Why Mobile Spend Management Is a Game Changer for Finance Teams

In today’s fast-paced business environment, organizations need real-time visibility and control over spending to maintain financial discipline and operational efficiency. Yet, traditional procurement and expense management solutions—often built for desktop use—can be too rigid for modern teams, especially in remote and hybrid work settings.

This is where mobile spend management makes a difference. By enabling employees and finance teams to approve purchases, track budgets, and manage expenses on the go, mobile solutions help organizations eliminate bottlenecks, increase accuracy, and maintain financial control from anywhere.

In this article, we’ll explore the key benefits of mobile spend management and how it can transform the way organizations handle procurement and expenses.

Enhancing procurement efficiency with mobile capabilities

In traditional procurement processes, requests, approvals, and order placements typically require employees to be at their desks, logged into a desktop system. This rigidity introduces unnecessary delays, particularly when approvers are offsite or traveling.

Mobile spend management removes these constraints by allowing users to submit, review, and approve transactions from anywhere. With mobile procurement, organizations benefit from:

-

Faster purchase approvals – Decision-makers can review and approve requests instantly through mobile notifications, avoiding approval backlogs.

-

On-the-go purchase requests – Employees can submit requests, browse vendor catalogs, and attach supporting documents like quotes or photos directly from their smartphones.

-

Increased flexibility – Procurement workflows move seamlessly whether employees are in the office, working remotely, or traveling.

For industries like construction, field services, and hybrid workforces, where purchases happen outside of a traditional office, mobile procurement ensures spending decisions don’t stall operations.

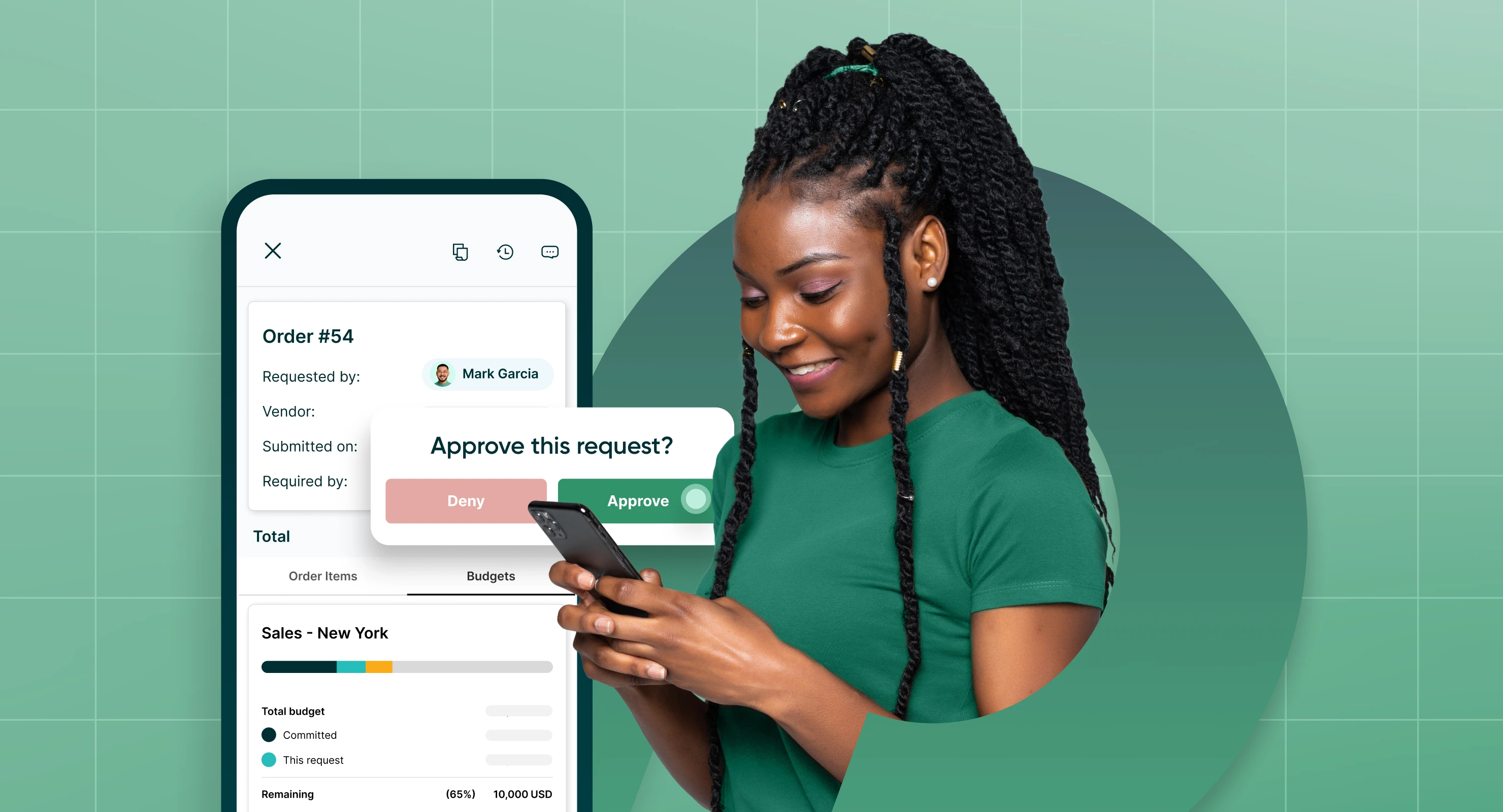

Smart purchasing anytime, anywhere

Procurify’s mobile app helps teams streamline procurement with instant purchase requests and mobile approvals, keeping workflows efficient and transparent.

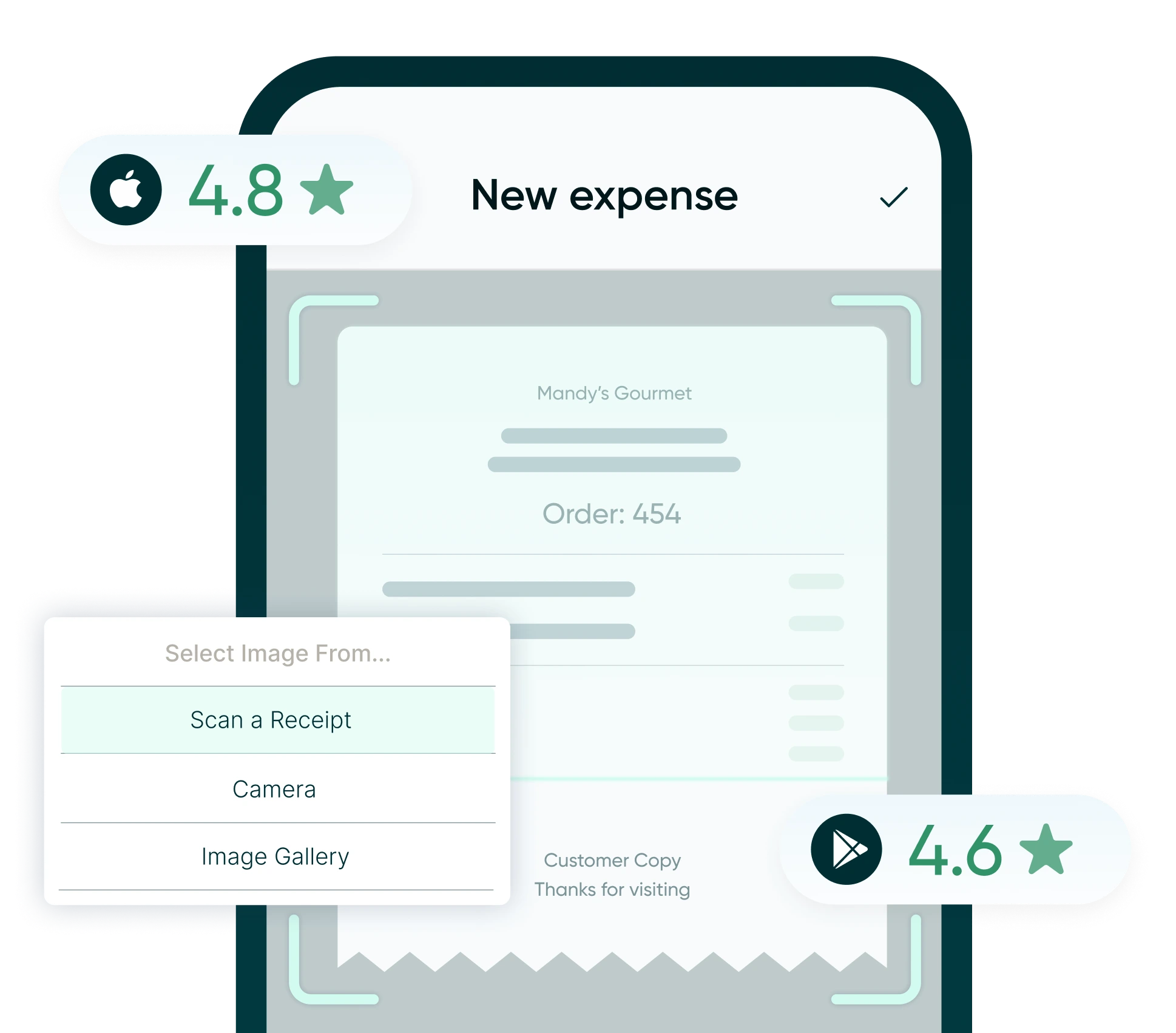

Real-time expense tracking and reporting

Accurate expense tracking is critical for preventing budget overruns, but traditional methods often involve delayed data entry and manual reconciliation. Mobile expense management ensures that spend data is always up to date by enabling:

-

Mobile receipt capture: Users can snap photos of receipts at the point of purchase and upload them directly into the system, ensuring no expense goes untracked.

-

Automated expense categorization: Expenses can be automatically tagged to projects, departments, or GL codes, helping finance teams easily allocate and analyze spend.

-

Real-time budget visibility: Finance leaders can track committed spend, pending approvals, and real-time expenses directly within the app, ensuring accurate financial forecasting.

With real-time expense tracking, organizations can maintain financial control and ensure that every dollar is accounted for—before it impacts the budget.

Streamlined approval workflows with mobile-first flexibility

One of the biggest challenges in spend management is approval delays. Many organizations still rely on email threads and outdated approval workflows, leading to unnecessary roadblocks.

Mobile spend management speeds up approvals with:

-

Push notifications for approvals: Approvers receive real-time alerts when requests require their attention, allowing them to review and approve (or reject) directly from their phone.

-

In-app collaboration: If an approver has questions about a purchase request, they can message the requester directly within the app, eliminating the need for lengthy email chains.

-

Conditional approvals: High-value purchases automatically route to the appropriate decision-makers based on preset approval rules.

By removing friction in the approval process, mobile spend management ensures that purchases are authorized quickly, keeping operations moving.

Improved compliance and policy enforcement

Ensuring compliance with internal purchasing policies can be difficult—especially when employees make purchases outside the office. Mobile spend management solutions help enforce compliance at the point of purchase by:

-

Requiring pre-purchase approvals: All purchase requests must go through configured approval workflows before any spend is committed, ensuring policy compliance.

-

Flagging non-compliant purchases: The system can automatically flag non-compliant purchases—such as purchases from unapproved vendors or over-budget items—prompting approvers to investigate before approving.

-

Maintaining a digital audit trail: Every request, approval, and receipt is automatically logged, simplifying audits and compliance reporting.

With built-in compliance safeguards, organizations can maintain financial oversight while allowing employees to make necessary purchases without unnecessary red tape

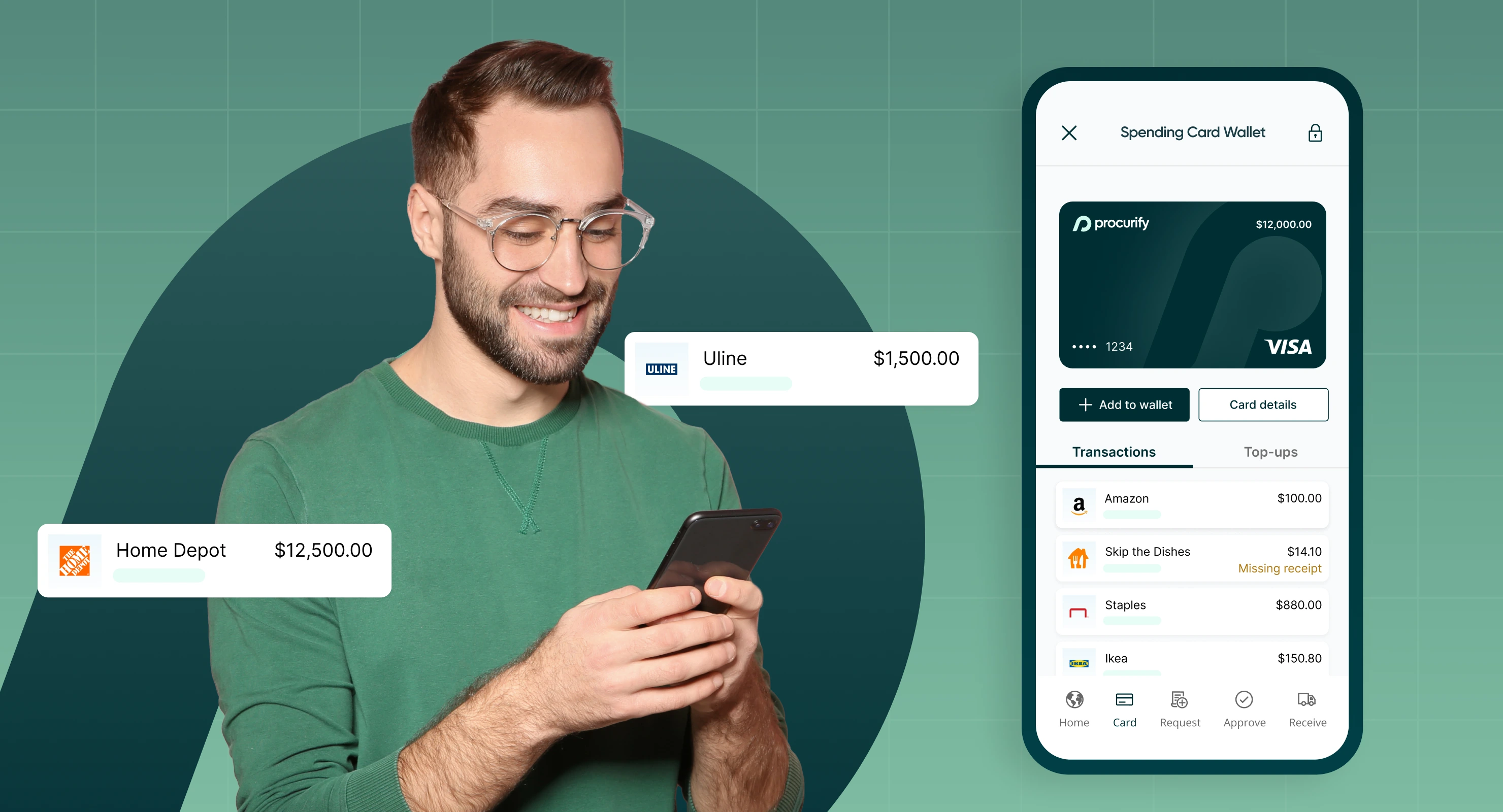

Seamless integration with ERP and accounting systems

For mobile spend management to be effective, it must integrate seamlessly with existing financial systems. Without integration, organizations risk data silos and manual reconciliation, leading to inefficiencies and errors.

A well-integrated mobile spend management solution enables:

-

Automated data syncing – Purchase data flows directly into accounting systems, reducing manual data entry.

-

Real-time spend insights – Finance teams can access accurate, up-to-date spend data across departments.

-

Effortless receipt management – Mobile-captured expenses link directly to financial reports and budgets.

Enhanced user experience drives faster adoption

The success of any spend management solution depends on employee adoption. A well-designed mobile interface ensures that teams can easily engage with the platform, improving compliance and data accuracy.

Key features of an intuitive mobile experience include:

-

Modern, intuitive design: Employees can request, approve, and track spending with just a few taps.

-

Role-based notifications: Users receive only the alerts relevant to their role, reducing notification fatigue.

-

On-the-go flexibility: Field workers, remote employees, and traveling managers can all access the app from their preferred devices.

When spend management tools are easy to use, employees are more likely to follow company policies, improving financial oversight.

The strategic value of mobile spend management

In a world where business moves quickly, organizations can’t afford to limit procurement and spend management to desktop-only systems. Mobile spend management empowers businesses to:

-

Gain real-time visibility – See spending as it happens, not after the fact.

-

Accelerate approvals – Eliminate delays with mobile-first workflows.

-

Ensure policy compliance – Enforce spending guidelines at the point of purchase.

-

Integrate seamlessly – Sync data with ERP and accounting systems for financial accuracy.

By embracing mobile-first spend management, organizations gain the agility and control needed to optimize cash flow, improve financial accuracy, and make smarter purchasing decisions—anytime, anywhere.