Invoice OCR: How Optical Character Recognition Streamlines Accounts Payable

Every finance team knows the frustration—piles of invoices, manual data entry, and the constant worry of human error. A single mistyped number can delay payments, disrupt vendor relationships, and cost your company thousands.

Yet, many mid-market businesses still rely on outdated processes, bogging down their accounts payable (AP) teams with inefficiencies. The result? Missed early payment discounts, costly errors, and a lack of real-time financial visibility.

Enter Optical Character Recognition (OCR)—a game-changer for AP automation. By extracting invoice data instantly and integrating seamlessly with ERP systems, OCR eliminates bottlenecks, reduces errors, and frees your team to focus on high-value work.

In this blog post, we’ll break down everything you need to know about invoice OCR—how it works, its benefits, best practices, and how to implement it effectively. If you’re ready to streamline your AP process and avoid the hidden costs of manual data entry, keep reading.

Understanding invoice OCR technology

Optical Character Recognition (OCR) is a technology that converts different types of documents, such as scanned paper documents, PDF files, or images captured by a digital camera, into editable and searchable data. In the context of invoice processing, OCR automates the extraction of key information—such as invoice numbers, dates, vendor details, line items, and total amounts—from invoices, transforming unstructured data into structured formats suitable for seamless integration into accounting systems.

The OCR process involves several critical steps:

-

Image acquisition: Capturing a digital image of the invoice through scanning or photography.

-

Pre-processing: Enhancing the image quality by adjusting brightness and contrast, removing noise, and correcting distortions to improve data extraction accuracy.

-

Text recognition: Analyzing the processed image to identify and extract characters and words using pattern recognition and feature detection algorithms.

-

Data extraction: Identifying and capturing specific data fields such as invoice number, date, vendor name, line items, and amounts.

-

Post-processing: Validating and correcting the extracted data to ensure accuracy before integration into the accounts payable system.

By automating these steps, OCR technology reduces the reliance on manual data entry, thereby enhancing efficiency and accuracy in invoice processing.

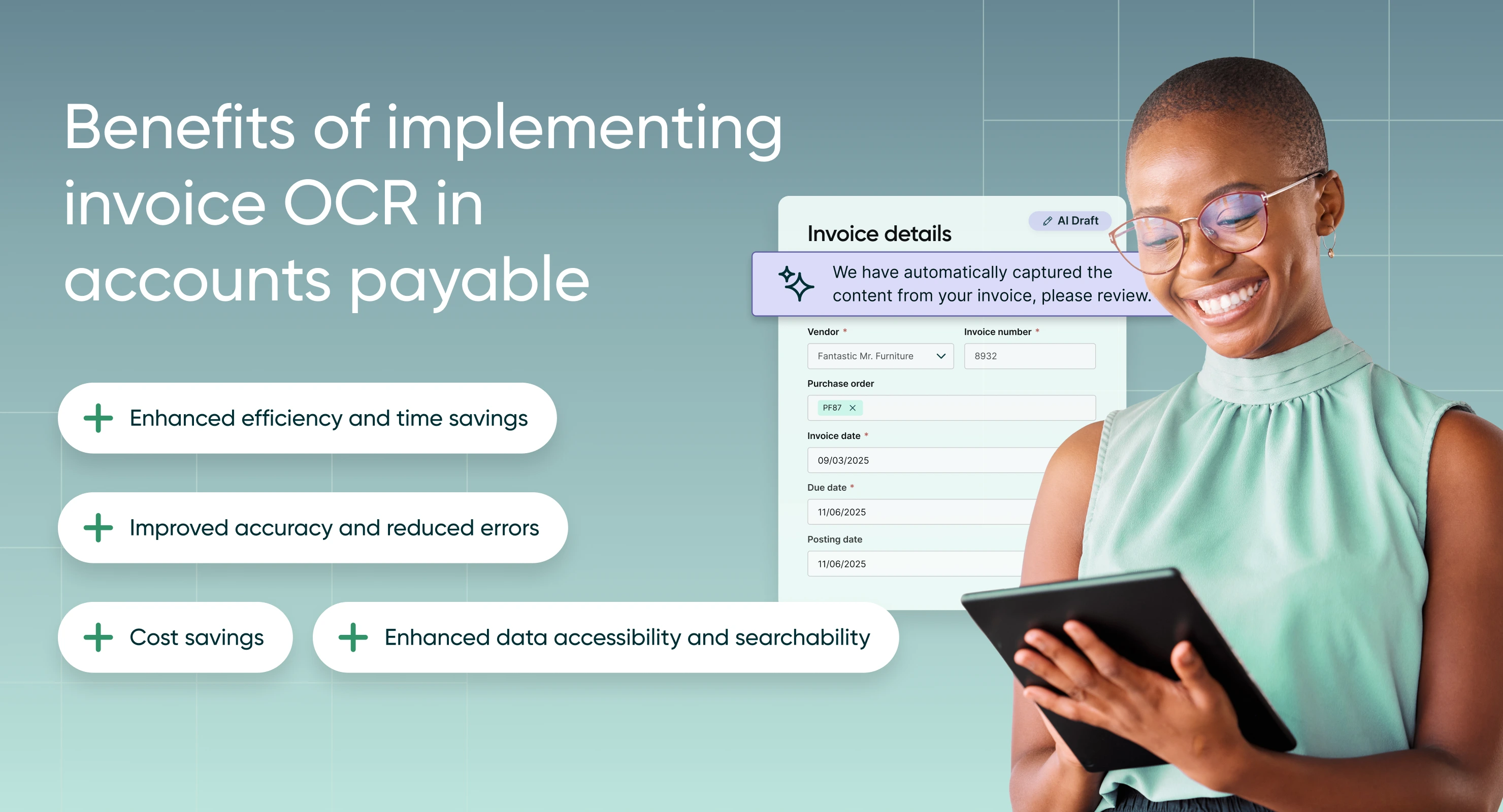

Benefits of implementing invoice OCR in accounts payable

Adopting OCR technology in invoice processing offers numerous advantages that can significantly impact a company’s operational efficiency and financial health:

Enhanced efficiency and time savings

OCR automates the extraction of data from invoices, drastically reducing the time required for manual data entry. This acceleration in processing time enables accounts payable departments to handle larger volumes of invoices with the same resources, improving overall productivity. Faster processing also allows companies to take advantage of early payment discounts offered by vendors.

Transform AP efficiency with Procurify’s AI-powered tools

Manual invoice processing is slowing you down. With AI-powered AP automation, you can eliminate data entry, reduce errors, and gain real-time financial visibility.

Improved accuracy and reduced errors

Manual data entry is susceptible to human errors, such as typographical mistakes or misinterpretation of handwritten information. OCR technology minimizes these errors by accurately capturing data from invoices, leading to more reliable financial records and reducing the risk of costly payment mistakes.

Cost savings

By decreasing the need for manual intervention, OCR reduces labor costs associated with invoice processing. Additionally, the increased accuracy and efficiency can lead to fewer disputes with vendors and avoidance of late payment penalties, further contributing to cost savings.

Enhanced data accessibility and searchability

Digitizing invoices through OCR makes them easily searchable and retrievable. This improved accessibility facilitates better record-keeping, simplifies audit processes, and supports compliance efforts by ensuring that all invoice data is stored in a centralized, organized manner.

Common challenges in implementing invoice OCR

While OCR technology offers substantial benefits, organizations may encounter several challenges during implementation:

Variability in invoice formats

Invoices from different vendors often come in various formats, layouts, and structures. This variability can pose difficulties for OCR systems in accurately identifying and extracting relevant data fields. To address this, advanced OCR solutions incorporate machine learning algorithms that can adapt to diverse invoice formats and improve accuracy over time.

Poor-quality scans or images

The accuracy of OCR is highly dependent on the quality of the scanned images. Poor-quality scans, resulting from low-resolution images, improper lighting, or physical damage to the invoice, can lead to misinterpretation of characters and data extraction errors. Implementing high-quality scanning equipment and pre-processing techniques can mitigate these issues.

Handwritten text recognition

Standard OCR systems may struggle to accurately interpret handwritten text on invoices. While Intelligent Character Recognition (ICR) technology has been developed to address this challenge, its accuracy can still be lower compared to printed text recognition. Combining ICR with human verification processes can enhance data accuracy when processing handwritten information.

Integration with existing systems

Seamlessly integrating OCR solutions with existing Enterprise Resource Planning (ERP) and accounting systems is crucial for maximizing efficiency. However, this integration can be complex and may require customization to ensure compatibility and smooth data flow between systems. Collaborating with experienced solution providers can facilitate successful integration.

Best practices for implementing invoice OCR solutions

To maximize the benefits of OCR technology in invoice processing, organizations should consider the following best practices:

Conduct a thorough needs assessment

Before selecting an OCR solution, assess your organization’s specific requirements, including the volume of invoices processed, the diversity of invoice formats, and integration needs with existing systems. This evaluation will inform the selection of an OCR solution that aligns with your operational goals.

Choose the right OCR solution

Select an OCR solution that offers high accuracy, supports multiple languages, and can handle various invoice formats. Consider solutions that incorporate artificial intelligence and machine learning capabilities to improve data extraction accuracy over time. Additionally, ensure that the chosen solution can seamlessly integrate with your existing ERP and accounting systems.

Invest in quality scanning equipment

High-quality digital images are essential for accurate OCR processing. Investing in reliable scanning equipment that produces clear, high-resolution images will enhance the performance of the OCR system and reduce errors in data extraction.

Implement a robust validation process

While OCR automates data extraction, implementing a validation process is crucial to ensure the accuracy of the captured data. This may involve setting up automated validation rules within the OCR system and incorporating human review for exceptions or low-confidence data extractions.

The bottom line: Why invoice OCR is a must-have

Manual invoice processing isn’t just tedious—it’s expensive. Every delay costs you early payment discounts, every error risks vendor disputes, and every inefficiency slows down your team.

OCR technology eliminates these roadblocks by automating data capture, improving accuracy, and giving finance teams real-time visibility into spending. Instead of wasting time on manual entry, your AP team can focus on smarter financial decisions.

The longer you wait, the more these inefficiencies add up. Isn’t it time to upgrade your AP process?

Webinar: Automate Your AP Processes with Procurify

Learn how AP automation enhances the efficiency, accuracy, and financial visibility of your accounts payable workflows.