Tips for Managing Accounts Payable & Accounts Receivable

Managing accounts payable and accounts receivable is essential to any business. You need to be able to track what you owe a supplier, what you’ve sold, and what your customer owes you. This is especially true in a large company that manages hundreds of different transactions a day.

Two departments, Accounts Payable (what you owe) and Accounts Receivable (what you’re owed), are responsible for keeping track of money coming in and money going out of your business.

Managing AP and AR can be a bit of a juggling act. Staying on top of these accounts means the difference between properly tracking your purchases and potentially overpaying or not being paid for goods and services (oh no!), which makes their proper management more important than ever. Here’s how many successful firms achieve that goal.

Tips for managing accounts payable and accounts receivable

1. Establish credit policies

One thing owners and managers don’t like about transactions is when they take a long time to close. Receivables departments often establish credit terms, which may vary according to the clientele they serve. Regular customers with good credit ratings receive a greater flexibility period for payment, whereas first-time customers may not be given as much leeway. When it comes to payment terms, most companies establish terms at 15–30 days. Accordingly, payables departments should pay suppliers as soon as the shipped items arrive in good condition. If you do so, you might even be able to take advantage of discounts offered by suppliers for early payments.

2. Shorten transaction cycles

A shorter transaction cycle for items bought and sold will save your company money on labor dedicated to making those exchanges. Longer cycles might be symptomatic of workflow bottlenecks or low cash flow, as occurs when a company opts to wait to be paid for a sale before repaying a supplier. To avoid that situation, establish timelines for receivables and payables. Better still, establish shorter receivables timelines so that you can quickly deal with your accounts payable. Get departments into the habit of issuing invoices, purchase orders and other documentation on designated days of the week or month to create a routine you can work with.

3. Foster more communication

Think of accounts receivable as your left hand and accounts payable as your right hand. Now juggle. Bit tough, isn’t it? Companies might struggle to stay on top of both departments, especially when dealing with large a volume of transactions. To make this easier, each department should consult the other on purchases and sales affecting the company. If there’s huge consumer demand, receivables can signal payables to order more items. If times are tight, payables may want to curb procurement until there’s greater stability.

4. Stay on top of aging accounts

You should be recording all transactions immediately and issuing statements regularly, but it’s also prudent to look at old accounts to make sure that everything is settled up. If any outstanding receivables are on the books, take action immediately and suspend any further business with that particular client until their account is balanced. Set up a policy indicating the maximum period it should take to clear a customer’s account. Similarly for payables, if suppliers are missing payment within a designated time period, pony up as soon as possible and establish a timeline for when payables should be cleared.

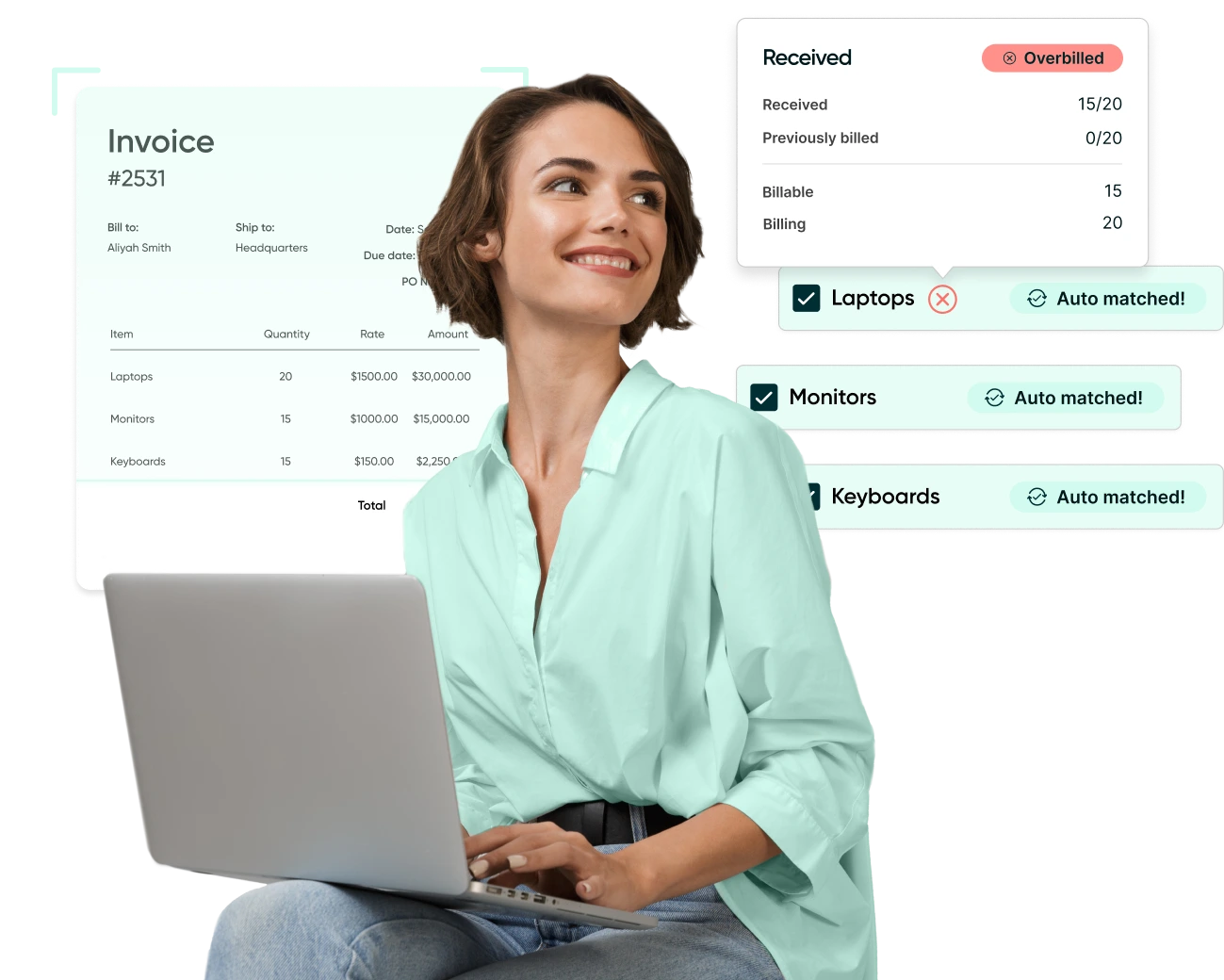

5. Use automation to track everything

Tracking accounts receivables and payables involves the creation of invoices, receipts, shipping orders, purchase orders, financial statements and other documentation. It’s a painstaking process and one that’s even more cumbersome if even a single document slips under the radar. Using accounts payable software to automate all those transactions in real-time allows for the quick compilation of information needed for financial statements and can help track anomalies such as delinquent accounts or interruptions in workflow.

Managing accounts payable and accounts receivable is critical in determining the financial health of any company. Properly tracking and managing them is important not only for assessing overall performance, but for helping managers and owners make smarter decisions that can influence an organization’s future. Time to start practicing your juggling.

Webinar: Automate Your AP Processes with Procurify

Learn how AP automation enhances the efficiency, accuracy, and financial visibility of your accounts payable workflows.