The Costly Mistake CFOs Make: Ignoring the Link Between AP and Procurement

CFOs, it’s time to rethink how your teams manage spend.

If your accounts payable team is only focused on processing invoices and ensuring timely payments, you could be missing out on a valuable opportunity.

Here’s the reality: your AP team probably isn’t thinking about requisitions, approvals, or procurement—and that can create hidden challenges. When AP only sees invoices after they’ve arrived, it’s too late to manage spend proactively. If you’re relying on invoice approvals as your main control, you’re not getting the full picture of your budget until the money is already spent.

By the time AP processes payments, opportunities to control costs, manage budgets, or negotiate with vendors may have slipped away. Without real visibility into the purchasing process, you’re stuck playing catch-up. And when unexpected invoices start to accumulate, the impact can be more than just frustrating—it can eat into your bottom line.

This is a moment to rethink your approach. While your AP team works hard to keep payments on track, it’s crucial to align procurement and AP processes to unlock better financial control and strategic insights.

Your siloed spend management is costing you more than you think

Does this sound familiar?

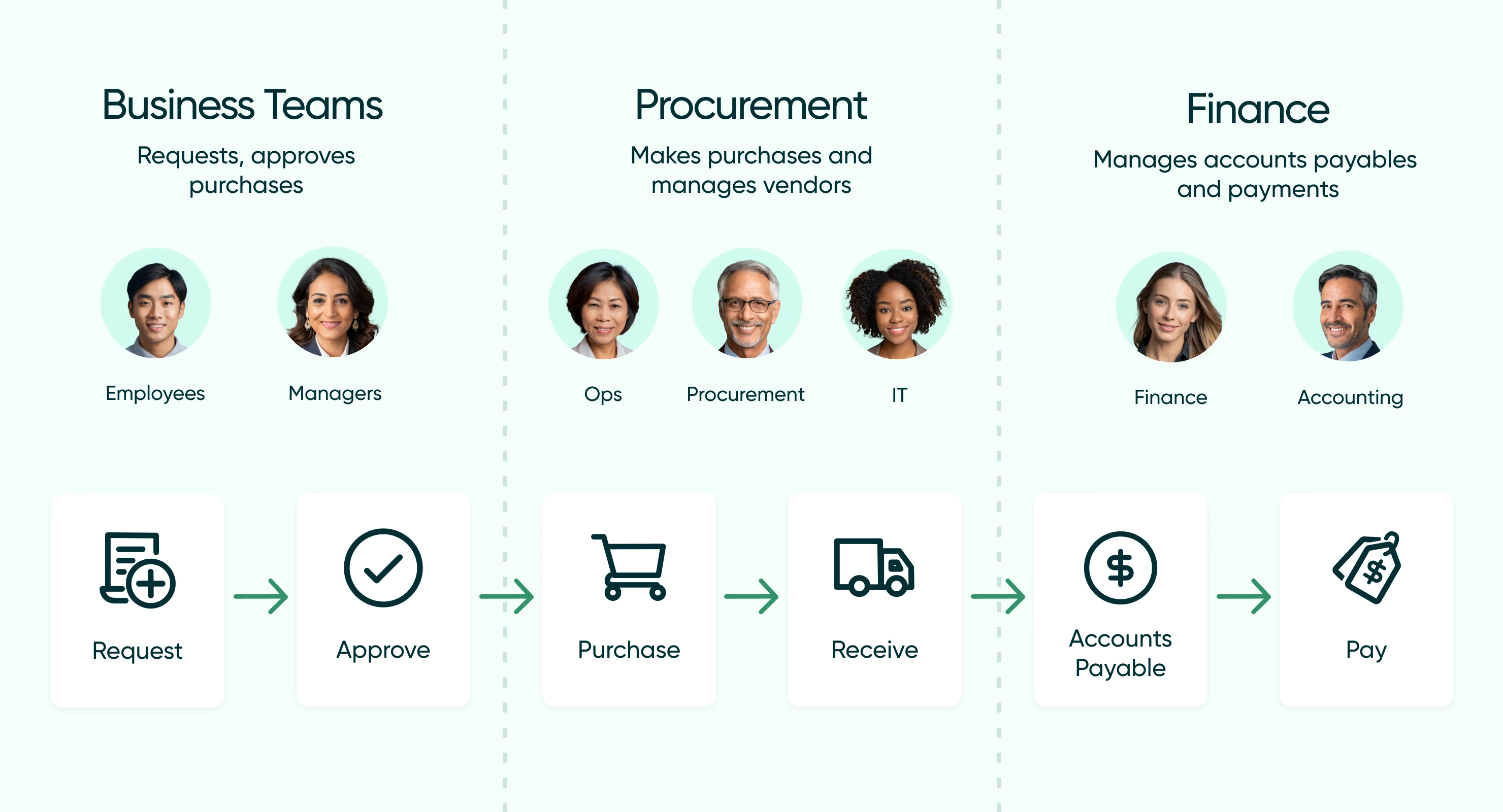

Procurement focuses on approving purchases, managing vendors, and placing orders. Meanwhile, AP is stuck in its own world, dealing with processing invoices and making payments. On paper, each department is minding its own business and optimizing its piece of the workflow.

But here’s the problem: When procurement and AP operate in isolation, silent problems are created downstream.

Procurement needs to place orders, make deposits, and fulfill orders – while AP scrambles to reconcile payments without the full picture. Critical information is missed, context is lost, and opportunities to strategically manage spend slip through the cracks.

Without collaboration between procurement and AP, you’re not just dealing with inefficiency—you’re losing control over your entire spend pipeline.

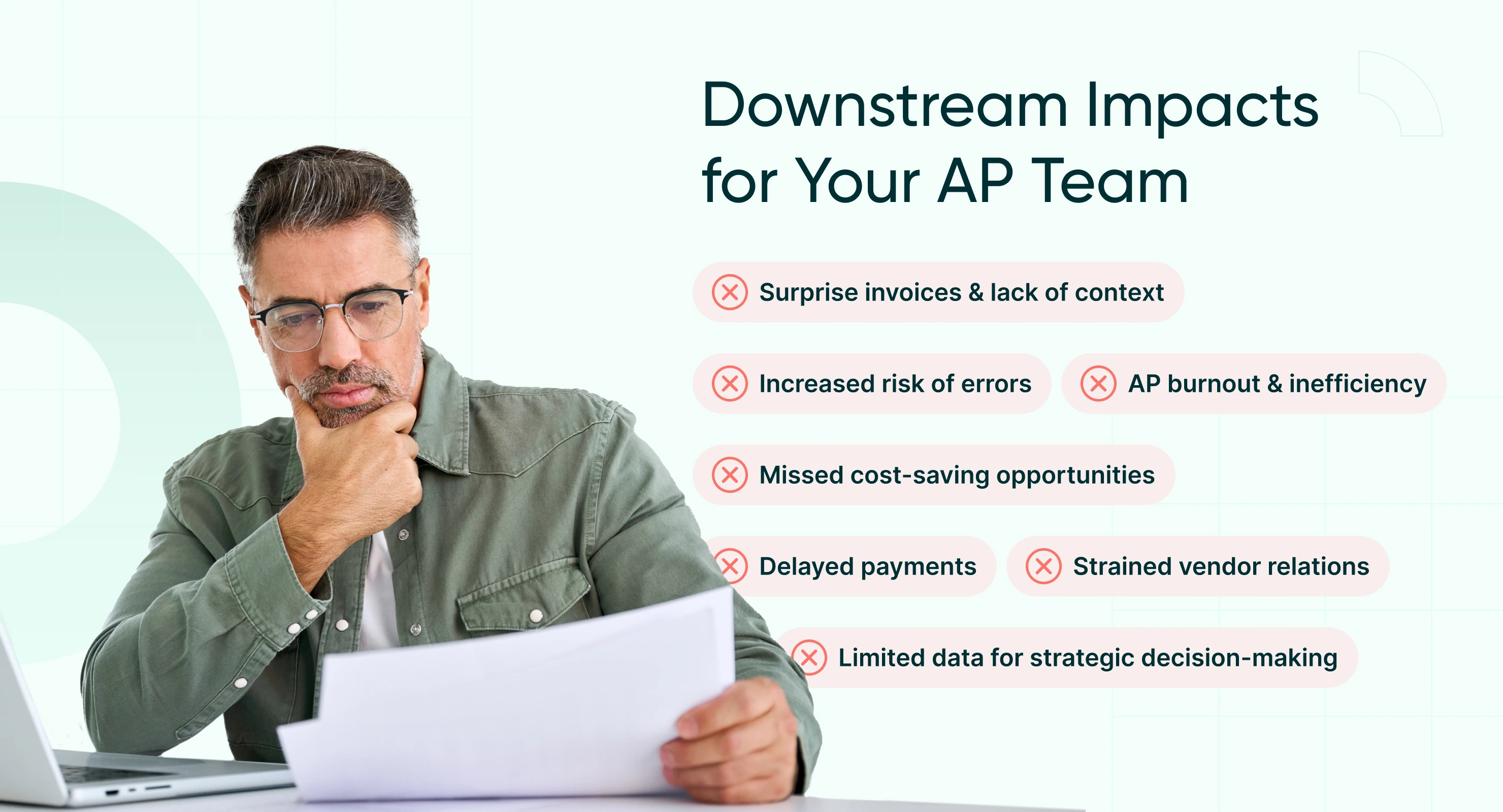

Downstream impacts for your AP team

The disconnect between procurement and AP is more than just a process inefficiency—it’s creating real pain points for your AP team. From surprise invoices to missed cost-saving opportunities, here’s how these challenges are piling up and affecting your team’s productivity, accuracy, and morale.

-

Surprise invoices & lack of context

AP teams often receive unexpected invoices without prior knowledge of the purchase, leaving them scrambling to determine if the invoice is valid. Without clear visibility into who made the request or what was ordered, the approval process stalls, and payments are delayed.

-

Increased risk of errors

Manual data entry and reconciliation between procurement and AP records increases the risk of mistakes. Incorrect amounts, duplicate payments, and missing invoices can slip through the cracks, resulting in costly errors.

-

Missed cost-saving opportunities

When procurement and AP operate in silos, opportunities for volume discounts or better terms are easily missed. Without alignment, AP can’t leverage key data to negotiate favorable payment terms or capture early payment discounts.

-

Delayed payments & strained vendor relations

Inefficient approval processes and a lack of integration between purchase orders and invoices often lead to payment delays. This strains vendor relationships and risks late fees or missed financial incentives, such as early payment discounts.

-

Limited data for strategic decision-making

Operating in isolation prevents AP and procurement from capturing valuable data that could inform better vendor negotiations, future purchasing decisions, and cost-saving strategies.

-

AP burnout & inefficiency

When AP teams are forced to manually chase down missing information, reconcile discrepancies, and handle surprise invoices, it results in wasted time and increased frustration. Constantly reacting to these issues instead of proactively managing them leads to burnout, inefficiencies, and reduced overall productivity.

Unlock improved financial efficiency, accuracy, and control

Check out Procurify’s AP Automation offerings and discover how end-to-end automation can take your financial operations to the next level.

Where your ERP or accounting system falls short

You might think you’ve already addressed these challenges with your ERP or accounting software. After all, these systems often claim to handle purchase orders, approvals, and invoice management right on their website. But here’s the reality: while they may tick some boxes, they don’t provide the full visibility or seamless integration that a procure-to-pay (P2P) system offers.

-

Your accounting software might manage purchase orders, but it doesn’t provide full visibility into spending.

While your accounting system can create and manage purchase orders, it doesn’t give your team a complete view of spending from the moment a purchase request is made. Without real-time insights into the entire procurement process, you’re left reacting to invoices rather than proactively managing spend. This reactive approach can lead to surprise invoices, missed budget controls, and unapproved orders slipping through the cracks.

-

Your ERP might automate approvals, but it doesn’t streamline them across procurement and AP.

Your ERP likely handles approvals based on preset rules, but without integrating procurement and AP, the approval process becomes fragmented. This leaves room for delays, bottlenecks, and potential errors when it’s time to pay the invoice. A unified procure-to-pay system ensures approvals are part of every step, from requisition to payment, giving you tighter control and minimizing the risk of overlooked approvals.

-

Your accounting system might manage AP, but it’s only reactive, not proactive.

Traditional accounting systems help manage accounts payable once the invoice arrives, but they don’t allow for proactive spend management. Without insight into the procurement side, AP teams are forced to track down purchase details after the fact, leading to delays and missed opportunities to prevent overspending or catch errors before they happen.

Without early visibility into purchasing, AP is stuck reacting to invoices instead of proactively controlling spend.

In short, ERP and accounting systems are built to manage transactions—not the entire end-to-end procurement process. Without a P2P system, you’re still missing out on real-time spend control, the ability to eliminate silos, and the strategic insights that only come from integrating procurement and AP from start to finish.

Procure-to-pay software enables a proactive spend culture

So what’s the fix? Here’s a hint: it’s not injecting more automation willy-nilly or relying on your ERP to patch things up.

The real game-changer is procure-to-pay (P2P) software. It’s not just about automating individual steps—it’s about connecting the entire process, from the moment someone submits a requisition to the second the invoice is paid.

With P2P software, you eliminate the guesswork. Procurement and AP become two sides of the same coin, working in harmony rather than isolation. By solving common AP problems at the source—before the invoice lands on your desk—you’ll streamline the entire flow and gain full control over your spend.

Connect the dots between procurement and AP

The right procure-to-pay software can help your teams collaborate, cut costs, and boost efficiency. Discover everything you need to know about choosing the best P2P solution for your business.

No more chasing down who requested what, or blindly approving payments. A P2P solution gives you real-time visibility into what’s being purchased, what’s been approved, and what’s waiting to be paid. It’s a proactive approach that turns finance teams from firefighters into strategic decision-makers.

As AP veteran Mary Schaeffer puts it:

It’s time to stop letting your ERP do a mediocre job at best and start using a tool that’s built to manage the entire procurement cycle—from request to pay. That’s where the real magic happens.

Why your AP team will thank you

Taking a holistic approach that integrates procurement with AP doesn’t just streamline workflows—it transforms them into powerful tools for strategic financial management.

Procure-to-pay (P2P) software goes beyond what AP automation alone can offer, giving your team complete control over spend, enhanced efficiency, and the visibility they need to make smarter decisions.

Here’s what P2P software delivers that AP automation alone can’t:

-

Centralized spend control & visibility

P2P software allows you to capture and track spending from the moment a requisition is made, offering real-time visibility into open orders and budgets. Unlike AP automation, which only comes into play when invoices arrive, P2P provides granular control from the start, with GL coding at the requisition step to show how budgets are impacted long before invoices reach AP.

-

Cost savings & expanded access

Reduce costs by extending access to purchasing workflows across your organization without the need for additional user licenses in your expensive ERP or accounting software. AP automation stops at processing invoices, but P2P enables you to control spend at the request level, improving spend visibility and control from requisition to payment.

-

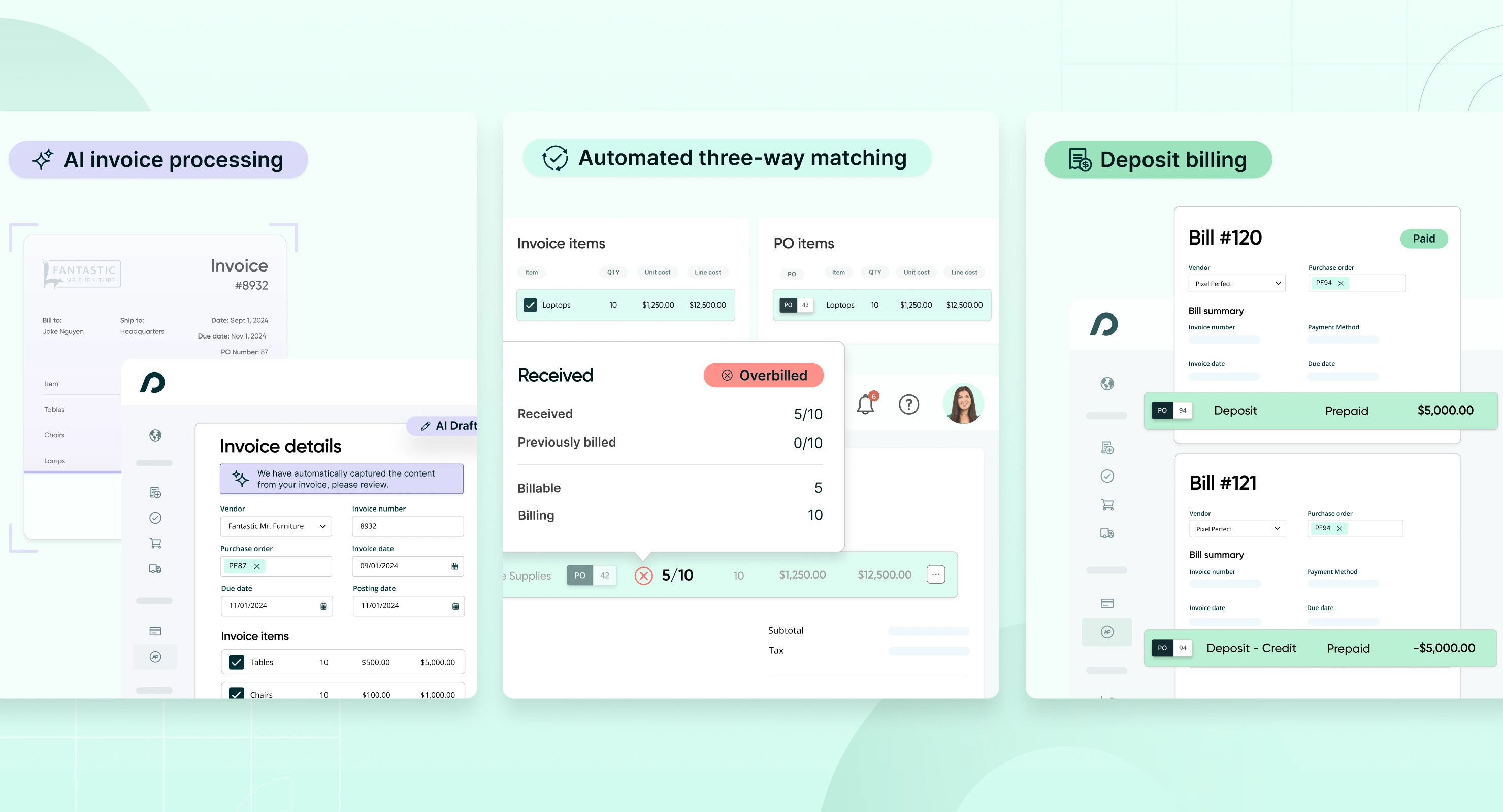

AI-enhanced efficiency

AI-enhanced invoice processing extracts data automatically, speeding up payments and reducing manual data entry. Unlike AP automation, which focuses on post-purchase invoice processing, P2P allows you to pre-populate draft bills and streamline the entire process, freeing up your AP team for more strategic work.

-

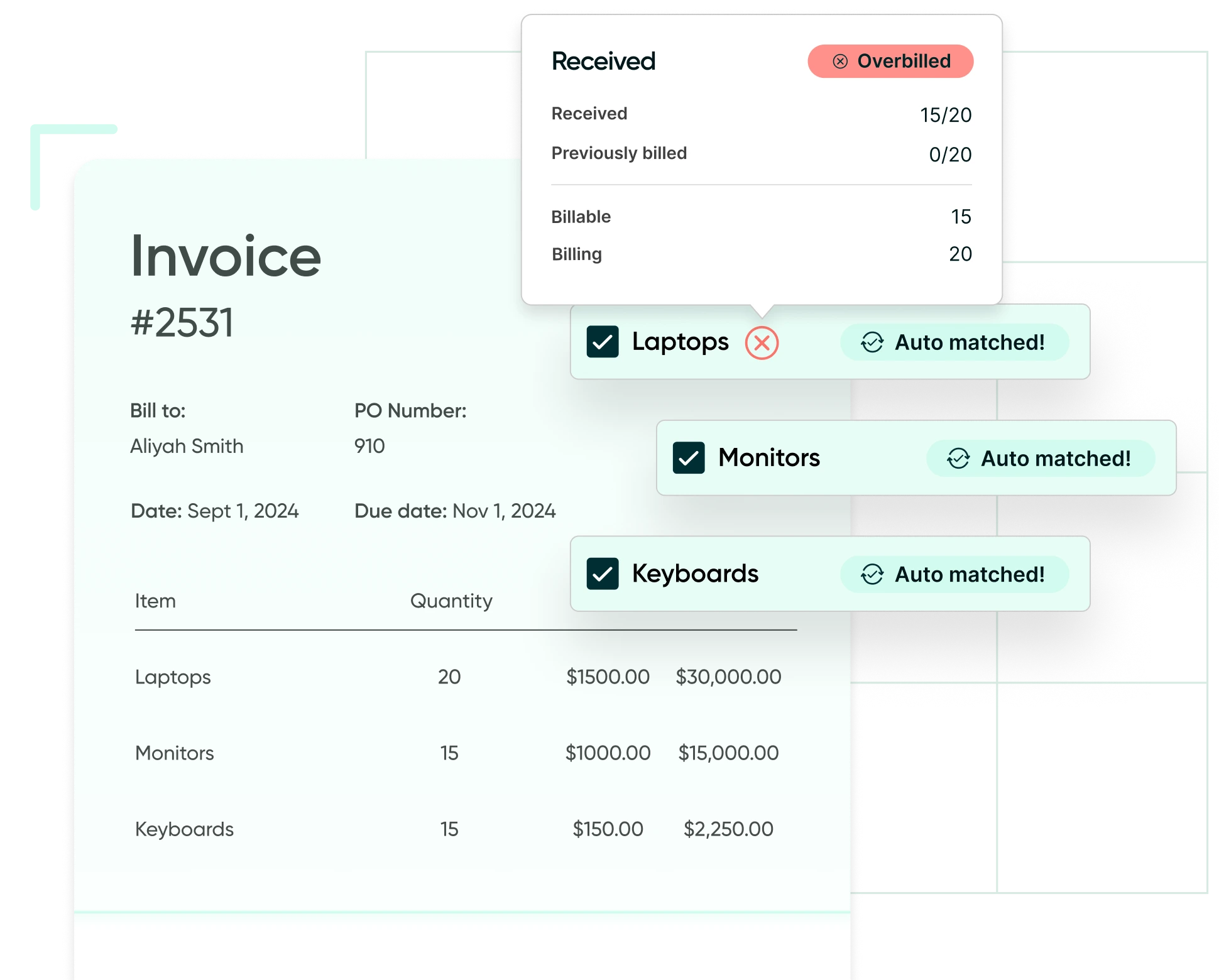

Automated three-way matching

P2P software automates three-way matching across purchase orders, invoices, and receipts, catching discrepancies early and ensuring payment accuracy. AP automation alone can’t match this level of control because it lacks visibility into the procurement process, leaving AP teams to react to issues rather than prevent them.

-

Compliance & risk mitigation

P2P systems provide a complete audit trail from request to payment, ensuring transparency and reducing risks throughout the entire procurement process. AP automation only tracks data after the invoice arrives, while P2P tracks every step—request, approval, purchase, receipt, and payment—ensuring end-to-end compliance and accuracy. This full visibility helps protect against errors, fraud, and compliance issues, ensuring your organization stays audit-ready.

-

Vendor relations & payment flexibility

With P2P software, you can strengthen vendor relationships by offering deposits and partial payments for items not yet received—something basic AP automation can’t handle. This flexibility helps you avoid late fees, reduce payment delays, and maintain stronger, more strategic vendor partnerships.

AP automation alone won’t cut it

AP automation is a great start—it streamlines processes and removes some of the manual work, but it’s not enough on its own. True transformation happens when you combine AP automation with end-to-end automation across procurement.

By shifting from a reactive mindset to a proactive, fully integrated process, finance teams can take control of their spend like never before.

Think about it:

-

Efficiency skyrockets when everything is centralized—no more chasing invoices or dealing with manual data entry.

-

Accuracy improves as the system catches errors and protects against overspending or fraud.

-

Control is in your hands, with a complete audit trail at your fingertips and the ability to strengthen vendor relationships by avoiding late payments.

It’s time to stop settling for half the solution. With full visibility and control, you’ll not only make your AP team’s life easier—but you’ll also unlock new efficiencies that fuel business growth.

2025 Spend Management Software Buyer’s Guide

Choose the spend management solution best suited to your organization’s needs with an overview of the 2025 software ecosystem, feature comparisons, and a free vendor capability evaluation checklist.