Mastering the Accounts Payable Process: A Step-by-Step Guide

In the modern business landscape, an efficient accounts payable (AP) process is crucial for maintaining healthy cash flow, fostering strong vendor relationships, and ensuring financial accuracy. However, for many organizations, managing AP can present significant challenges, such as missed invoice payments, lost early-payment discounts, duplicate payments, and disputes with suppliers. These inefficiencies can quickly escalate into costly problems, potentially threatening the financial health of a business.

The AP process is more than just a routine function; it is a critical part of an organization’s overall expense management system. Ensuring that every financial obligation is met on time, accurately, and strategically is key to managing cash flow, mitigating risks, and supporting scalability. Optimizing the AP process offers substantial benefits, including reduced operational costs, improved vendor trust, and enhanced financial visibility.

Despite its importance, many businesses still rely on manual processes that are time-consuming, prone to errors, and ultimately inefficient. A report by Ardent Partners highlights that manual AP processes cost businesses more than twice as much as automated solutions, with invoice processing times significantly extended. In an era driven by digital transformation, failing to modernize your AP process could put you at a competitive disadvantage.

This comprehensive guide will walk you through the AP process, providing a step-by-step breakdown, actionable optimization techniques like automation, and best practices that will help you elevate your AP operations. By the end of this article, you’ll have the knowledge and tools to make your AP process more efficient, accurate, and strategically aligned with your business goals.

What is the accounts payable process?

The accounts payable (AP) process refers to the series of steps a business takes to manage its short-term obligations to vendors or suppliers. These obligations arise when a company purchases goods or services on credit, creating a liability that must be recorded, verified, approved, and paid within the terms agreed upon by both parties.

While the concept of paying bills seems straightforward, the AP process is often more complex, especially for businesses that deal with a high volume of transactions. The process involves multiple steps that require precision, compliance, and efficiency, all of which contribute to the overall financial health of the company. Efficient AP management allows businesses to maintain strong vendor relationships, improve cash flow, and track expenses accurately, whereas poor management can result in late payments, penalties, strained vendor relationships, and inaccurate financial reporting.

Key components of the accounts payable process

-

Purchase order (PO) creation: Sets clear expectations with vendors and aligns procurement with financial oversight. Using standardized digital PO templates ensures accuracy, while implementing approval workflows before issuing POs helps prevent unauthorized spending.

-

Receiving goods or services: Ensures that what was ordered matches what was delivered, preventing overpayments or disputes. Inspecting all deliveries upon receipt and documenting any discrepancies immediately minimizes errors. Leveraging procurement software simplifies matching received goods with POs.

-

Invoice receipt and verification: Confirms invoice accuracy through three-way matching (PO, invoice, and delivery receipt). Automating invoice scanning and data extraction improves efficiency, while flagging discrepancies before payment approval prevents costly mistakes. Standardizing invoice submission procedures for vendors further streamlines the process.

-

Approval workflow: Assigns proper authorization to ensure valid payments. Setting approval thresholds based on invoice amounts and implementing automated routing expedites approvals. Real-time notifications help approvers stay on top of pending invoices.

-

Payment execution: Processes transactions on time while optimizing cash flow. Scheduling payments strategically captures potential discounts, while secure payment platforms reduce fraud risk. Tracking payment confirmations ensures transparency and proper recordkeeping.

-

Record keeping and reconciliation: Maintains accurate financial records to support audits and reporting. Storing all invoices, POs, and payment records digitally ensures easy access and security. Reconciling accounts payable balances monthly prevents discrepancies, while generating AP reports provides valuable insights into spending trends.

Why an efficient accounts payable process matters

An efficient AP process is essential for ensuring the smooth operation of a business. The impact of an optimized AP cycle extends beyond just paying bills on time—it affects cash flow management, vendor relationships, compliance, and even scalability.

Below are the top reasons why an efficient AP process is vital for any business.

Protecting and improving cash flow

Cash flow is the lifeblood of any organization. A well-managed AP process ensures that payments are made on time and in accordance with the company’s financial plan. By strategically scheduling payments and prioritizing vendors, businesses can avoid late-payment penalties, capitalize on early-payment discounts, and maintain healthy liquidity.

On the other hand, without an efficient AP system, businesses risk missing out on savings and encountering liquidity problems.

Building and maintaining strong vendor relationships

Vendors are crucial partners for any business. Timely payments and accurate invoicing help foster strong, long-term relationships. Delayed payments or disputes over invoices can strain these relationships, leading to less favorable contract terms, missed discounts, or disruptions in the supply chain. A streamlined AP process ensures that vendors are paid promptly, strengthening these crucial partnerships.

Reducing costs and avoiding errors

Manual AP processes are prone to errors, such as duplicate payments, overpayments, and missed invoices. These mistakes can add up, inflating operational costs and harming the company’s financial reputation.

Implementing an efficient AP process—supported by automation—helps reduce human error, cut down on administrative overhead, and prevent costly errors.

Enhancing financial visibility and control

An optimized AP system provides businesses with real-time visibility into their liabilities and cash flow. This visibility empowers decision-makers to make informed financial decisions, allocate resources effectively, and identify inefficiencies. By monitoring AP data and analyzing trends, businesses can gain insights into spending patterns, vendor performance, and opportunities for cost savings.

Supporting compliance and audit readiness

An organized AP process supports compliance with financial regulations and simplifies audits. Clear approval workflows, detailed transaction histories, and accurate record-keeping make it easier for businesses to meet audit requirements and demonstrate accountability.

Noncompliance can result in fines, reputational damage, and regulatory penalties, all of which can be mitigated by maintaining an efficient AP process.

Enabling scalability and growth

As businesses scale, their AP processes must be able to handle an increasing volume of transactions without adding unnecessary administrative burden. An efficient, scalable AP system—especially one powered by automation—ensures that businesses can process more invoices without a corresponding increase in staff or overhead. This scalability supports growth and ensures that operational efficiency is maintained as the company expands.

Enhancing the AP process with technology

Technology plays a critical role in enhancing the efficiency, accuracy, and scalability of the accounts payable (AP) process. With businesses increasingly adopting digital tools and automation, leveraging technology allows for significant improvements in workflow management, error reduction, and operational efficiency.

Modern spend management solutions integrate multiple AP functions into a single platform, eliminating the need for separate tools to handle different aspects of the process.

When evaluating spend management software, businesses should look for solutions that provide invoice matching, automated approvals, secure payment processing, and real-time analytics—all within one cohesive system.

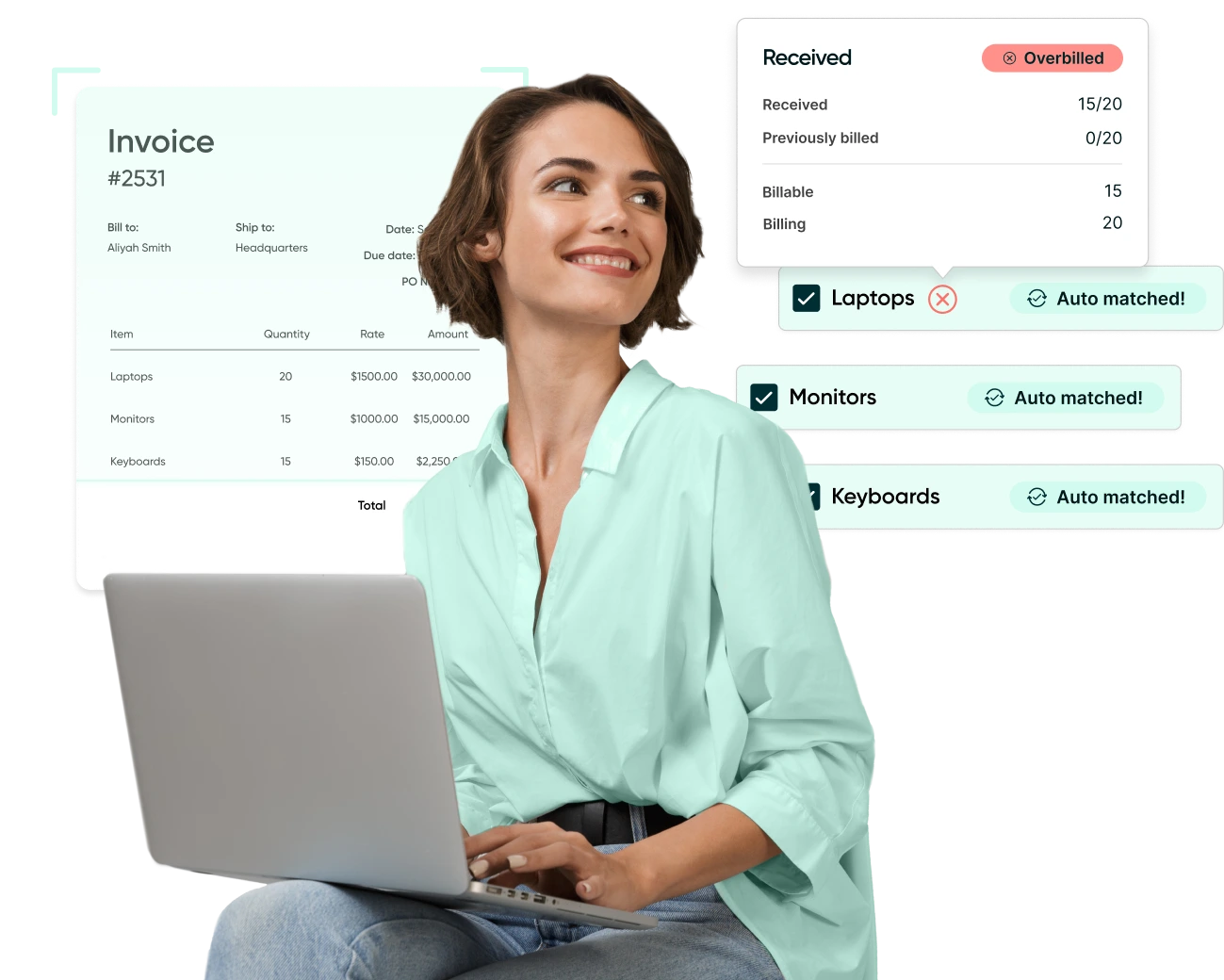

Automated invoice matching for accuracy and efficiency

One of the most common sources of AP inefficiencies is invoice discrepancies. When invoices don’t match purchase orders or receiving documents, it can lead to payment delays and increased workload for finance teams.

A robust spend management tool should include automated three-way matching, cross-referencing purchase orders, receiving reports, and vendor invoices before processing payments. This ensures payments are accurate, prevents duplicate charges, and eliminates the need for manual verification, reducing the risk of human error and unauthorized transactions.

Streamlined approval workflows to eliminate bottlenecks

Manual invoice approvals are a common bottleneck, often causing delays that lead to late payments and strained vendor relationships. Spend management platforms with built-in approval automation can dynamically route invoices to the right stakeholders based on predefined rules, such as invoice amount or department.

This not only speeds up approvals but also enhances transparency and accountability. A cloud-based system ensures that stakeholders can review and authorize invoices from anywhere, reducing the risk of delays caused by paperwork or email backlogs.

Integrated digital payments for faster and more secure transactions

Traditional payment methods like paper checks are slow, prone to fraud, and labor-intensive. A comprehensive spend management solution should support multiple digital payment options—including ACH transfers, wire payments, and virtual cards—offering businesses a faster, more secure way to pay vendors.

These built-in payment capabilities reduce processing costs while minimizing fraud risk through enhanced security features such as multi-factor authentication and real-time transaction monitoring. Choosing a spend management tool with integrated payments ensures a seamless workflow from invoice receipt to reconciliation.

Real-time analytics for smarter decision-making

Beyond efficiency gains, a strong AP system should provide real-time insights into financial performance. Spend management tools with built-in AP analytics allow finance teams to track key metrics such as invoice processing times, payment trends, and cash flow impact.

These insights enable businesses to make data-driven decisions, optimize payment schedules, and identify inefficiencies in the workflow. By choosing a platform that consolidates analytics with AP functions, businesses can ensure they have the visibility needed to improve financial operations continuously.

By investing in a comprehensive spend management solution that integrates these functionalities, businesses can streamline AP operations, reduce manual effort, and improve financial control—all while enhancing efficiency and vendor relationships.

Best practices for optimizing your accounts payable process

Even with the best systems in place, AP processes can be vulnerable to inefficiencies and risks that impact cash flow, vendor relationships, and compliance. Identifying and proactively addressing these challenges is crucial for maintaining a well-functioning AP operation.

The following best practices help businesses achieve a streamlined, strategic approach to AP management.

Harnessing automation to eliminate bottlenecks

Human error is one of the biggest risks in AP, leading to incorrect payments, duplicate invoices, and reconciliation headaches. Businesses relying on manual data entry expose themselves to inconsistencies that can cause financial discrepancies.

Implementing optical character recognition (OCR) technology and automated data extraction reduces these risks by capturing invoice details accurately and seamlessly integrating them into AP systems. Regular audits further help identify and rectify errors before they escalate into larger issues.

Automating payments to avoid penalties and missed discounts

Timely payments are essential for maintaining strong vendor relationships and avoiding unnecessary fees. Late payments can lead to penalties and lost early-payment discounts that could otherwise improve cash flow.

Automating payment scheduling ensures that invoices are paid on time, while built-in reminder systems prevent overlooked due dates. Prioritizing payments based on due dates and contractual terms can help businesses optimize cash management without disrupting vendor partnerships.

Establishing standardized approval workflows

A lack of structure in invoice approvals often results in delays and unapproved payments slipping through the cracks.

Standardizing approval workflows ensures that all invoices follow a consistent review process, reducing bottlenecks and minimizing the risk of unauthorized payments. Automated escalation procedures can be incorporated to prevent invoices from sitting idle, ensuring a seamless flow from approval to payment.

Enhancing vendor management for greater control

Disorganized vendor records can cause delays, duplicate payments, and confusion over payment terms.

A centralized vendor database improves efficiency by maintaining accurate records of supplier details, payment terms, and transaction history. Vendor portals can further enhance collaboration by allowing suppliers to submit invoices and track payment statuses in real time, reducing disputes and ensuring smoother transactions.

Strengthening internal controls to reduce fraud risks

Fraud remains a significant concern in AP, whether from external bad actors or internal misconduct.

Implementing strong internal controls—such as segregating duties, verifying vendors before making payments, and using fraud detection software—can mitigate these risks. Businesses should also establish approval thresholds that require additional scrutiny for high-value invoices, preventing unauthorized transactions from slipping through.

By addressing these common pitfalls, businesses can enhance efficiency, minimize financial risk, and create a more resilient AP function.

Key metrics to monitor

Tracking key performance metrics (KPIs) is critical for optimizing the accounts payable process. KPIs provide valuable insights into the efficiency of the AP workflow, highlighting areas for improvement and helping businesses make data-driven decisions.

-

Days Payable Outstanding (DPO) measures how long it takes a business to pay its suppliers after receiving an invoice. A higher DPO indicates effective cash flow management, but excessively high DPOs could damage supplier relationships. Businesses should calculate DPO and compare it to industry benchmarks to identify areas where cash flow management can be improved.

-

Invoice Processing Time tracks the time it takes from receiving an invoice to processing the payment. Long processing times can lead to missed discounts, late payments, and strained vendor relationships. Setting goals to reduce invoice processing times and measuring the effectiveness of automation tools can help optimize this metric.

-

Early Payment Discounts Captured reflects the percentage of early-payment discounts that businesses successfully take advantage of. Missing these discounts can result in lost cost-saving opportunities. Monitoring missed discount opportunities and optimizing payment schedules can improve cost savings.

-

Cost per Invoice Processed calculates the total cost involved in processing each invoice, including labor, technology, and overhead expenses. Businesses should benchmark their cost per invoice against industry averages and focus on reducing costs through automation and process optimization.

By tracking these key metrics, businesses can continuously improve their AP process, driving efficiencies, reducing costs, and enhancing vendor relationships.

Turning accounts payable into a strategic advantage

Optimizing the accounts payable process is not just about making payments on time; it’s about building stronger vendor relationships, improving financial visibility, reducing operational costs, and supporting long-term business growth.

By leveraging automation, standardizing workflows, and monitoring key performance metrics, businesses can turn their AP process into a strategic asset.

Webinar: Automate Your AP Processes with Procurify

Learn how AP automation enhances the efficiency, accuracy, and financial visibility of your accounts payable workflows.