7 Benefits of a Comprehensive Spend Management Strategy

Understanding and controlling spending has never been more crucial.

During current challenging economic times with soaring inflation and high interest rates, companies face increasing pressure to cut costs and maximize value. It is vital to business sustainability.

Effective spend management is more than just tracking company expenses—it’s a strategic approach that empowers businesses to optimize their financial resources, improve operational efficiency, and maintain a competitive edge.

A spend management strategy involves a comprehensive system of processes designed to grant businesses real-time visibility into where their money is going, helping leaders make informed decisions and drive growth. Whether overseeing procurement, managing supplier relationships, or mitigating financial risks, the right spend management strategy can unlock significant benefits across your organization.

Ready to take control of your organizational spend?

Book a personalized demo to see how Procurify makes it super easy for businesses to manage spend and save millions in time and money.

Let’s explore seven key benefits of spend management that can revolutionize an organization’s finances.

Improved visibility into spending

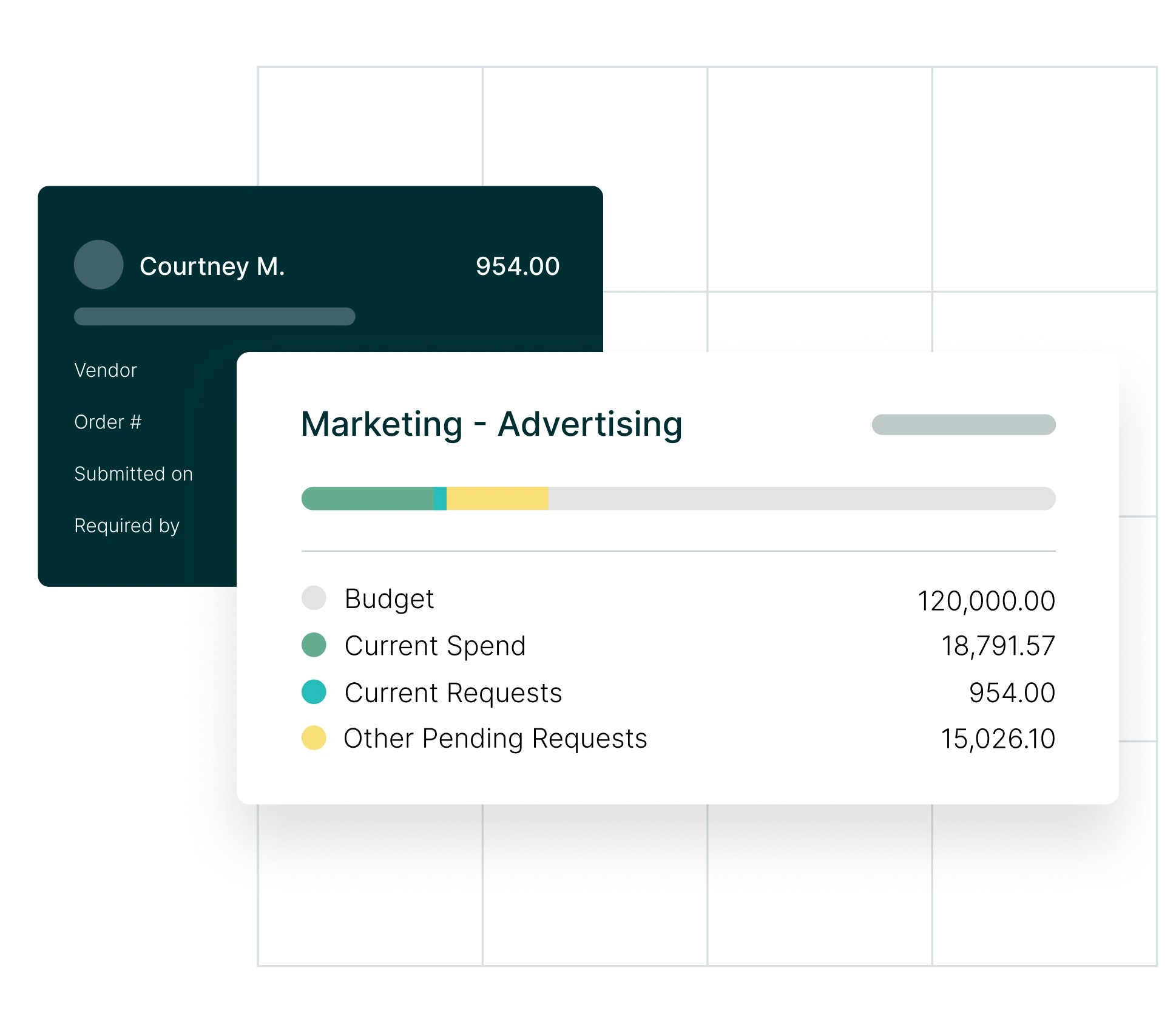

One of the most immediate and valuable outcomes of effective spend management is gaining clear, real-time visibility into where your money is going. Without this visibility, finance teams are often left in the dark—piecing together spend data from emails, spreadsheets, and siloed systems.

With the right processes and tools in place, spend visibility shifts from reactive to proactive. That means consolidating purchase requests, approvals, and payments in a centralized platform, tagging and categorizing spend by department, project, or vendor, and setting up automated reports and dashboards for real-time budget tracking. By also scheduling regular spend reviews with department heads, you can spot issues early and align spending with strategic goals.

Visibility isn’t just about cost control—it’s about empowering leadership to make confident, data-backed decisions.

Better budget control

When spend is tracked in real time and governed by consistent workflows, staying on budget becomes far more achievable. Instead of discovering overspending after the fact, proactive spend management allows you to spot deviations early and course-correct before they spiral.

One way to achieve this is by creating departmental budgets that tie directly into purchase approval workflows. When requests come in that exceed set thresholds, automated alerts can notify the right people before the spend is approved. Giving department heads access to live budget tracking—rather than relying solely on quarterly reports—ensures they’re equipped to make informed decisions in the moment. Pair that with monthly budget review meetings, and finance teams can catch trends early, optimize allocations, and make smarter use of every dollar.

Budget control isn’t about saying “no” to spending—it’s about aligning purchases with strategic priorities. With this level of oversight and collaboration, finance teams can flag unnecessary costs, reallocate unused funds, and ensure spending stays tied to business goals. Just as importantly, proactive budget control builds trust. When leaders can rely on accurate, up-to-date numbers, they’re far more likely to support and follow financial policies.

Time saved through automation

Manual procurement and AP processes don’t just slow things down—they drain valuable time from your team. From chasing approvals over email to entering invoice data by hand, these tasks add up quickly and are prone to error.

A proactive spend management strategy uses automation to eliminate these bottlenecks. By setting up approval workflows that automatically route requests based on thresholds, departments, or categories, you reduce the need for manual follow-up. Instead of relying on paper-based forms or scattered email threads, everything is centralized and trackable. Three-way matching can reconcile POs, invoices, and receipts automatically, cutting down on data entry and preventing costly mismatches. And by integrating procurement and AP tools with your accounting or ERP system, information flows seamlessly between platforms—no duplicate work required.

Saving time doesn’t just improve efficiency—it speeds up the entire procurement-to-payment process and creates a smoother experience for every team involved.

Reduced risk and improved compliance

Uncontrolled spending doesn’t just hurt your bottom line—it exposes your organization to serious risk. When purchases happen outside approved workflows or vendor agreements, you lose oversight, weaken audit trails, and open the door to fraud, errors, or regulatory issues.

Proactive spend management helps enforce internal policies and ensures every purchase follows a standardized, documented process. This starts with a clear approval workflow that includes audit trails for every transaction, making it easy to track and verify spend. Vendor controls can be put in place to ensure purchases are only made through pre-approved suppliers, reducing the chance of rogue spending. Automating policy checks—like flagging duplicate or out-of-budget purchases—adds another layer of protection, while proper segregation of duties across finance and procurement functions minimizes the risk of conflicts or missteps.

With every step tracked and validated, your organization becomes more resilient, audit-ready, and better protected from financial and reputational risk.

More informed decision-making

Good decisions require good data—and in most organizations, that data is scattered across spreadsheets, inboxes, and disconnected systems. Proactive spend management changes that by consolidating procurement and payment activity into one centralized platform, giving you a clear, comprehensive view of your financial landscape.

With a centralized dashboard, finance teams can break down spending by vendor, team, category, or time period—surfacing insights that were previously hidden or hard to track. Regular reporting cadences help highlight key trends and monitor KPIs, while involving department leads in reviewing their own spend fosters a sense of ownership and accountability. Layer in spend analytics to support vendor negotiations and long-term planning, and your team is no longer relying on instinct—they’re backed by timely, trustworthy data.

When everyone operates from a single source of truth, strategic decisions become clearer, faster, and more impactful.

Greater employee accountability

Without clear purchasing processes, it’s easy for employees to assume that spending decisions are someone else’s responsibility. This lack of accountability can lead to budget overruns, non-compliant purchases, and a disconnect between day-to-day actions and broader financial goals.

A strong spend management system brings structure and transparency to the process. By assigning clear roles and permissions, every request and purchase can be traced back to an individual, creating a sense of responsibility from the start. Giving team leads access to real-time budget vs. actuals allows them to monitor their department’s performance and make timely adjustments. And when monthly spend reviews are part of the routine, expectations are reinforced, and accountability becomes embedded in the culture.

When employees understand how their purchasing decisions impact the organization—and know those decisions are visible—they become more thoughtful, responsible participants in the company’s financial health.

Cost savings and long-term efficiency gains

While cost savings are often the most talked-about benefit of spend management, they’re really the outcome of getting everything else right—improving visibility, enforcing policies, automating workflows, and holding teams accountable. When those pieces are in place, savings happen naturally.

By consolidating vendors and standardizing pricing across departments, you reduce duplication and increase your leverage in negotiations. Spend analytics help uncover low-value or redundant purchases that can be eliminated without sacrificing performance. Automating manual tasks like invoice entry and reconciliation frees up time and reduces costly errors, while continuous workflow optimization ensures your processes evolve as your organization grows.

Spend management isn’t a one-time fix—it’s a long-term strategy. And the more disciplined and data-driven your approach becomes, the more savings and operational efficiency you’ll unlock over time.

Spend management is a growth enabler

Spend management isn’t just a finance function—it’s a business strategy. When you proactively manage how money flows through your organization, you unlock more than just savings. You create clarity, empower teams, reduce risk, and build a foundation for smarter, faster decisions.

Whether you’re dealing with inefficient processes, budget surprises, or disconnected systems, taking control of your spend is one of the most impactful changes you can make. And the sooner you start, the faster you’ll see results—both operationally and strategically.