Webinar: What Cannabis CEOs Need to Know About Accounting Practices

This interview is taken from an episode of the Spend Culture Stories podcast. In the month of April 2019, we’re launching a monthly segment that focuses on cannabis businesses and best finance and accounting practices. In this episode, Andrew Hunzicker, the founder of DOPE CFO shares his insights on best accounting practices for cannabis businesses under strict compliance laws, and how to win in a growing industry.

About the podcast

Your company culture might attract talent, but your Spend Culture will make or break your company. Spend Culture Stories is a female-hosted and produced podcast that helps finance leaders learn the tactics, strategies, and processes to build a proactive Spend Culture. Learn how to pick the right tools, implement the most efficient processes, and how to develop the right people to transform the Spend Culture of your organization for the better.

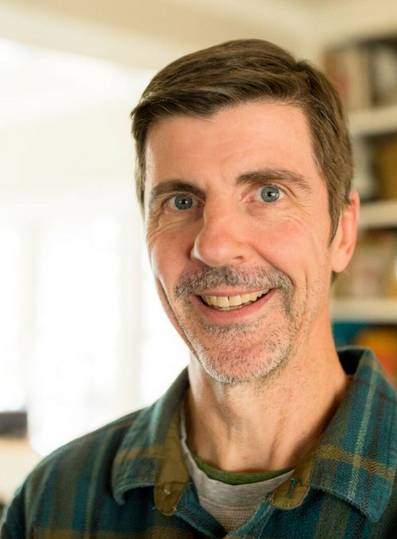

Andrew Hunzicker, CPA is President of CFO Bend, currently serving cannabis companies in every vertical, in 4 states. Additionally DOPE CFO teaches Accountants, Bookkeepers, and CPAs how to successfully enter this industry with a complete DIY “accounting practice in a box” training program. He is an expert in Cannabis startups, CFO services, turnaround strategies, high-growth strategies, capital sourcing, mergers, exits, wealth protection, startups.

He has provided executive leadership and business counsel to companies across many industries including retail, manufacturing, energy, medical/bio, high tech.

In this episode, Andrew shares his insights on best accounting practices for cannabis businesses under strict compliance laws, and how to win in a growing industry.

Speakers: Andrew Hunzicker, Founder, DOPE CFO

Listen to the episode now

Notable quotes

What are some of the problems that you’ve seen in the cannabis industry for business owners when it comes to accounting and auditing practices?

Bookkeepers lack the knowledge of accountants

Nine of ten of these cannabis companies even today were served by people that are just bookkeepers – which is fine if they know the accounting practices for cannabis comapnies, but most of them don’t.

I’d say more than half are trained by Quickbooks, and so they may have their quick books pro they may have an accounting degree which is fine, but very, very few have any idea how to do correct cost or absorption accounting or gap accruals – any of that.

What’s happening then is that you have this industry with a CEO starting out and they are looking for accountants, and just getting turned away. They still are. So they had to find whatever help they could, and a lot of them are just using people that are recording transactions but conducting very base-level bookkeeping.

Lack of audit trails and record keeping

We even see a lot of sloppiness around record keeping. I mean – I’m talking about the very, very, basic level. For example, you go to Home Depot, you buy a ladder for 50 bucks, you take the invoice, you scan it, you attach it to the transactions and quick books, you have a good audit trail. We’re seeing it’s almost the ‘old receipts that are in a shoe box’ kind of method in this industry. It’s slowly getting better, but we’re talking about literally building accounting from the base up. What I’m saying doesn’t just apply to the Mom and Pops, but even the bigger players in the industry too.

Setting good expectations around building good financial controls early

When CEOs come to us, we’re pretty hard on them. We normally say: ‘Look. If you want to deal with us, the accounting is going to be world class from start to finish.

We’re not going to piecemeal any of it – we’re going to do the cost accounting right. Everything’s gonna have an audit trail, and we’re going to do inventory accounts and cash accounts. We’re going to reconcile the different POS and the systems daily, and weekly. And by the way, we’re incredibly expensive to hire, because no one’s doing that. So we’re doing the best and so you can take your pick.

Can you maybe share with us some examples of your clients this horror stories you’ve seen surrounding internal controls and spending for cannabis companies?

Lots of VC cash with inexperienced business owners

Within a lot of these cannabis companies early on, capital was readily available. so many people wanted in. Everyone from private equity groups or basically down to angel investors are throwing them a couple million to start a pharma. We have one client that fits this description. He gave a few million dollars to build a farm who weren’t doing accounting at all. And so they finally came to us and said “hey, I think we need to be doing accounting.”

Pressure from the investors to have clean books

We find we’re getting hired sometimes by the investors as opposed to the CEOs. Many cannabis company CEOs are goodhearted, nice people who are passionate about this industry, but they might not have a ton of business sense. I’m only saying this when compared to some of the tech startups I worked with. Within VC backed tech, often times I’d meet these Harvard-educated MBA who are founding these tech startups, who are very smart about accounting and excel if that’s not their expertise, but in cannabis, we’re not seeing that as much.

The spend culture of cannabis is “out of control”

You may have someone who’s a passionate grower and has tons of knowledge around how to grow pot, or wants to open a dispensary – but they often know little about accounting practices. And so the spend culture of cannabis has been a little bit out of control to be honest. I will say the one area I see decent controls is cash. There’s a lot of cash in this industry, and I think even the CEOs understand that cash can walk away in people’s pockets really easily. Therefore, you see lots of vaults in locations, and so their cash is usually pretty well controlled.

But as far as their spending, tracking, and budgeting, this industry is still in its infancy. So, quite literally, we’re talking about the ground up.

If you’d like to nominate a speaker for the podcast, please fill out our guest nomination form here.

Subscribe and help us grow

Did you enjoy the podcast? Subscribe to the Spend Culture podcast on Spotify, Apple Podcasts, or wherever you listen to podcasts. If you have an extra 10 seconds, please leave us a rating or review to help us grow. Have recommendations for future podcasts? Contact our host at dani.hao [at] procurify.com.