Optimizing Your Invoice Workflow: A Comprehensive Guide to Efficiency, Automation, and Cost Savings

Invoice workflows are at the heart of every finance or accounts payable (AP) department.

Timely, accurate payment processing isn’t just an administrative task—it’s vital for maintaining strong vendor relationships, ensuring consistent cash flow, and protecting your company’s financial standing. Yet many organizations still rely on manual or outdated methods, which can result in late payments, missed discounts, and even fraudulent transactions.

This guide explores the importance of optimizing your invoice workflow from end to end. Whether you’re a small business or a multinational corporation, adopting best practices and automation tools can reduce errors, cut costs, and accelerate processing times.

By embracing modern technologies like AI-driven data extraction, robotic process automation (RPA), and real-time analytics, you’ll gain clearer financial visibility, improve compliance, and position your company for long-term success.

What is an invoice workflow?

An invoice workflow encompasses all the steps an invoice takes from the moment it arrives in your company’s system to when it’s fully paid and recorded. In essence, it’s a roadmap that ensures every invoice is processed correctly and in compliance with your organization’s policies.

While different businesses may have unique internal procedures, an efficient invoice workflow ensures accuracy, timeliness, and compliance. A well-structured process minimizes manual work, prevents errors, and keeps vendors satisfied. Here’s how it works:

-

Invoice receipt: Receiving invoices from various channels, such as email, paper mail, e-invoicing platforms, or vendor self-service portals.

-

Invoice verification: Checking the details (invoice number, amount, vendor information) and validating them against purchase orders (POs) or contracts.

-

Approval routing: Ensuring the right individual or department reviews and authorizes the invoice, especially for larger or higher-risk transactions.

-

Payment execution: Scheduling and making the payment via a chosen method (ACH, virtual card, wire transfer, etc.).

-

Recording and reconciliation: Updating the accounting or ERP system, preserving clear documentation for future reference, and tying all data together for accurate financial reporting.

An organized workflow keeps invoices moving quickly and helps your company avoid late fees, improve vendor rapport, and reduce manual paperwork. In contrast, a disorganized or purely manual approach can lead to misplaced invoices, data entry errors, duplicate payments, or even serious compliance issues.

Common challenges in invoice workflows (and how to solve them)

Invoice processing seems straightforward—receive, approve, and pay. But inefficiencies lurk beneath the surface, slowing payments and increasing errors.

A supplier waiting for payment may find their invoice delayed in an approval backlog, affecting their trust in the business relationship. Meanwhile, a duplicate payment might slip through unnoticed, skewing financial reports and wasting valuable funds.

Here are some of the most common bottlenecks and challenges in invoice workflows.

Manual processing errors

Relying on manual data entry for invoice processing is a recipe for mistakes. Typos, omissions, and misinterpretations can result in duplicate or missed payments, inaccurate financial reporting, and excessive costs to correct errors. Even the most diligent AP teams are prone to human error when manually entering invoice details across different systems. Over time, these inefficiencies compound, causing inconsistencies in financial records and unnecessary delays in payment cycles.

The solution lies in automation and standardization. Optical character recognition (OCR) and AI-driven data capture tools eliminate the need for manual typing by extracting key details directly from invoices. By centralizing all invoices in a single digital system, businesses can reduce discrepancies and improve accessibility. Standardizing invoice formats and submission processes further minimizes the risk of misinterpretation, ensuring that every invoice follows a uniform structure. When invoices are received and processed consistently, errors become the exception rather than the norm.

Delayed approvals

An invoice sitting in someone’s inbox for too long is a common yet preventable issue. When approvals are delayed—whether due to workload, travel, or unclear responsibilities—payment schedules are disrupted, leading to late fees, missed early-payment discounts, and frustrated vendors. A single bottleneck in the approval process can snowball into larger operational challenges, impacting cash flow and supplier trust.

To keep approvals moving, businesses should implement automated workflows that dynamically route invoices. If a primary approver is unavailable, backup approvers should be notified automatically to prevent unnecessary hold-ups. Mobile-friendly approval systems allow managers to sign off on invoices from anywhere, ensuring that travel or remote work doesn’t stall the process. Additionally, tracking approval times as a key performance indicator (KPI) helps organizations identify recurring slowdowns and take proactive steps to resolve them. When approvals are frictionless, payments remain on schedule, reducing financial and operational stress.

Fraud risks

AP fraud is a growing concern, especially for businesses without strong internal controls. Fraudsters may exploit weak processes by submitting fake invoices, impersonating vendors, or manipulating bank details. Without proper safeguards, a company may unknowingly process fraudulent payments, leading to significant financial losses.

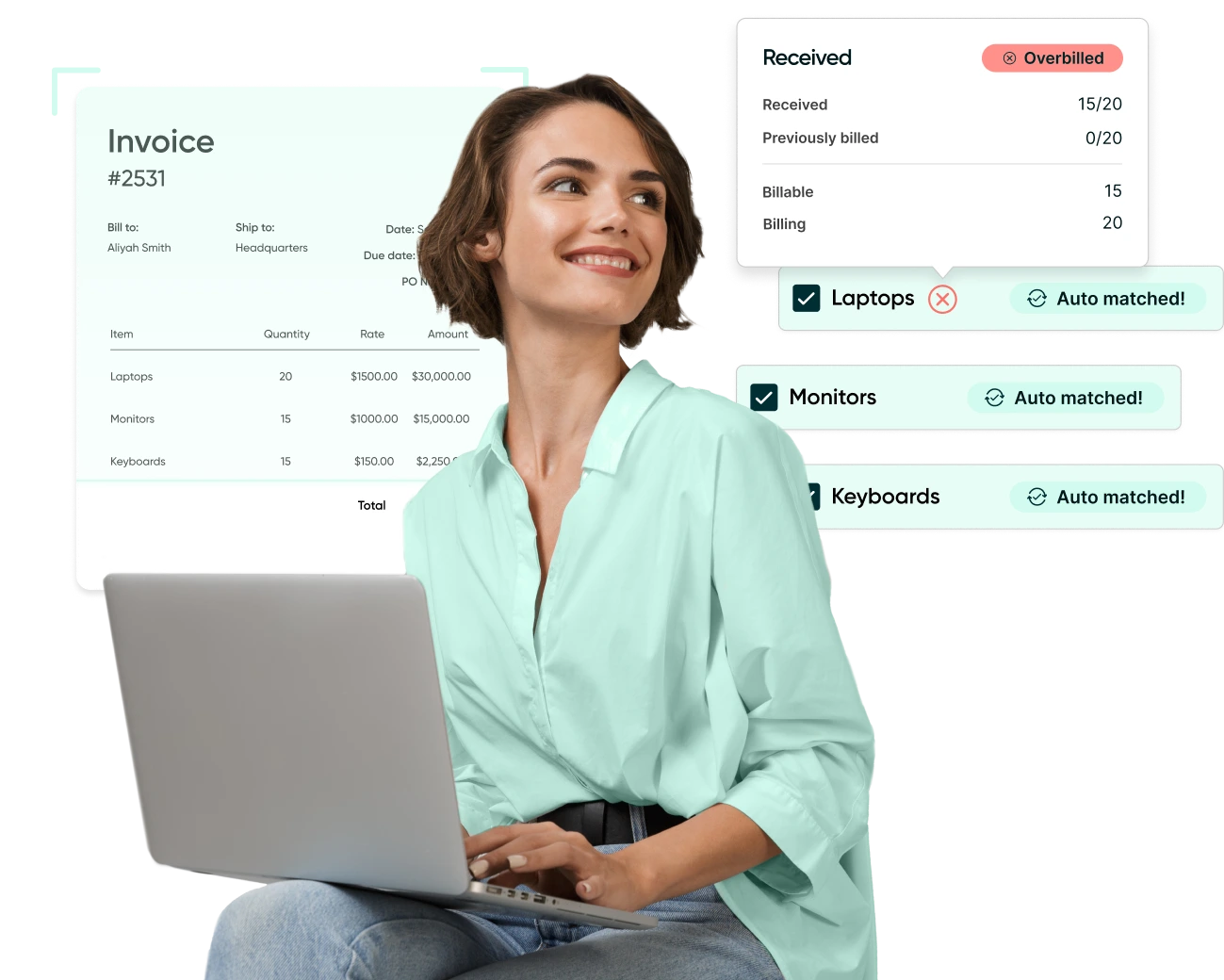

A robust multi-layered security approach is the best defense against AP fraud. Implementing three-way matching—where invoices are cross-checked against purchase orders and receipts—ensures that payments are only made for verified goods and services. Enforcing segregation of duties prevents any single individual from both approving and executing payments, reducing the risk of internal fraud. AI-powered anomaly detection can further safeguard transactions by flagging unusual patterns, such as sudden vendor address changes or invoice amounts that deviate from historical trends. By proactively identifying red flags, businesses can prevent fraudulent transactions before they occur.

Lack of visibility

When AP teams lack real-time visibility into invoice status, financial leaders struggle to track outgoing cash flow and identify potential risks. Without a centralized dashboard or an integrated system, teams may be unaware of pending approvals, outstanding payments, or approaching due dates. This lack of transparency leads to poor cash flow planning and missed opportunities to resolve disputes before penalties accrue.

Investing in AP solutions that integrate with ERP platforms provides real-time access to invoice data, helping finance teams stay ahead of deadlines. Companies can track critical metrics such as Days Payable Outstanding (DPO) and on-time payment rates, ensuring that AP performance aligns with financial goals. Vendor self-service portals also improve transparency by allowing suppliers to check their invoice status without constantly contacting AP teams. When invoice data is readily available and accessible, businesses can make informed financial decisions, avoid late fees, and strengthen vendor relationships.

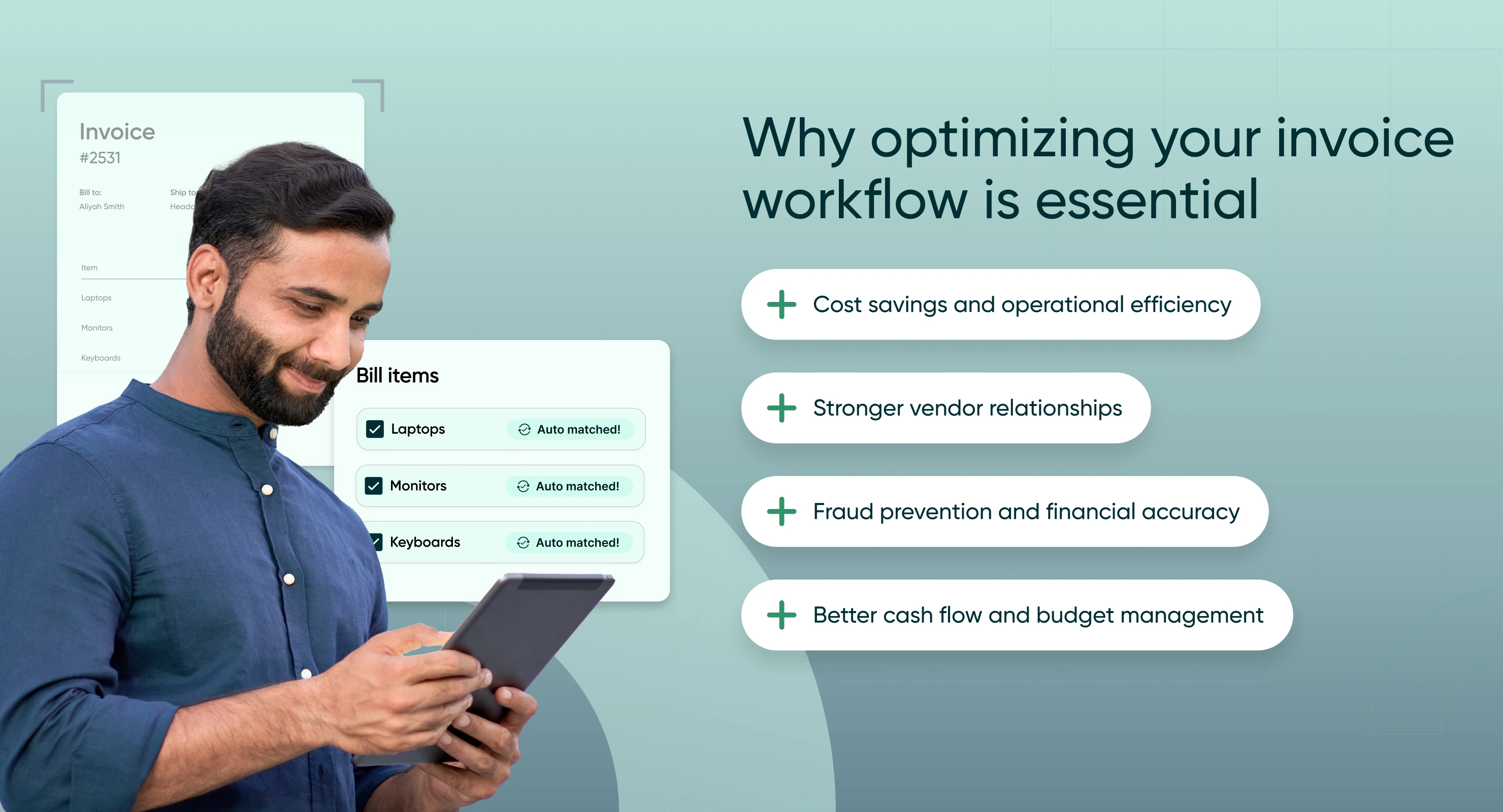

Why optimizing your invoice workflow is essential

Many organizations underestimate how inefficient invoice processing can derail broader financial management. The ripple effects range from increased operational costs to damaged supplier relationships. Below are the main reasons why it’s critical to improve and automate your invoice workflow.

Cost savings and operational efficiency

One of the most tangible benefits is cost reduction. Manual invoice processing (where staff manually enter data, match POs, and chase approvals) can cost anywhere from $15 to $40 per invoice. In contrast, automated systems can bring that cost down to around $3 per invoice—or even less—by minimizing the time and labor required.

Key ways automation achieves these savings:

-

Reduced labor: Automated tools handle tasks like data extraction, matching, and routing, so staff can focus on more strategic work.

-

Lower error rates: Automated systems are less prone to typos or duplicate entries, which otherwise require time and money to fix.

-

Faster approvals: Automated workflows route invoices to approvers immediately, often cutting processing time from weeks to days—or even hours.

To really drive the potential for cost savings home, let’s take a look at a hypothetical example. A company processing 10,000 invoices annually at a manual cost of $15 per invoice might spend $150,000 on processing alone. By adopting an automated solution at $5 per invoice, total processing costs could drop to $50,000—an immediate $100,000 saving.

Stronger vendor relationships

Vendors appreciate getting paid on time and often extend better terms, discounts, or services to consistent payers. Early payment discounts (like 2/10 net 30, where you receive a 2% discount for paying within 10 days) can become significant cost advantages, especially for large invoices.

By optimizing your approval timelines and ensuring payments go out promptly, you:

-

Avoid late fees and penalties.

-

Strengthen trust and create a collaborative environment with suppliers.

-

Position yourself for negotiated discounts or priority service.

Fraud prevention and financial accuracy

Fraudulent invoices and duplicate payments can seriously undermine a company’s finances. Accounts payable (AP) fraud can take many forms: someone posing as a legitimate vendor, submitting duplicate bills, or manipulating invoice details. Optimized workflows address these risks by:

-

AI-powered detection: Automated systems use machine learning to spot anomalies, such as suspicious vendor activities or sudden increases in invoice amounts.

-

Three-way matching: Invoices must match a valid purchase order and a goods receipt, drastically reducing unauthorized payments.

-

Approval hierarchies: High-value or unusual invoices require additional layers of authorization before payment.

Given that billing fraud is one of the most common forms of occupational fraud, every organization should have robust measures in place to detect irregularities and enforce stronger internal controls.

Better cash flow and budget management

When your AP process is slowed down by manual tasks, you lose real-time visibility into your payables. An optimized workflow puts invoice data at your fingertips, allowing you to:

-

Track outstanding invoices easily.

-

Pinpoint upcoming expenses and plan accordingly.

-

Identify areas for potential cost reductions or discounts.

-

Forecast cash flow needs with greater accuracy.

Having a clear picture of your liabilities and due dates enables more strategic budgeting. This level of visibility is crucial for CFOs and finance teams who need to make data-driven decisions on everything from vendor negotiations to capital investments.

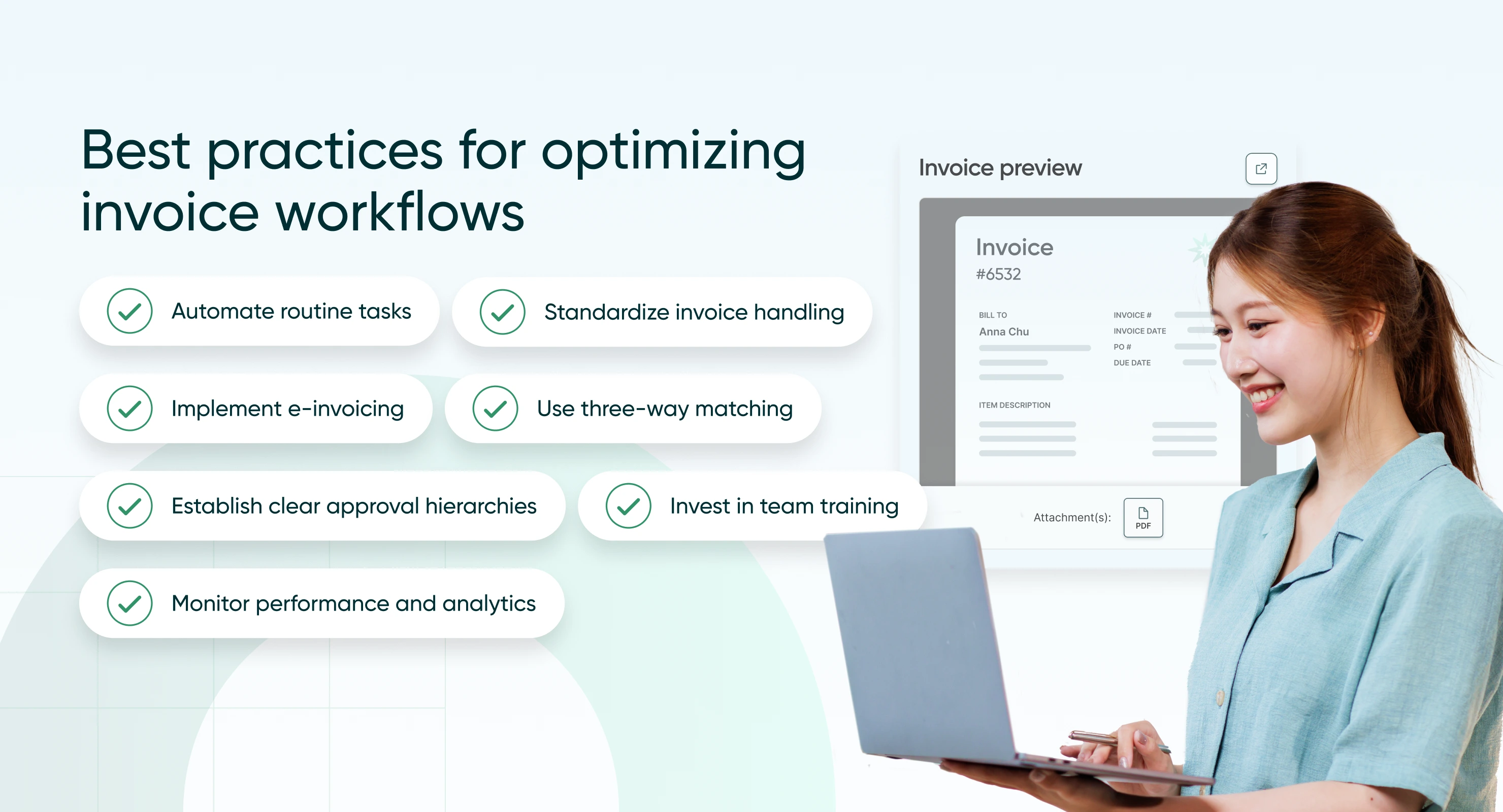

Best practices for optimizing invoice workflows

By implementing proven best practices, businesses can transform invoice processing from a time-consuming chore into a seamless, automated workflow.

From leveraging AI-powered data capture to enforcing standardized submission methods, small process improvements can lead to faster approvals, fewer payment errors, and stronger financial oversight.

Below are the most effective strategies to optimize your invoice workflow and create a more efficient AP function.

Automate routine tasks

Focus on areas where your team spends the most time on repetitive or simple work, such as copying and pasting invoice details into spreadsheets, manually matching data, or sending email reminders for approvals.

-

AI and OCR: Leverage intelligent data capture to eliminate manual typing.

-

Workflow automation: Automatically route invoices and escalate issues.

-

Payment scheduling: Queue payments based on due dates or discount windows.

Companies that automate these tasks often reduce their average invoice processing time from several weeks to just a few days.

Standardize invoice handling

Inconsistency is the enemy of efficiency. When every department (or vendor) has its own method for submitting and reviewing invoices, bottlenecks are inevitable.

-

Company-wide policies: Define a single set of rules for handling invoices, from submission format to approval thresholds.

-

Vendor education: Provide guidelines on how suppliers should submit invoices (e.g., PDF or e-invoice).

-

Centralized reception: Establish one dedicated email address or portal to receive all invoices.

This level of standardization reduces confusion, accelerates processing, and ensures that staff and vendors know exactly what to expect.

Implement e-invoicing

E-invoicing platforms allow vendors to submit invoices in a structured electronic format. This format can then be automatically parsed and funneled into your AP system, reducing or even eliminating the need for manual data entry.

-

Cost reductions: Paper, postage, and physical storage costs drop significantly.

-

Speed: E-invoices often appear in your system within minutes of submission, letting you begin the approval process right away.

-

Accuracy: Clear, standardized data fields reduce opportunities for error.

Many e-invoicing solutions also offer added features like automated matching, reminder notifications, and direct integration with ERP platforms.

Use three-way matching

Verifying that an invoice matches both the purchase order and the goods receipt is a cornerstone of fraud prevention and payment accuracy.

-

Tolerance levels: Minor discrepancies (e.g., a 2% difference in price) might be automatically approved, while major differences trigger an alert.

-

Automated matching: Systematically cross-references invoice details, item quantities, and total amounts with PO data.

-

Real-time alerts: When the system detects a mismatch, it immediately notifies the AP team or the relevant buyer.

This eliminates the need for time-consuming manual checks and significantly reduces the risk of paying for unordered goods or inflated amounts.

Establish clear approval hierarchies

A well-defined hierarchy prevents confusion over who needs to sign off on an invoice, especially for larger amounts or unusual expenses.

-

Value-based routing: Route invoices to a designated approver depending on the total amount.

-

Departmental routing: Department heads review invoices specific to their budget or cost center.

-

Mobile access: Approvers can sign off using their phone or tablet, reducing delays when they’re out of the office.

Companies that streamline approvals often witness a marked decrease in late payments and find it easier to leverage early payment discounts.

Monitor performance and analytics

Adopting an automated or semi-automated workflow isn’t a one-time fix—you’ll want to keep refining it based on measurable data.

-

Track key metrics: Include invoice processing time, cost per invoice, error rate, and on-time payment percentage.

-

Use dashboards: See real-time data on outstanding invoices, average approval times, and potential bottlenecks.

-

Benchmark and set goals: Compare your metrics to industry averages and set improvement targets.

Continuous improvement is crucial to maintaining efficiency gains and staying ahead of evolving market demands.

Invest in team training

Even the most advanced system falters if employees don’t know how to use it effectively or understand the rationale behind new policies.

-

Onboarding sessions: Provide hands-on training when you roll out a new AP tool or process.

-

Regular refresher courses: Ensure new hires or long-term employees stay updated on best practices.

-

Fraud awareness: Train staff to recognize red flags, such as suspicious vendor requests or mismatched bank account details.

A well-informed team makes fewer errors, escalates potential issues more quickly, and ultimately helps the entire process run smoothly.

Future trends in invoice workflow management

Invoice workflows continue to evolve rapidly as new technologies and processes reshape the landscape. Here’s what to expect in the coming years.

AI-powered predictive analytics

Soon, AI will do more than just process invoices—it will predict future spending and payment trends. By analyzing historical data and market conditions, predictive analytics can:

-

Warn you of potential late payments weeks in advance.

-

Suggest the best payment schedule to optimize early discounts.

-

Provide real-time cash flow forecasts.

Blockchain for invoice security

Blockchain technology can add a layer of transparency and tamper-proof security to invoice management. Each invoice transaction is recorded on a decentralized ledger, making it exceedingly difficult to manipulate or duplicate.

-

Prevents unauthorized invoice changes.

-

Allows vendors and buyers to track invoice status in real time.

-

Can trigger automatic payments via smart contracts when terms are met.

Mobile-first invoice management

While mobile approvals are already here, the next wave of innovation will center on mobile apps that do everything from capturing invoices on the go to showing real-time analytics dashboards.

-

Finance executives can sign off on urgent invoices from anywhere.

-

Field teams can submit receipts and vendor invoices the moment they receive them.

-

Mobile alerts can notify managers of potential fraud or critical deadlines.

Touchless, end-to-end automation

The ultimate vision is a completely touchless process where AI and automation handle each step, from ingestion and data entry to approvals and payment release. Human intervention will only be needed for exceptions or complex cases.

-

Eliminates nearly all manual tasks.

-

Lowers processing costs drastically.

-

Enables companies to manage exponential increases in invoice volume without adding staff.

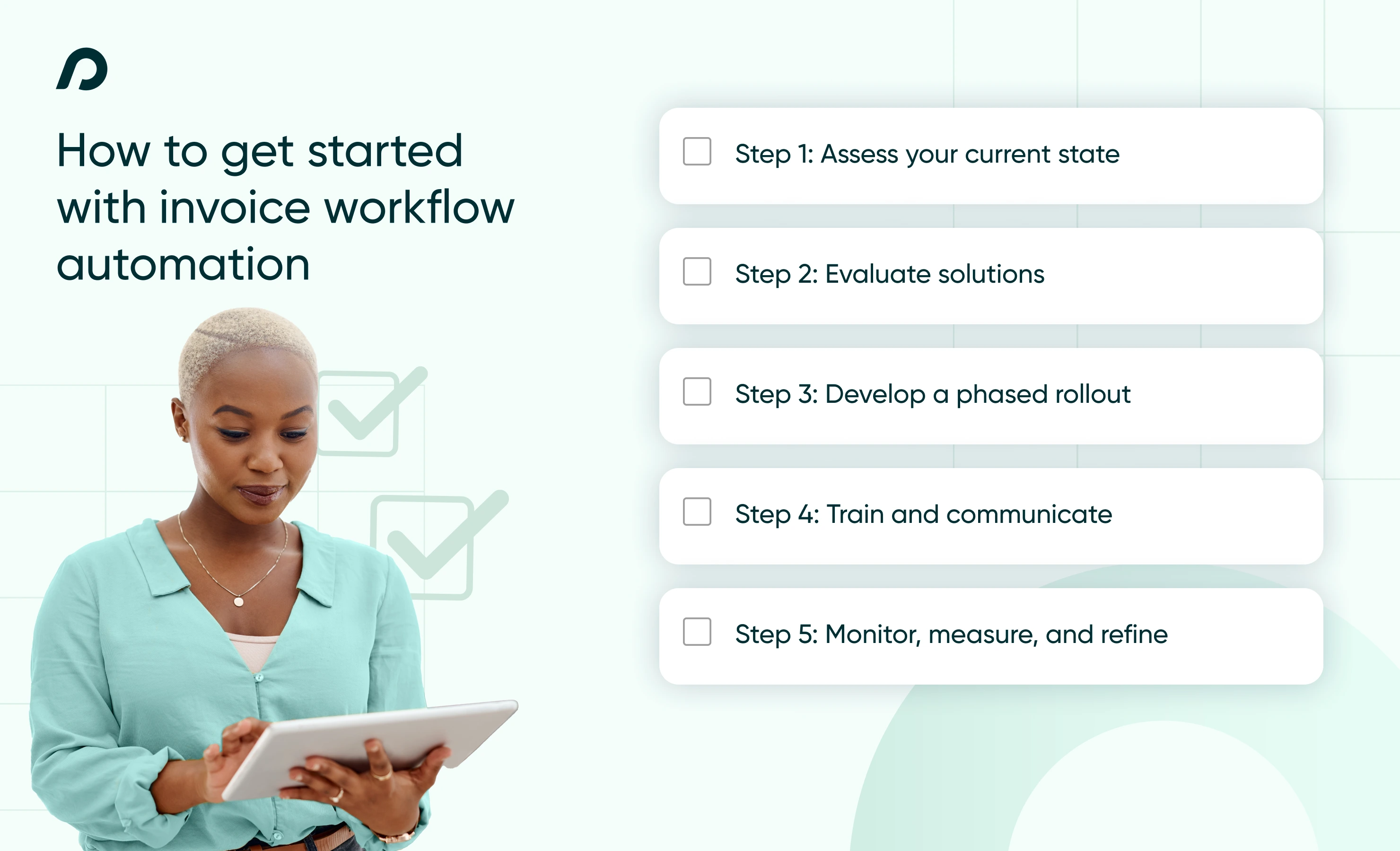

How to get started with invoice workflow automation

Assess your current state

-

Calculate your average cost per invoice.

-

Identify persistent bottlenecks (e.g., approval delays, data entry backlogs).

Evaluate solutions

-

Compare AP automation platforms with features like OCR, AI matching, and fraud detection.

-

Look for seamless ERP integration if you rely on systems like NetSuite, Microsoft Dynamics, or QuickBooks.

Develop a phased rollout

-

Start with a pilot program to automate specific steps (like data extraction or approval routing).

-

Gradually expand to a full, end-to-end solution.

Train and communicate

-

Ensure your AP team, approvers, and management understand the new workflow and tools.

-

Provide vendor education for e-invoicing or portal usage.

Monitor, measure, and refine

-

Track KPIs such as processing time, error rates, cost per invoice, and on-time payment metrics.

-

Use dashboard analytics to identify and correct any new bottlenecks or inefficiencies.

The future of invoice workflows is here

Optimizing your invoice workflow is more than a technological upgrade—it’s a strategic move that can help you build stronger supplier relationships, safeguard against fraud, and enhance your organization’s financial agility.

By embracing automation, AI-driven insights, and continuous process improvement, you’ll save money, make smarter decisions, and be better prepared for whatever challenges the business environment brings.

Now is the ideal time to modernize your AP operations. Evaluate your current processes, explore the available technologies, and begin the transition to a streamlined, fully optimized invoice workflow that benefits both your bottom line and your team’s efficiency.

Webinar: Automate Your AP Processes with Procurify

Learn how AP automation enhances the efficiency, accuracy, and financial visibility of your accounts payable workflows.