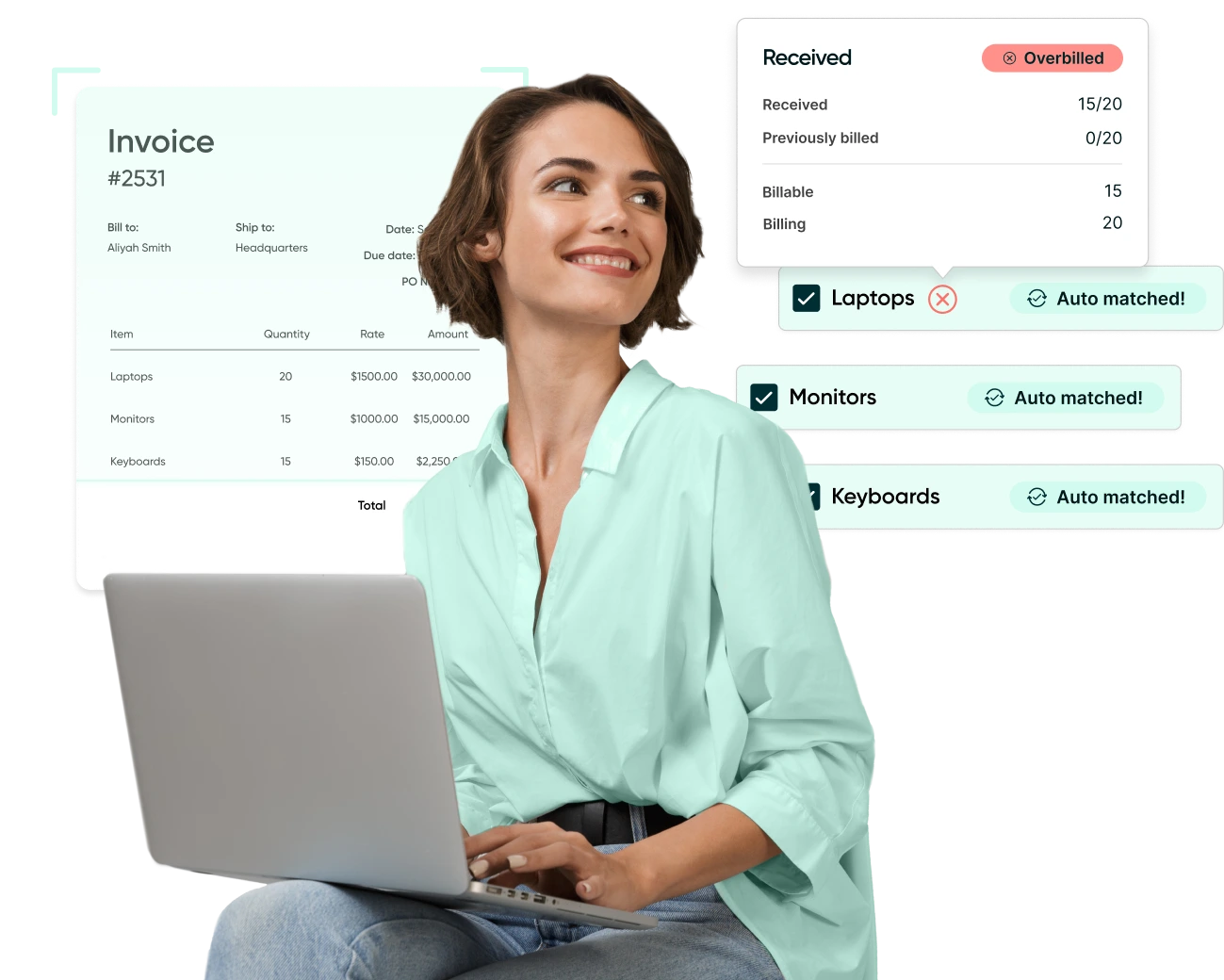

Automated matching with purchase orders (POs)

- Process: The software performs automated matching to ensure the invoice corresponds with existing POs, receipts, or contracts. This is typically done through:

- 2-Way Matching: Comparing the invoice with the purchase order.

- 3-Way Matching: Matching the invoice with both the purchase order and goods receipt.

- Outcome: Discrepancies, such as mismatched amounts or missing information, are flagged for review, ensuring accuracy before approval.

- Process: The software performs automated matching to ensure the invoice corresponds with existing POs, receipts, or contracts. This is typically done through:

-

Routing to appropriate approvers based on rules

- Process: Once verified, the invoice is automatically routed to the relevant approvers based on predefined business rules, such as:

- Invoice amount thresholds (e.g., invoices over $5,000 may require senior-level approval).

- Department-specific workflows.

- Outcome: The invoice reaches the correct stakeholder without delays or confusion.

- Process: Once verified, the invoice is automatically routed to the relevant approvers based on predefined business rules, such as:

-

Notifications and reminders for pending tasks

- Process: Approvers are notified via email or in-app alerts about pending invoices. The system can send automated reminders for overdue tasks to prevent bottlenecks.

- Outcome: Approvals happen promptly, reducing the risk of missed payment deadlines.

-

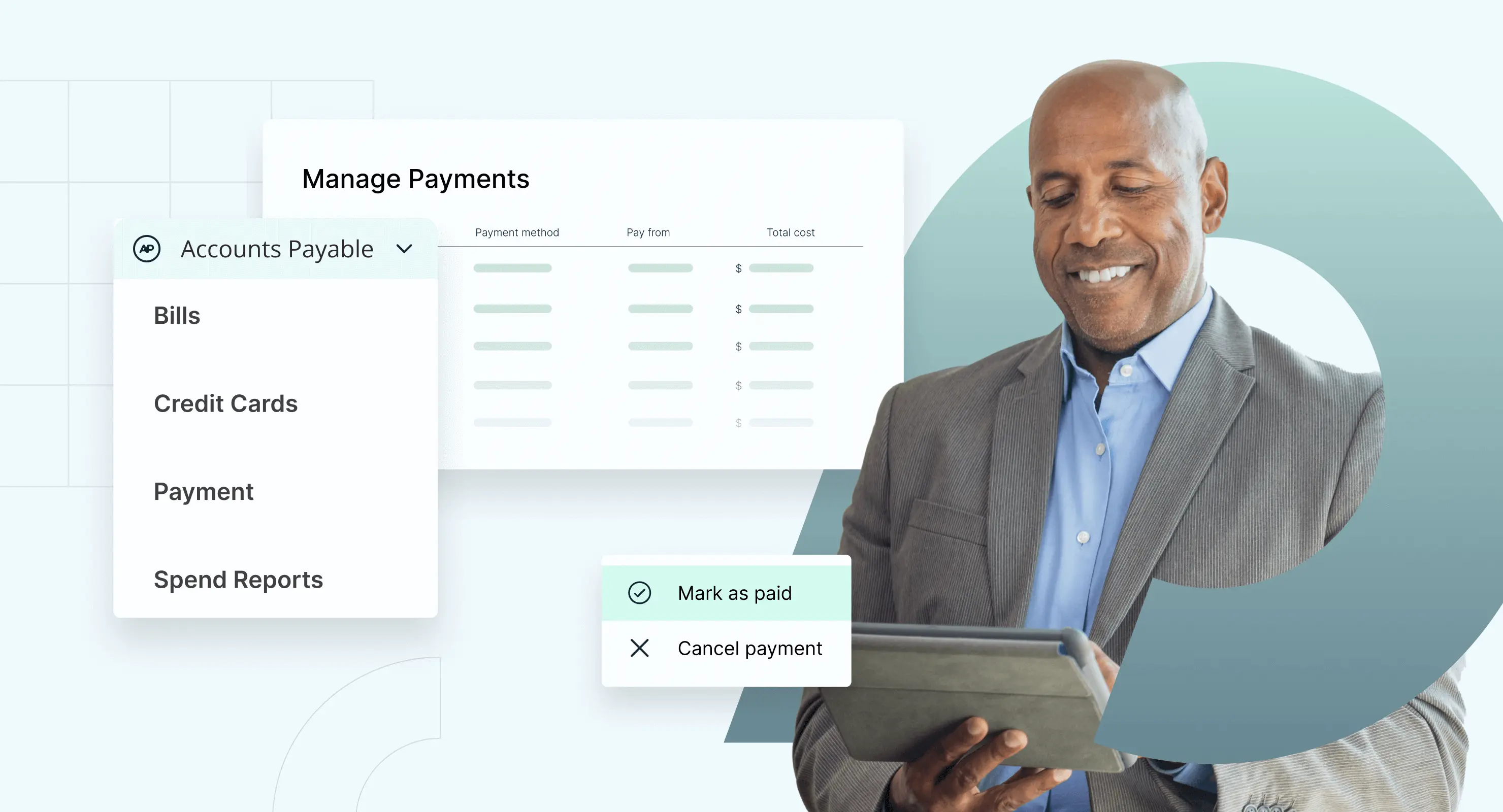

Final approval and integration with accounting/ERP systems

- Process: After all necessary approvals are obtained, the invoice is marked as approved. The software integrates with the organization’s accounting or ERP system (e.g., QuickBooks, NetSuite, or Sage Intacct) to facilitate payment and record-keeping.

- Outcome: A seamless handoff to the payment process, with all relevant data automatically updated in the financial system for future reporting or audits.

ROI and cost-benefit analysis of invoice approval software

Investing in invoice approval software delivers measurable benefits that translate into significant cost savings and operational efficiency. Here’s a closer look at the quantifiable advantages and how they contribute to a strong return on investment (ROI):

-

Reduction in manual labor and processing time

Impact:

Automating invoice approvals reduces the time spent on manual tasks such as data entry, tracking approvals, and resolving discrepancies. This enables accounts payable (AP) teams to focus on higher-value tasks like financial planning and vendor management.A hypothetical example:

- A mid-sized company processing 1,000 invoices per month manually spends an average of 12 minutes per invoice.

- With invoice approval software, processing time is cut to 4 minutes per invoice.

- Savings:

- Monthly time saved: 8 minutes per invoice × 1,000 invoices = 133 hours.

- Annual labor savings: 1,596 hours, equating to approximately $48,000 saved annually (assuming a $30/hour AP clerk salary).

Additional benefit:

Faster invoice processing reduces bottlenecks, enabling better cash flow management. -

Savings from avoiding late payment penalties

Impact:

Delayed invoice approvals can result in missed payment deadlines, leading to penalties. These fees can add up, especially for businesses managing high invoice volumes.A hypothetical example:

- A company incurs $5,000 in late fees annually due to delayed invoice approvals.

- Implementing automated workflows eliminates 90% of delays, saving $4,500 per year.

Hypothetical benefit from early payment discounts:

- A vendor offers a 2% discount for invoices paid within 10 days.

- With $500,000 in annual payable invoices, taking advantage of this discount saves $10,000 annually.

-

Improved vendor relationships through timely payments

Impact:

Timely payments strengthen vendor relationships, leading to better terms, improved service levels, and prioritized supply. Vendors are more likely to offer favorable rates and accommodate business needs when they trust in consistent payments.A hypothetical example:

- A retail business using invoice approval software improved on-time payment rates from 70% to 95%.

- As a result, vendors extended better credit terms, saving the company 1% on annual procurement costs (e.g., $200,000 savings on $20 million in procurement).

Additional benefit:

Satisfied vendors help businesses avoid supply disruptions, which can lead to lost sales or project delays. -

Real-world metrics and ROI calculation

Cost of software implementation:

- Subscription cost: $1,500/month for a company processing 1,000 invoices per month.

- Annual cost: $18,000.

Savings achieved:

- Labor savings: $48,000/year.

- Late payment savings: $4,500/year.

- Early payment discounts: $10,000/year.

Total Annual Savings:

$62,500.ROI:

- Annual savings ($62,500) – Annual cost ($18,000) = $44,500 net savings.

- ROI = ($44,500 ÷ $18,000) × 100 = 247% ROI in the first year.

-

Intangible benefits

- Audit readiness: Reduced time preparing for audits due to automated record-keeping.

- Scalability: The software grows with your business without requiring additional staff.

- Employee Satisfaction: Less time on repetitive tasks improves morale and productivity.

Integration capabilities of invoice approval software

Seamless integration with existing systems is a cornerstone of effective invoice approval software. By connecting with ERP, accounting, and procurement platforms, the software ensures data consistency, eliminates redundant tasks, and enhances workflow efficiency. Below, we’ll explore the importance of these integrations and the specific benefits they bring.

Importance of integrations

Businesses rely on various tools to manage their financial and operational workflows. Without integration, invoice approval software operates in a silo, leading to:

-

Manual data transfers that increase the risk of errors.

-

Redundant processes that slow down approval and payment cycles.

-

Difficulty maintaining a single source of truth across platforms.

By integrating invoice approval software with key systems, organizations create a unified ecosystem that improves data flow, accuracy, and productivity.

Benefits of seamless integration

-

Data consistency

Integration ensures that all platforms share accurate, up-to-date data, reducing the risk of mismatches and errors. For example, if a payment is processed in the accounting system, the update is reflected in the invoice approval software automatically.

-

Workflow efficiency

Eliminating manual transfers allows employees to focus on value-added tasks instead of repetitive administrative work. This is especially crucial for high-volume invoice environments.

-

With integrated systems, businesses gain a holistic view of their financial health. Real-time reporting across platforms provides actionable insights into spending patterns, compliance, and vendor performance.

-

Scalability for growth

As organizations expand, integration enables them to manage higher invoice volumes, multiple locations, and complex workflows without adding manual effort or additional staff.

Integrating invoice approval software with ERP, accounting, and procurement systems is essential for achieving data consistency, streamlining workflows, and improving overall operational efficiency. Whether syncing with tools like QuickBooks or managing complex procurement processes via SAP Ariba, these integrations empower businesses to automate their AP processes effectively and focus on growth.

Compliance and audit readiness with invoice approval software

Regulatory compliance and audit readiness are critical aspects of financial management for organizations of all sizes. Invoice approval software simplifies these challenges by automating processes, ensuring adherence to financial and tax regulations, and providing transparency for internal and external audits.

-

Automated role-based access controls

How it works:

Invoice approval software assigns access permissions based on roles within the organization. This ensures that employees only access the information and functions relevant to their responsibilities.Compliance benefits:

- Prevents unauthorized access to sensitive financial data, reducing fraud risks.

- Maintains segregation of duties to comply with regulations like SOX (Sarbanes-Oxley Act), which require clear demarcation of roles in financial processes.

- Tracks all actions performed by users, providing accountability at every stage of the approval workflow.

-

Detailed audit trails for financial transparency

How it works:

Every action taken on an invoice—from submission to final approval—is recorded in a time-stamped log. These records include details such as who reviewed the invoice, what changes were made, and when the invoice was approved or flagged for review.Compliance benefits:

- Provides a clear, unalterable history of financial transactions, simplifying internal and external audits.

- Reduces the time and effort required to prepare for audits by maintaining organized, accessible records.

- Ensures accountability by tying every action to a specific user or department.

-

Tax and regulatory compliance (e.g., VAT, GST, SOX)

How it works:

Invoice approval software is equipped to handle regional tax requirements such as VAT (Value Added Tax) and GST (Goods and Services Tax). Features like tax validation, automated calculations, and compliance flags ensure that invoices meet legal standards.Compliance benefits:

- Flags incomplete or incorrect tax details, preventing filing errors and penalties.

- Ensures compliance with SOX by automating processes that safeguard against fraud and financial misstatements.

- Facilitates cross-border transactions by validating tax rates and formats for international invoices.

-

Adherence to internal and external policies

How it works:

Predefined rules and workflows enforce adherence to organizational policies, such as multi-level approvals for high-value invoices or mandatory review by department heads. External compliance requirements are integrated into the workflow to ensure alignment with industry standards.Compliance benefits:

- Minimizes the risk of policy violations by automating checks and balances.

- Standardizes workflows to ensure all transactions follow company and regulatory requirements.

- Reduces reliance on manual enforcement of policies, which can be inconsistent and prone to error.

Key features supporting compliance

-

Predefined approval workflows: Ensure invoices follow all necessary steps for compliance with internal and external regulations.

-

Real-time validation: Automatically checks invoices for missing fields, incorrect tax details, or policy violations.

-

Centralized data repository: Stores all records securely, making them easily retrievable for audits or legal reviews.

-

Customizable access levels: Aligns access controls with the organization’s hierarchy and regulatory needs.

Invoice approval software is an indispensable tool for maintaining compliance and audit readiness. By automating role-based access controls, providing detailed audit trails, and enforcing tax and regulatory standards, it reduces the risks of financial mismanagement and simplifies adherence to complex legal requirements. This not only helps businesses avoid penalties but also ensures they are always prepared for audits and inspections.

Future trends in invoice approval software

As technology advances, invoice approval software continues to evolve, incorporating cutting-edge features that enhance efficiency, security, and flexibility. Here are the emerging trends shaping the future of invoice approval systems and how businesses can prepare to future-proof their processes.

-

AI for predictive analytics and fraud detection

Trend:

Artificial intelligence (AI) is becoming an integral part of invoice approval software, enabling advanced capabilities such as predictive analytics and real-time fraud detection.Applications:

- Predictive analytics: AI analyzes historical data to identify patterns, such as recurring approval delays or bottlenecks, and provides actionable insights for process optimization.

- Fraud detection: Machine learning algorithms identify anomalies in invoices, such as duplicate entries, inflated amounts, or vendor inconsistencies, flagging them for review.

Hypothetical example:

A manufacturing firm using AI-enabled software detected a series of duplicate invoices from a vendor, saving $20,000 in potential overpayments and improving their fraud prevention protocols.Future impact:

AI will enable smarter, more efficient invoice processing, minimizing human intervention and proactively mitigating risks. -

Blockchain for secure and transparent invoice records

Trend:

Blockchain technology is gaining traction for its ability to create tamper-proof, decentralized records, ensuring transparency and security in financial transactions.Applications:

- Immutable records: Invoices stored on a blockchain cannot be altered, providing a secure and reliable audit trail.

- Smart contracts: Automates payments by linking contract conditions directly to invoice approvals, reducing delays and disputes.

- Enhanced vendor trust: Transparent records boost confidence between buyers and suppliers by eliminating ambiguity in transactions.

Hypothetical example:

A global logistics company implemented blockchain for invoice approvals, enabling real-time visibility and ensuring compliance across its multi-country operations.Future impact:

Blockchain adoption will make invoice processing more secure, verifiable, and efficient, especially for industries managing high-value or cross-border transactions. -

Mobile-first solutions for remote approvals

Trend:

As remote work becomes the norm, mobile-first invoice approval solutions are critical for ensuring business continuity and productivity.Applications:

- Real-Time Notifications: Mobile apps notify users of pending invoices, enabling faster approvals.

- On-the-Go Approvals: Users can review, approve, or reject invoices from anywhere, eliminating bottlenecks caused by location constraints.

- Integration with Wearables: Future applications could include voice or gesture-activated approvals via smartwatches or other wearable devices.

Hypothetical example:

A retail chain equipped its managers with mobile invoice approval apps, reducing approval delays by 60% during peak seasons, even when teams were on-site at different store locations.Future impact:

Mobile-first systems will ensure flexibility and responsiveness, catering to a growing need for decentralized workflows. -

Advice on future-proofing your invoice processing system

To stay ahead of these trends and maximize the benefits of emerging technologies, businesses should:

- Adopt scalable solutions:

Choose software with modular features that can grow with your business. Look for vendors that offer regular updates and enhancements. - Leverage AI and machine learning:

Start incorporating AI-driven tools to analyze data, optimize workflows, and reduce risks like fraud or payment errors. - Consider blockchain readiness:

Evaluate blockchain solutions for long-term adoption, especially if your industry involves high-value transactions or complex supply chains. - Prioritize mobility:

Ensure your invoice approval software offers robust mobile functionality to accommodate remote work and on-the-go decision-making. - Invest in integration capabilities:

Look for tools that seamlessly integrate with existing ERP, accounting, and procurement systems to maintain consistency and streamline workflows. - Stay security-focused:

Keep compliance and data security at the forefront by selecting tools that offer advanced encryption, role-based access controls, and regulatory adherence.

- Adopt scalable solutions:

Best practices for implementing invoice approval software

Implementing invoice approval software can transform your accounts payable (AP) process, but successful adoption requires careful planning, training, and ongoing optimization. Here are best practices to ensure a smooth implementation and maximize the software’s benefits.

-

Conducting a needs assessment to identify software requirements

Every organization has unique requirements based on its size, industry, and AP processes. A thorough needs assessment ensures you choose software that aligns with your specific goals and challenges.

Steps to take:

- Map your current process: Document how invoices are currently received, processed, and approved, identifying pain points and inefficiencies.

- Set goals: Define clear objectives for the software, such as reducing processing time, improving compliance, or enhancing visibility.

- Engage stakeholders: Involve key users, including finance teams, department heads, and IT, to gather insights and prioritize features.

- Evaluate compatibility: Ensure the software integrates with existing tools like ERP, accounting, and procurement systems.

Failing to involve end-users in the assessment process can result in selecting software that doesn’t meet their needs or is overly complex.

-

Ensuring proper staff training and buy-in

Even the best software is ineffective without user adoption. Training and gaining buy-in from your team are critical to maximizing the software’s potential.

Steps to take:

- Provide Comprehensive Training: Offer training sessions tailored to different user roles, such as approvers, finance staff, and IT support.

- Communicate benefits clearly: Help staff understand how the software will make their work easier, reduce errors, and enhance efficiency.

- Designate power users: Identify a few team members to become experts in the software and act as resources for their colleagues.

- Encourage feedback: Create an open feedback loop during the initial rollout to address concerns and make adjustments.

Skipping or rushing training sessions can lead to user frustration and resistance, slowing down adoption.

-

Regularly reviewing and optimizing workflows post-implementation

Why it’s important:

Implementing the software isn’t a one-time task—it requires ongoing optimization to adapt to changing needs and improve performance.- Monitor performance: Use the software’s analytics and reporting features to track key metrics, such as processing times and approval delays.

- Identify bottlenecks: Regularly review workflows to identify and address inefficiencies.

- Solicit feedback: Gather input from users to understand what’s working and what can be improved.

- Adjust rules and workflows: Update approval hierarchies, thresholds, or automation rules as your business grows or changes.

Failing to revisit workflows can result in outdated processes that negate the benefits of automation.

-

Common pitfalls to avoid during the adoption process

- Choosing the wrong software:

Selecting a tool that doesn’t align with your organization’s needs or lacks critical features can lead to poor ROI. - Ignoring change management:

Transitioning from manual to automated processes requires a cultural shift. Ignoring change management can lead to resistance and slow adoption. - Overcomplicating workflows:

Overly complex approval rules or configurations can frustrate users and reduce efficiency. Aim for simplicity wherever possible. - Underestimating integration needs:

Poor integration with existing systems can result in data silos, redundant tasks, and inaccurate reporting. - Lack of executive support:

Without leadership backing, implementation efforts may lack the authority and resources needed for success.

- Choosing the wrong software:

Implementing invoice approval software is a powerful step toward modernizing your AP processes, but success depends on thoughtful planning, robust training, and a commitment to continuous improvement.

Invoice approval software FAQs

Implementing invoice approval software can significantly enhance your accounts payable (AP) processes. Below are answers to common questions businesses often have about this technology:

By addressing these common questions, businesses can better understand the value and functionality of invoice approval software, paving the way for more informed decision-making and successful implementation.

So what?

Invoice approval software offers a powerful solution, automating critical accounts payable (AP) tasks, reducing errors, and ensuring compliance. By streamlining workflows, providing real-time visibility, and enabling seamless integration with existing systems, this software empowers businesses to improve efficiency, save money, and enhance vendor relationships.

With features like automated workflows, role-based access controls, and robust audit trails, invoice approval software not only simplifies day-to-day operations but also prepares organizations for future growth and compliance requirements. As emerging technologies like AI, blockchain, and mobile-first solutions continue to shape the space, investing in this tool is a step toward future-proofing your financial processes.

Don’t let outdated manual processes hold your business back. Take the next step in transforming your AP workflows. Request a demo today and see how Procurify can revolutionize your invoice management system.

Webinar: Automate Your AP Processes with Procurify

Learn how AP automation enhances the efficiency, accuracy, and financial visibility of your accounts payable workflows.